Technology transformation services

Businesses are innovating and identifying more efficient ways of meeting the ever-expanding needs of today, whilst also tackling tomorrow’s challenges. Utilising technology can improve the quality and accuracy of work, providing comfort and confidence in multiple processes, and frees individuals to focus on value work and distribute more relevant information, contributing to overall business success.

Tax rate card 2024/25

Our tax rate card gives tax rates and related information for the 2024/25 tax year, as announced in the Spring 2024 Budget.

The Evelyn Partners' technology team is experienced and innovative, combining deep technological knowledge with commercial acumen. We efficiently deliver pragmatic, tailored solutions. We achieve this by taking the time to understand your organisation, its objectives, risks and the longer-term challenges you’re likely to face.

Why should you modernise your business through process and system transformation?

Reduce costs

Boost productivity

Improve quality

Rapid delivery

*The statistics above are based on the average process automation experience of clients in 2021. The figures are based off a feasibility study we carry out for each process – current employee time taken to complete the process VS robot time taken to complete the process.

Business health check and monitor

Working with our Advisory Consulting colleagues, a business health check may help identify specific areas within your organisation that require further systemic analysis. The results of any business health check are provided back to the board as a series of reports as explained below:

- Bespoke interactive dashboard based on built-in tests and alerts devised by Evelyn Partners' specialists

- Accounts receivable and payable analysis to auto-detect risk and suggest improvement in areas such as cashflow and rent collection

- Portfolio analytics combining live data from multiple sources, tracking against KPIs and targets

Data-led digital transformation

We have partnered with Soroco, a leading AI-led task mining company that offers our clients a data-led approach to identifying hidden inefficiencies and opportunities to deliver sustainable digital transformation.

Systems and process review

A systems and process review can often be the best first step to take in the journey of transformation. Evelyn Partners can bridge the gap between tax and IT to identify risk areas and recommend better controls and improvement opportunities. It is worth considering a review when there are:

- Heavy reliance on Excel for financial and regulatory reporting

- Identified/ recognised issues with data across multiple systems

- Mergers, acquisitions or disposal of entities

- Changes of enterprise resource planning (ERP) or accounting systems

- Wider financial transformation initiatives

- Regulatory changes

Keeping up to date with software systems is key to making sense of your business data. The right system reduces the workload and automation of activities. As a result, businesses improve effectiveness and consistency.

We assist businesses with systems reviews, gap analysis, future state requirements, platform recommendations, and vendor evaluation exercises.

Data analytics, governance, insight and visualisation

Data is everywhere, from your phone’s weekly screen time report to your monthly management accounts. It is one of the most valuable assets a company owns and is highly underutilised.

Data Analytics is key to understanding how your business is performing, what the future could look like, and what you need to focus on to get there. With analytics-focused technology, you can present real-time reporting to make better decisions faster.

From data visualisation to predictive modelling, Evelyn Partners can work with you to conduct data analytics and generate rapid business intelligence. Benefits to your business include improvements in tax reporting, better decision-making, cost reductions and identifying your finance, tax, and other business trends.

Specific areas where technology has helped businesses:

- Achieve the target operating model

- Improve governance

- Track KPIs with live information

- Real-time risk management and compliance

New ways of working mean an organisation can:

- Consider best in class v best in cost

- Operate a virtual / digital workforce and location strategy

- Manage vendors in a cloud environment

- Deliver sustainable finance and tax processes in new ecosystems

A digitalised and automated finance function will deliver:

- Improved data architecture and data quality

- Real-time analytics

- Dashboards and workflow management

- System connectivity through the use of APIs

Automation

Automation technologies largely conduct processes with or without manual intervention, thus minimising errors, reducing costs and the amount of human time required, e.g. invoice processing, bank reconciliations, document comparatives, contract analysis, etc.

Robotic Process Automation (RPA)

Manual, time-consuming, repetitive and rules-based tasks should be automated. Robotic Process Automation (RPA) provides businesses with the means to free up employees to focus on more creative and valuable work. RPA will also help de-risk outmoded processes.

