Environmental tax

What are environmental taxes and do they apply to your business?

ESG, net zero, plastic pollution and energy prices are high on the agenda for businesses and the Government. Environmental taxes are one of the tools used as part of a suite of policies to help drive a change in behaviour to meet environmental objectives.

Environmental taxes – a definition

Environmental tax is an umbrella term that comprises a range of individual operational taxes. They are payable by businesses and are aimed at making companies operate in a more environmentally friendly manner. Put simply, companies who pollute or cause damage to the environment, pay more in taxes. Sometimes, they are referred to as ecotax or green tax.

Evelyn Partners Professional Services, soon to be S&W

The new face in the professional services world.

Environmental tax examples

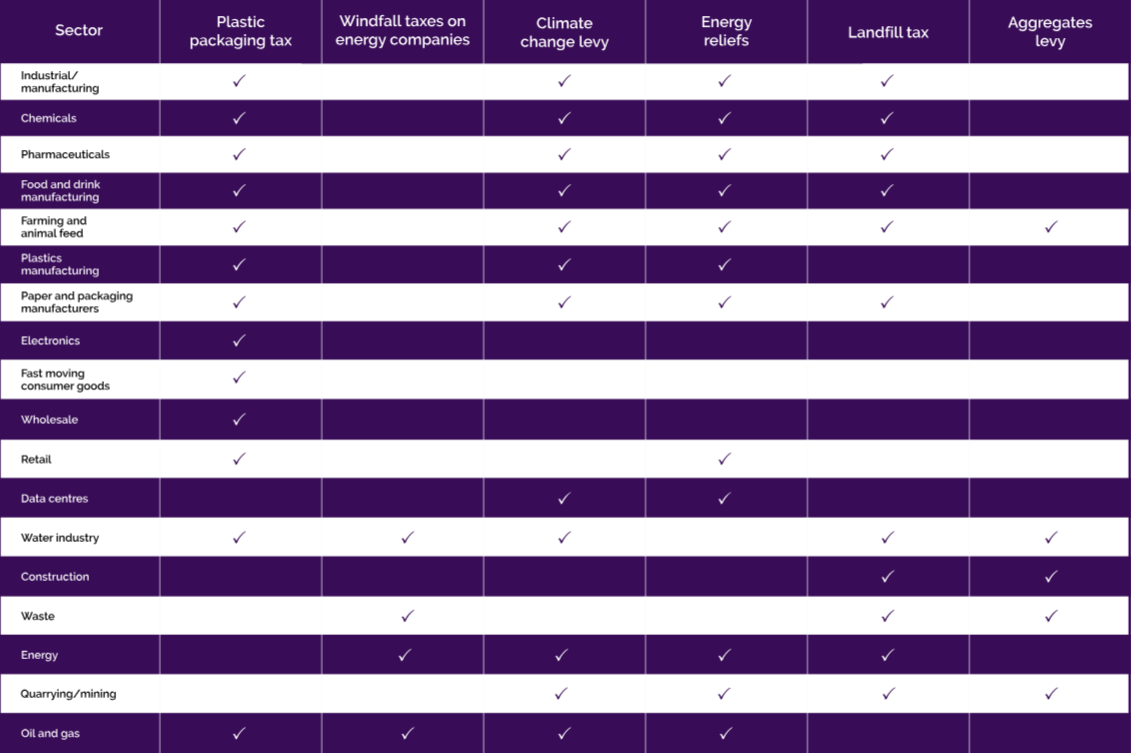

Many sectors of UK business are now liable for environmental taxes. To help see if they apply to you, we’ve put together the below table.

How Evelyn Partners can help you with environmental tax

We have a dedicated environmental tax team, led by a partner who is one of the leading specialists in the UK and is a member of the Chartered Institute of Taxation’s (CIOT) climate change working group.

The team has extensive experience of dealing with the environmental taxes. Their notable work and achievements for the team include:

- Advising a wide range of companies from packaging manufacturers through to retailers on the implementation of and compliance associated with plastic packaging tax, and leading multinational implementation projects including Spain and Italy

- Representing multiple landfill site operators and quarry operators on high value landfill tax enquiries and disputes with HMRC

- Advising energy sector businesses on the tax implications of new and novel energy generation and distribution models including renewable energy, green gas, combined heat and power plants, hydrogen and battery storage

- Helping manufacturing businesses to understand the energy reliefs available and managing those reliefs effectively

- Helping companies to understand how aggregates levy affects large scale construction and development projects and securing agreement with HMRC

For more information on how we can help you and your business with environmental tax, speak to a member of our team.

Frequently asked questions about environmental tax

Who pays environmental taxes?

Environmental taxes were previously quite niche and affected a limited number of businesses, but the introduction of new taxes, such as plastic packaging tax and windfall taxes on energy companies, means that environmental taxes affect a broad range of businesses.

