Advisory consulting

From debt, profitability and working capital to optimisation, strategic delivery and operational efficiency, discover what Evelyn Partners can do for your business

Our advisory and consulting team has the experience and resources to support your business in a wide range of situations, whether you’re experiencing underperformance or looking to further optimise and grow.

We always put ourselves in your shoes, cutting through financial complexities to drive meaningful change. From helping you prepare a business exit strategy, to post-merger integrations and simplifying corporate structures, our advisory consultants can help you every step of the way.

Evelyn Partners Professional Services, soon to be S&W

The new face in the professional services world.

How does advisory consulting work?

Advisory consulting provides independent, third-party support to improve a company’s processes and systems or helps to overcome risks and challenges. It offers valuable insights during a period of flux, change and growth, or when things have gone off track.

Ultimately, a business advisory consultant can help companies and non-profit organisations to make positive changes, while easing the burden on financial directors. This could be through specific projects or streamlining operations. It removes logjams and puts words into action.

How can struggling firms benefit from advisory consulting services?

Business advisory consulting services offer a variety of support for organisations that are underperforming or facing financial pressure. An advisory consultant can analyse both quantitative and qualitative factors to pinpoint the root causes of issues, while offering pragmatic, time-sensitive solutions and help to implement any long-term plans.

With years of experience in successfully solving debt, working capital and profitability issues, Evelyn Partners can deliver both light-touch and more involved support.

Our advisory and consulting support for struggling organisations can include:

- Root-cause analysis of operational and financial underperformance

- Working capital cycle optimisation

- Business turnaround delivery

- Targeted troubleshooting

- Strategic advice

How can advisory and consulting services support business growth?

Advisory and consulting services can also take businesses to the next level if they’re already performing well but have their sights set on bigger goals. A business advisory consultant can recommend optimisations, strategic delivery plans and operational efficiency improvements.

Evelyn Partners offers cutting-edge ideas, target operating models and data analytics solutions to growing businesses. With significant situational experience in growth and transformation, combined with sector knowledge, we always tailor our solutions to maximise opportunities.

Our advisory and consulting services for growth and transformation include:

- Transformation delivery

- Identification of value-enhancers

- Project planning, management and control

- Funding model optimisation

- 360º business advice

How can advisory consulting help make a business sale successful?

Our advisory consulting service is also invaluable when completing the final stage of your business lifecycle, exiting your business. We can work with you early in the process (as much as two years before you are planning to sell) to ensure that you are making the right decisions and receive the maximum value for your business.

Through a process we call ‘exit readiness’, we make sure that you have everything in place to make the company look enticing to prospective buyers. At the same time, we help to fill in possible gaps and rectify any potential contentious points of the sale to avoid price chipping and make the whole process as quick and seamless as possible.

Our advisory consulting services for selling a business include:

- Helping you articulate your strategy and value levers

- Putting in place improvements to cash and profit to boost the value of your business

- Streamlining your group structure to make it simpler for a purchaser

- Improving your management information and data quality ahead of due diligence

- Market mapping and benchmarking against competitors to identify areas to improve pre-due diligence

- Review of current technology and risks

- Historical financial analysis and preparing integrated financial forecast models

- Identifying and fixing any devaluing factors

What advisory consulting services and approaches does Evelyn Partners offer?

From business turnaround to transformation and optimisation, our consulting and advisory services cover a broad spectrum.

Business turnaround and working capital

Turn your business around with operational improvements, working capital cycle reviews, integrated cashflow forecasting, troubleshooting support and more.

Transformation and optimisation

Identify and maximise value-enhancers, benefit from strategic assessments and advice, get help with change management and reduce your costs.

Post-merger integration (PMI)

Ensure processes and procedures are aligned in the months after a merger. Achieve synergies, plus cultural and strategic consolidation.

Simplifying corporate structures

Get support on project management and implementation. Tax-structuring assistance and specialist technical support are also available.

Professional practices

We can help you maximise margin and operational efficiencies, streamline and cut costs and optimise lock-up and working capital.

Renewable energy and natural resources

Across funding, margins, financial forecasting, strategic options and more, our team caters for both energy suppliers and renewables firms.

Technology and automation

From robotic process automation to data governance and developing a future vision, Evelyn Partners has the answers.

