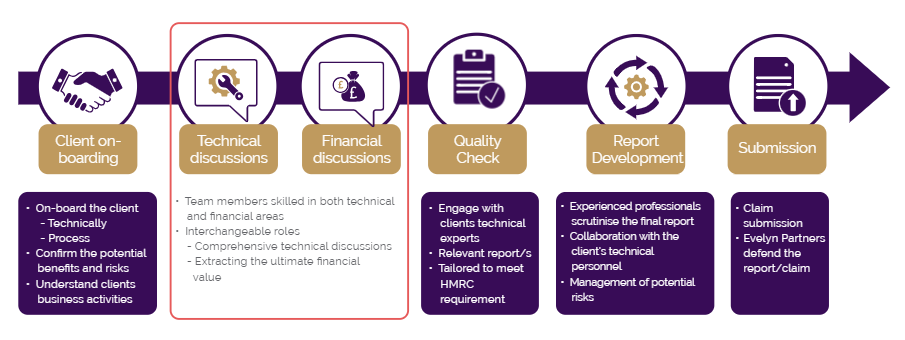

Our approach to R&D relief

We tailor our services to suit your business’ needs. Whether it is an end-to-end partnership or high-level advice, our goal is to optimise your business’ R&D relief and promote a culture of innovation within your company.

A full, comprehensive service includes:

- Client onboarding and introductory workshops: we will learn how your business operates, and ensure your business understands the relevant aspects of the R&D tax regimes

- Collation of technical and financial information: we will lead project-specific discussions in relation to activities identified during the introductory workshops to determine what R&D relief is available to the company. In these meetings we will also discuss the associated expenditure that has been incurred as part of the R&D activities

- Preparation of the R&D claim report: we will prepare a report detailing how the claim meets the eligibility criteria as set out by HMRC. This will involve preparing supporting cost schedules and detailed technical narratives of the R&D activities undertaken

- Submission and management of the finalised R&D report: we will provide you with the final R&D report for submission to HMRC. If requested, we will submit it to HMRC on your behalf, manage the approval process, and respond to any queries from HMRC

This entire process usually takes between two and six weeks, depending on the size and structure of the business.

Key to this approach is holding the technical and financial discussions in parallel, which ensures that there is clear evidence linking the expenditure claimed to the eligible activities undertaken.