Tax risk and governance

Implementing a robust tax governance and risk framework to improve compliance, risk and assurance and tax resilience.

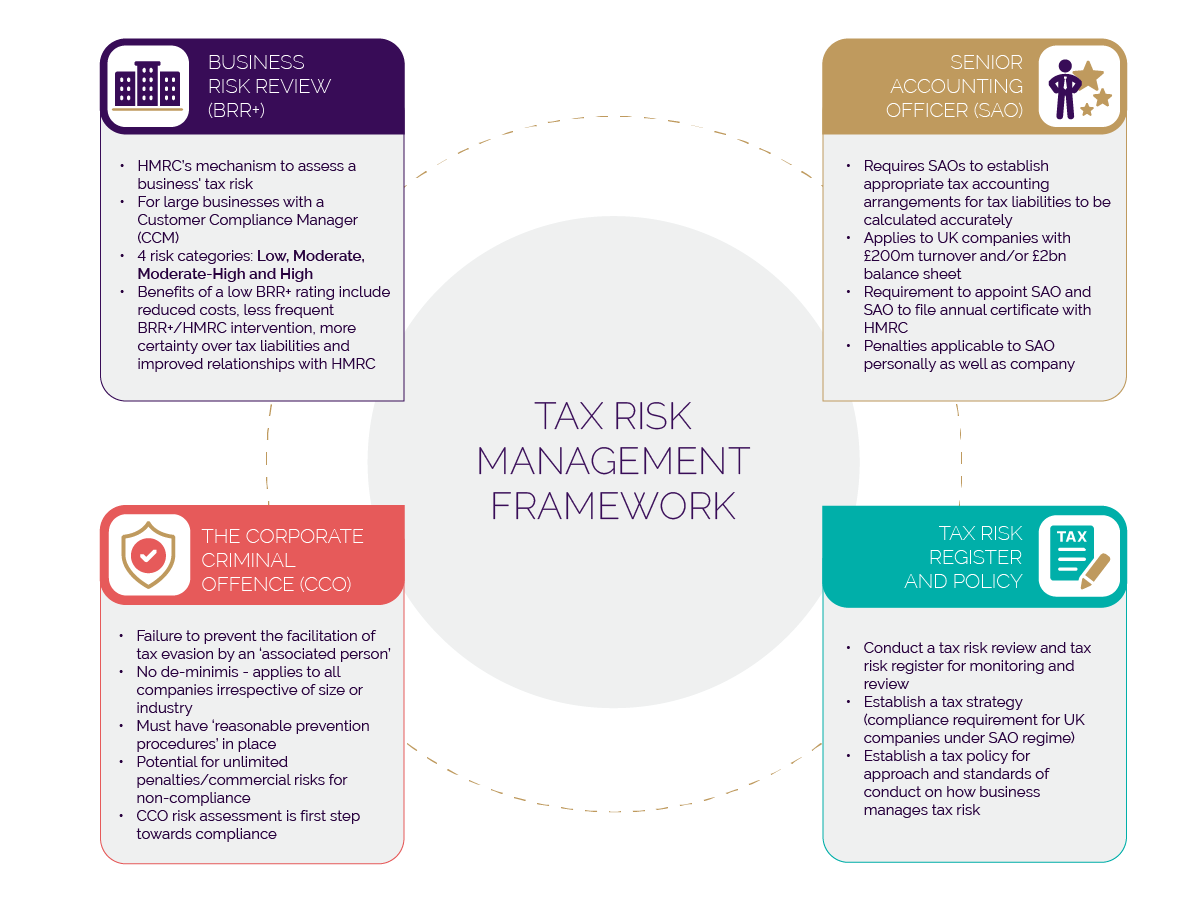

Understanding and managing tax risk is becoming increasingly important for businesses. To stay ahead of an evolving tax landscape, businesses need robust tax processes and a focus on accurate tax data. This includes being able to demonstrate reasonable prevention procedures required by the Corporate Criminal Offence (CCO), ensuring the business has appropriate tax accounting arrangements under the Senior Accounting Officer (SAO) regime and regularly monitoring tax risk in the business.

The HMRC review process is increasing its focus on tax governance among large businesses across all sectors. As part of the BRR+ process, HMRC reviews an organisation and allocates a risk rating based on a number of indicators measuring the strength of a firm’s tax systems, processes, policies, controls and risk management. For businesses, the financial cost and reputational damage of not managing tax risk can be high.

There are also commercial considerations that businesses should be aware of:

- Tax governance and compliance with the regimes form part of any due diligence in an exit event or refinancing (risk of protection or limitations being sought)

- Reputational damage for non-compliance

- Personal fines/implications for directors and the company

- Confirmations of compliance with CCO now requested in customer/supplier/business partner agreements

Evelyn Partners Professional Services, soon to be S&W

The new face in the professional services world.

An overview of key tax risk and governance areas

In recent years, a wide range of measures have been introduced in the UK that require businesses to focus on tax governance and risk management. These include the CCO of failing to prevent the facilitation of tax evasion, the SAO regime, the requirement to publish a tax strategy document online and the introduction of HMRC’s Business Risk Review (BRR+):

Building a strong tax risk management framework

A strong tax risk management framework is the foundation for managing business tax risk. A tax risk management framework is ultimately the structure that underpins your tax compliance and is critical to ensuring a robust approach to tax compliance and tax risk management.

The framework should be bespoke and consider the landscape the business operates in, as well as inherent risks due to size and complexity. Compliance with the key governance regimes will form part of this framework.

This three-step approach to building a strong tax risk management framework can be applied by businesses of all sizes:

Assess

Undertake an initial assessment of the business’ tax risk and governance position. The business should identify an appropriate person who is responsible for tax risk.

Respond

Create a working action plan to reduce the level of risk in each area. Proportionate controls are implemented to reduce the level of risk without taking unnecessary time and effort. The business can choose to adopt technology where appropriate to ensure controls are operating effectively.

Monitor

Review the risk framework regularly to ensure it continues to meet the business’ needs.

How Evelyn Partners can help support your tax risk and governance

Our expert tax risk and governance advisors can support your businesses with:

- Compliance with the various governance regimes, including CCO, SAO and BRR+

- Understanding and staying up to date with the changing tax risk landscape

- Understanding and documenting the business’ tax risk appetite

- Identifying, documenting and prioritising tax risks

- Designing, documenting and implementing tax processes and controls to mitigate tax risks

Get in touch

If you have any questions or would like to discuss the tax risk and governance in more depth, or how we can support your organisation more, please get in touch.