In the UK, the main environmental taxes relate to packaging, affecting many retail companies, energy usage affecting the technology sector and many less obvious industries.

What are the different types of UK environmental taxes?

The list of UK environmental taxes include:

- Plastic packaging tax

- Windfall taxes on energy companies

- Climate change levy

- Energy reliefs

- Landfill tax

- Aggregates levy

Our environmental tax team can help you see if your business is liable to any of these taxes and if so, ensure that you are making full use of the reliefs available to you.

Is environmental tax direct or indirect?

Most environmental taxes are indirect taxes which are levied once in the supply chain by the taxable person. Who the taxable person is depends on the tax being charged:

- the manufacturer or importer of plastic packaging for plastic packaging tax

- the landfill site operator for landfill tax

- the energy supplier for climate change levy

- the quarry operator for aggregates levy

Windfall taxes on energy are treated differently. They are direct taxes which are administered through the corporation tax return.

How are environmental taxes important as policy tools?

Although the environmental taxes are only levied once in the supply chain, they have an impact on the market price of goods and services and affect pricing throughout the supply chain. By increasing the price associated with the behaviour the Government wants to discourage, these taxes act to stimulate the adoption of alternative, less polluting, behaviour of everyone.

Related content

Plastic Packaging Tax (PPT) update – response to consultation on chemically recycled content

HMRC confirms a mass balance approach for measuring chemically recycled content eligible for relief from PPT.

UK CBAM - Government response to the policy design consultation

The UK Carbon Border Adjustment Mechanism (CBAM) will tax carbon emissions on certain imports. With the Government’s response to its consultation now available, what more do we know and how can businesses prepare?

Government consultation published on tackling the hidden economy

To address the tax gap from the hidden economy, HMRC is consulting on expanding tax conditionality to new sectors. This aims to improve tax compliance and create a fairer business environment.

Waste crime: a growing concern

Waste disposal and waste management crime is a growing issue that poses significant threats to the environment, public health and the economy.

The Urgency of Carbon Emissions Data for UK Exporters of CBAM Goods

As the European Union (EU) continues to lead the charge on global climate action, UK businesses exporting goods to Europe are facing new information requirements from their customers under the Carbon Border Adjustment Mechanism (CBAM).

Changes to Energy Profits Levy (EPL) for oil and gas

On 29 July, the new UK Government announced the widely expected changes to the Energy (Oil and Gas) Profits Levy (EPL) which had been signalled in their manifesto.

HMRC announces that Voluntary Carbon Credits will be subject to VAT from 1 September 2024

Voluntary Carbon Credits (VCCs) are tradable certificates that represent the reduction or removal of one metric tonne of carbon dioxide, or an equivalent amount of greenhouse gases (GHGs) from the atmosphere.

UK Carbon Border Adjustment Mechanism to be implemented by 2027

On 18 December 2023, the Government published the summary of responses to the consultation on addressing carbon leakage risk to support decarbonisation.

Aggregates levy update

Aggregates levy is a tax levied on the commercial exploitation of rock, sand and gravel in the UK. It is currently charged at £2 per tonne. There are a number of changes that have been recently implemented or are in the pipeline.

The Government continues to ramp up its efforts to tackle crime in the waste sector

The Government has announced new measures to tackle economic crime and money laundering in the waste sector. The Environment Agency has launched an Economic Crime Unit to investigate ‘waste crimes’ (such as fly-tipping and landfill tax evasion) and money laundering in the sector, and exercise powers to freeze and seize assets. The Unit will work with other law enforcement agencies such as the police and HMRC to gather intelligence and proactively pursue criminals.

Consultation on UK Carbon Border Adjustment Mechanism

The latest consultation, titled “Introduction of a UK carbon border adjustment mechanism from January 2027”, aims to provide an insight into how the Government intends to structure and administer a UK CBAM; inviting interested parties to present their views until the deadline of 13 June 2024.

What are the tax implications of the Net Zero Review?

The Mission Zero review, recently published by the UK Government, examined whether or not existing policies would be sufficient to meet Net Zero carbon emissions by 2050. It considers the policies that should be enacted to increase the likelihood the target will be met. This article sets out our analysis of these recommendations.

Reminder to energy intensive businesses to claim their energy tax reliefs on time

The Court of Justice of the European Union’s (CJEU) ruling in Shell Deutschland Oil GmbH (“Shell) case is a timely reminder for businesses to review their claims for tax relief on energy products and electricity (used for heating or manufacturing) and make sure that they file them in time. In this case the Court agreed that Shell’s late submission should be accepted, but only because of the particular circumstances involving an ongoing tax audit.

Electricity Generator Levy Update

On 20 December 2022, the Government published a new technical note and draft legislation with significant changes to the proposed electricity generator levy (EGL) which was announced in the Autumn Statement.

Plastic Packaging Tax (PPT) update - August 2024

What insights can we gain from the most recent Plastic Packaging Tax (PPT) statistics released by HMRC