Use Robotic Process Automation to gather, collate and validate information including:

- Data extraction

- Data entry/administration

- Finance reconciliations and tax computations

- Document processing e.g. invoice handling

With RPA, processes can be left to run unattended enabling the business to operate in a more agile and forward-thinking manner. By deploying RPA processes at the departmental level, they can support repetitive processes, achieving efficiencies and cost savings while preserving flexibility. These types of processes are especially common in tax, finance and accounting, HR and form processing, but can also be found in all parts of a business.

We offer process selection, development and managed service for the running of RPAs with our technology and finance knowledge.

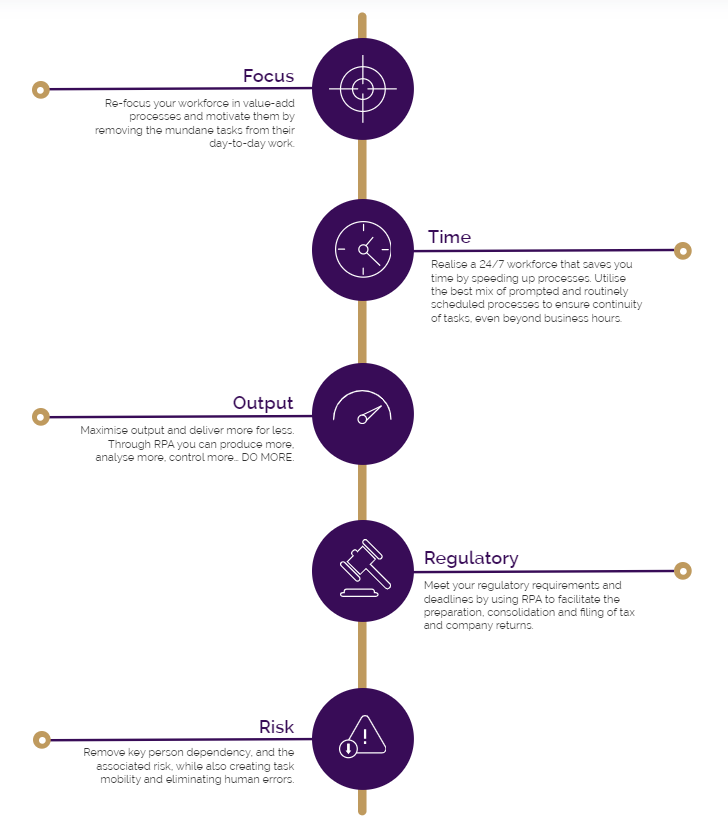

Benefits of Robotic Process Automation

Changing regulatory reporting and legislative requirements

The challenge

Authorities are increasingly going digital (e.g. through the use of Making Tax Digital (MTD), Country-by-Country Reporting (CbCR) and Common Reporting Standard (CRS)), along with developing new policies requiring increased transparency and sharing of data.

The burden is on the finance department to report more data than they have ever had to before. This in turn leads to a need for more data extraction and integration, a better understanding of the data available and improved efficiency to complete the extra work.

Digitalised finance and tax administration

Making Tax Digital (MTD) is part of a much wider trend involving the global digitalisation of tax. This presents a unique opportunity for the finance and tax function to capitalise on technological advancements and gain control over data and processes.

The Technology and Transformation Services team at Evelyn Partners has extensive experience to help businesses translate finance and tax requirements into technology-enabled solutions.

Our services include:

- Establishing technology strategies within the organisation

- Conducting a process review and recommending potential technological improvements to reduce effort and streamline processes

- Scoping, designing and implementing software applications

- Designing and deploying Robotic Process Automation (RPA) routines

- Generating financial and tax insight through data analytics and data visualisation

How Evelyn Partners can help

Our structured and connected approach ensures the right technology strategy will be achieved.