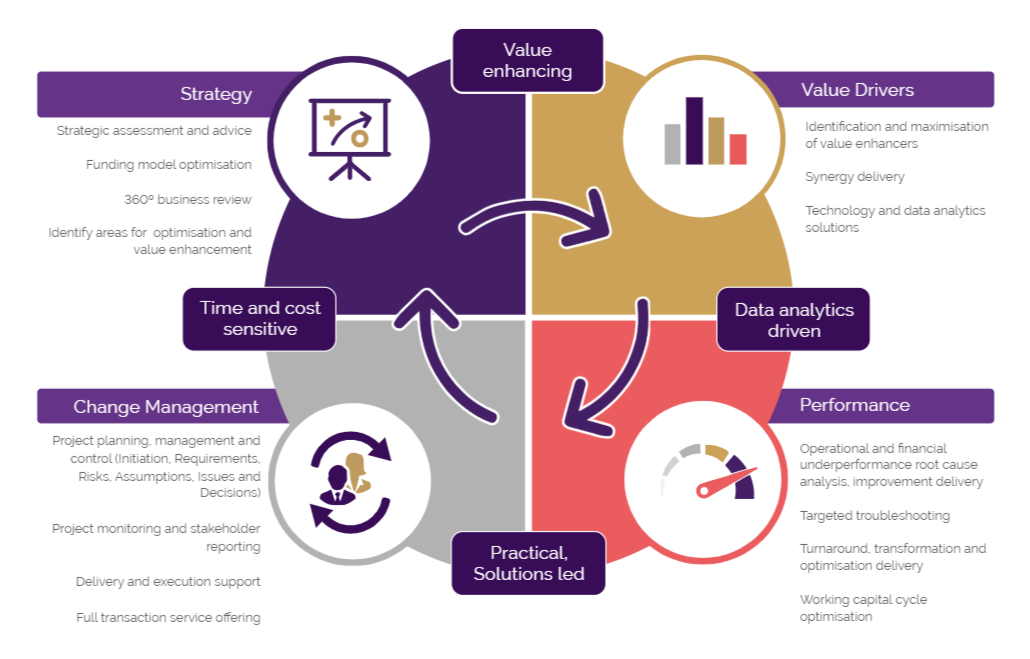

Here’s how our approach fits together:

What can our advisory consultants do for your business?

Solutions-led support

Success for us means ensuring you get effective solutions in place as quickly as possible. We don’t apply off-the-shelf solutions or generic best practices. Instead, we find a tailored approach which is more effective and enduring. Our service lines are combined with commercial acumen to ensure we recommend practical, enduring solutions.

Time-sensitive assistance

It’s hectic being a business leader, facing a daunting list of responsibilities and often flying blind due to a lack of live information. Critical tasks can get deprioritised against seemingly urgent but low-risk activity. Meanwhile, cultural improvements and strategy can be all but forgotten. When an issue takes hold, stakeholder management can use up all your time, further worsening the impact.

Our service brings clarity, support and additional bandwidth to ensure all objectives are delivered.

Access to industry specialists

In addressing the root causes of issues, our advisory consulting services can identify problems that need to be dealt with by a specialist. Within our closely knit Evelyn Partners family, a range of specialist experts are on hand if you need help with fraud resolution, mergers and acquisitions (M&A), insolvency, tax planning, contractual disputes and more.

Data-driven analytics

We use technology in an accessible way to remove complexity and risk when dealing with ‘Big Data’. That unleashes a world of added value and information for leaders. We deploy data visualisation tools to build dashboards that pinpoint problems, identify opportunities and can be used easily as live tools.

What makes Evelyn Partners unique?

Industry experience

With many years of experience working in board roles focussed on turnaround and transformation, our business advisory consultants know what it’s like to be responsible for the delivery of objectives and correcting underperformance. Importantly, this includes dealing with cash pressures.

Partner-led service

We provide real value to clients from our partner-led delivery, including a great understanding of the practical implications of our recommendations.

Our combination of many years’ industry and advisory consulting experience brings together the best of both worlds, delivering effective and enduring results, not simply glossy reports that get put on the shelf. We work as your trusted advisers, delivering to individual requirements.

A varied team

Our team combines varied knowledge with advisory consulting expertise, working with a wide network of lenders and keeping track of market responses and trends. It means we’re best placed to successfully steer your business through tough times or uncharted new waters.

As experienced advisers, we’ve been where you are today and can help with real-world solutions and insights, combined with practical implementations.

An extension of your team

With former financial directors among our specialists, we already know the ins and outs of your situation. But we can also take things one step further by allowing them to act as interim directors for your business. It’s all part of our unique financial advisory consulting service.

Innovative toolkit

Our innovative toolkit covers all your needs, from target operating models, project planning tools and process mapping to technology and data analytics solutions. We use these tools selectively, in an insightful and commercial way, to add genuine value to your business and situation.

Frequently asked questions about advisory consulting

How can advisory consulting build enterprise value in my organisation?

Building enterprise value is among the areas where an advisory consultant can support your organisation.

Focusing on the right things frees up valuable time across a business and creates sustainable cash generation.

Identifying the value levers in an organisation brings clarity and a focus on all activities being aligned with building value. Many businesses don’t articulate their value levers and instead focus only on outcomes to be improved, such as profit.

But without a clear understanding of value levers, a misalignment may occur. At best, a lack of focus on value levers can lead to activities being centred on the wrong things, wasting time and money. At worst, this can lead to a loss of competitive advantage and failure, as the organisation is left behind in the market.

As part of our advisory and consultancy services, we work with businesses to identify value levers, areas for improved focus, activities and support with implementation. We can also focus on a specific goal if required, such as working to maximise value ahead of an anticipated investment or sale of a business.

Find out more about our transformation and optimisation services

How do I improve cash and working capital in my business?

Releasing tied-up cash gives valuable breathing space, freeing up time and reducing pressure on the finance team.

Cash is tied up in more than just debtor balances or stock; the whole picture needs to be considered from both a pragmatic and data-analytics standpoint. That’s where the work of a business advisory consultant can come in.