How we can help

- We develop logical processes which will facilitate your finance and compliance processes, saving time and minimising risk

- We tailor to your process and make it digitally linked and, where appropriate, automated. You would not need to tear apart the whole finance function, instead make incremental improvements that add significant value

- We deliver process efficient workflows to reduce key person dependencies through the smart use of software

- We can automate reporting, tax, accounting and entity tracking to allow personnel to refocus their time towards adding value

Frequently asked questions about tax technology

What is tax technology?

Building a high performing and future proof tax function is critical to business success.

Effective use of technology, including automation, data management and analytics, is a key component to making any business successful. Businesses must innovate and identify more efficient ways of meeting the ever-expanding needs of today, while tackling tomorrow's challenges. Through the use of technology, finance and tax teams can focus on high value work and distribute more relevant information, contributing to overall business success.

How is technology changing the authorities approaches to taxation?

Future plans will see tax authorities using big data analytics and artificial intelligence to fight against tax evasion and fraud as well as create new taxes.

Digitalisation of tax is not just being driven by technology but also legislation, with more countries moving away from periodic assessments towards real-time or transactional compliance.

The burden is on the tax department of organisations to report more data than they have ever before. Tax regimes such as FATCA, CRS, BEPS and DAC6 place a huge data burden on the tax department to sort through data and then report digitally.

Tax authorities are collecting more data, in more detail, more often, but the interesting part is they are using this data to understand, evaluate and analyse taxpayers.

Everyone from the self-employed and SMEs to global and national institutions will find that their relationship with the HMRC will soon look and operate very differently.

Do we really need technology in our tax or finance function?

Technology paves the way to handling business and legislative challenges in an effective, efficient and most importantly, accurate way.

Regulatory reporting requirements are increasingly complex. The volume and complexity of the data that has to be collated, processed and communicated are increasing.

Technology paves the way to handling these challenges in an effective and efficient way.

There are some questions you should ask yourself to help understand if you could benefit from adopting more tax technology:

- Are your compliance processes efficient, accurate and streamlined?

- Do your tax provision, compliance and planning processes help mitigate risk and have a clear audit trail?

- Are you getting optimal output from your tax or finance department?

- Do you have a clear understanding of your total tax liability?

What does ‘digitalised tax function’ mean to me?

There are several key areas that a digitalised tax function should look to deliver to any and every organisation.

A digitalised tax and finance function should look to deliver the following:

- Standardised data structure and architecture

- Improved data quality

- The capability to run detailed data analytics and visualisation

- Process automation and the increased use of robotics

- Integration of emerging technologies including harnessing cloud capabilities and application programming interfaces to gather and transfer data seamlessly

- Governance dashboards and workflow management

Surely the technology moves so quickly that it’s out of date by the time it goes live in my business?

The need to manage and maintain technology solutions means that they never sit still. They are never the ‘final’ version deployed.

The legislative landscape changes daily, weekly, monthly or annually, depending on which country you are based in and to which reporting requirements you and your business need to respond.

Technology platforms are constantly being updated to deal with changes in legislation and add capabilities as new reporting requirements are introduced by local authorities.

As reporting requirements become more complex, so technology becomes more suitable to ensure that individuals and businesses can sign off to confirm that they are:

- Compliant

- Accurate

- Demonstrating reasonable care

- Able to respond easily to change

- Able to provide fully auditable data sets to local authorities

Does technology enablement mean lengthy and costly projects?

There is a natural assumption that technology projects will be time consuming, resource intensive and heavily invasive, impacting all current processes.

Technology improvement can be looked at in two different ways. The first is a large transformational project that will impact people, processes and technology in the organisation over, typically, two to three years.

The other is taking small steps and making minor changes across regular two to six week sprints. Each small change made to the technology system improves a small part of a process or function and is far less invasive and less costly than a major transformational exercise.

The benefit of regular sprints and the ‘small steps’ approach is that the transformation of a business can be as large or small as it needs to be.