Once the whole working capital cycle is reviewed and the gap is highlighted, tailored solutions can be identified. These may include supporting arrangements, such as implementing asset-based lending facilities or enhanced insurance coverage to mitigate risks.

Operational changes often deliver significant working capital improvements too. These include changes to customer debtor collection processes, supplier contracts, shipping and sourcing arrangements.

In addition to identifying practical improvements, our advisory consulting team can build live dashboards. This means working capital can be managed to KPIs on an ongoing basis, with filters and drilldowns in the dashboard to target activity.

Learn more about our business turnaround and cash management services

What cost reduction and streamlining methods are available to businesses?

Reducing costs is a controllable way to generate valuable cash and improve profits.

Businesses should regularly review their cost base to ensure spending remains effective and lean. However, when costs have spiralled out of control, or are impacting profitability and cash generation, a more in-depth review should be undertaken to strategically assess spending. Our advisory and consulting services can help with this.

There are different methods available, ranging from a simple review of cost categories to in-depth zero-based budgeting, benchmarking and strategic cost reviews to consider how spend enhances enterprise value.

We scale the opportunities based on ease of implementation and impact, while considering any upfront cost to generate a plan to implement and track against.

Rather than simply looking at costs to cut, we can also complete streamlining reviews as part of our advisory and consultancy services, identifying operational process improvements. These range from removing low-value or redundant activities to replacing time-intensive, repetitive work with Robotic Process Automation (RPA).

Explore our transformation and optimisation services

How do I implement a transformation project using advisory consulting services?

Implementing a transformation project well reduces costs and frees up management time in dealing with issues.

Implementation of the project will be more successful if what you are trying to achieve is set out clearly, with related timeframes, roles and responsibilities. Throughout delivery, a Risks, Assumptions, Issues and Decisions (RAID) log, along with regular progress reporting, is important. This manages expectations and deals with any dependencies, blockers or risks effectively so that the project is not slowed down or derailed.

Change management is critical and involves dealing with qualitative factors such as culture and communication. This can often be a greater challenge if project managers focus more on quantitative factors, causing transformation projects to fall at the final hurdle.

At Evelyn Partners, our business advisory consulting services strategically review and identify transformation opportunities, and support with delivery. Our level of involvement is tailored to your requirements. It ranges from light-touch, strategic support to full project management, to ensure effective delivery and properly embedded solutions.

Read about our transformation and optimisation services

How do I turn around an underperforming business?

Turning around a business reduces stakeholder pressure, management stress and the risk of ultimate failure.

A business turnaround programme requires careful consideration and implementation, and we recommend this is undertaken with the support of a qualified, experienced advisory consultant.

Our partners who lead this work are Institute for Turnaround accredited. We also draw on the extensive experience of our colleagues who are licensed insolvency practitioners in more distressed situations.

We can complete a 360º business review to identify the best route forward, enabling your board and stakeholders to have confidence in the available solutions and their deliverability. Ultimately, we pride ourselves on supporting successful implementation.

Take a look at our business turnaround and cash management services

My organisational structure is too complicated – how do I simplify it and reduce costs?

A simple structure reduces costs and management time. A complex group structure can increase risks and add to costs. Barriers to simplification include a lack of bandwidth to plan and implement the revised structure, the risk of triggering tax liabilities, and missing in-house expertise (for example, only licensed insolvency practitioners can complete solvent liquidations).

Our experts help businesses to overcome these barriers by offering organisations a flexible, integrated corporate simplification service. We deliver cost-effective, lower-risk structures and return capital in a tax-efficient way to realise value.

We have extensive experience of successfully providing corporate simplification and post-merger integration support, within complex and regulated UK and multinational groups.

See how we simplify corporate structures

How do I integrate a new business into my organisation to achieve acquisition synergies?

Proper integration streamlines management time, reduces costs, and generates cash and profit faster.

Investment in post-merger integration (PMI) support can be the difference between success and failure to achieve the deal rationale and implement key cultural changes in those critical weeks post-acquisition. It can also materially accelerate the achievement of synergies and capture strategic benefits before competitors have the chance to react.

It’s important that integration plans are properly customised to deliver the objectives and value-enhancers that warranted the acquisition in the first place. Our consulting and advisory services focus on ensuring the value behind the deal rationale is achieved, and that the integration is enduring and properly embedded.

Through partner-led delivery, we advise on performance and activities required against a 100-day plan. When issues arise, we provide additional bandwidth, identify solutions and work to bring performance back on track.

Discover our post-merger integration (PMI) services

Related content

Dealing with rising costs for businesses: 5 ways to get ahead in 2025

The incoming, post-Budget cost squeeze on employers is piling yet more pressure on hard hit businesses. These five key areas can help you manage costs and stay ahead in 2025.

Company insolvency: is your business in trouble?

Company insolvencies are on the rise. This article considers how company directors can gauge whether their business might be in danger of insolvency, and actions that can protect the business – and themselves.

9 practical steps to help avoid insolvency

With economic turmoil and volatility taking their toll on businesses, this article sets out 9 practical steps you can take to help avoid insolvency.