Jason Hollands, Managing Director at the Tilney Group, looks at which funds proved most popular with clients using the group’s Bestinvest Online Investment Service in August.

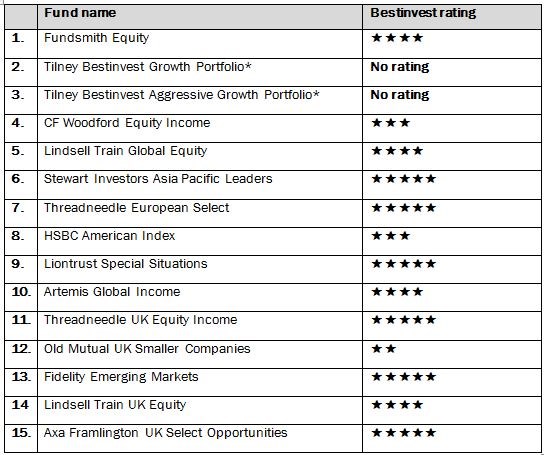

At a glance: The most popular funds selected by clients using the Bestinvest Online Investment Service in August 2017:

*As a matter of policy Tilney does not star-rate its own in-house managed Multi-Asset Portfolio funds. However each of these invests in a diversified selection of circa 20 top-rated underlying funds selected by the Tilney research team.

Hollands comments: “August proved to be the most volatile month for the markets so far in 2017, mainly due to escalating tensions over North Korea’s nuclear weapons programme. However, the investment choices made by Bestinvest clients in August proved to be consistent with the pattern over the last number of months: a heavy preference for equities and choices dominated by seasoned active fund managers.

“Once again, Terry Smith’s Fundsmith Equity fund came out on top, a position it has held for well over a year. Terry Smith has an invest-and-hold strategy focused on a concentrated portfolio of 29 quality growth stocks from across developed markets. His strategy continues to prove to be effective with positive returns in 76% of the months since the funds inception in 2010.

“The Tilney Bestinvest Growth was the second most popular fund and is a ready-made portfolio for investors with a long investment time horizon. It invests into a portfolio of funds and ETFs selected by our research team which include the likes of JO Hambro UK Opportunities, Liontrust Special Situations, Majedie UK Equity, Vanguard S&P 500 ETF and Artemis European Opportunities. 56% of the portfolio is invested in equities, with the remainder in absolute return funds, bonds, commercial property and gold.

“The Tilney Bestinvest Aggressive Growth Portfolio takes a more adventurous investment approach than the Growth portfolio, with a larger exposure to shares in small companies and overseas companies. It is also designed for investors with a high tolerance for risk and a long investment time horizon.

“The CF Woodford Equity Income fund, managed by Neil Woodford, has consistently appeared in our top 10 listed since launch, despite some high profile stock disappointments during the month which generated a lot of negative publicity. The fund now sits bottom in its sector over one year, with negative returns over the past twelve month period. Among the holdings that have endured rocky performance are Astra Zeneca, Imperial Brands and Provident Financial.

“The Lindsell Train Global Equity fund, run by Michael Lindsell and Nick Train, invests in a a concentrated portfolio of cash-generative business franchises which are held for the long term. The biggest holdings in the fund are the well-known household names like of Nintendo, Walt Disney, PepsiCo and PayPal, which although they note are often deemed to be ‘boring, over the long term ‘boring’ wins out.

“One fund which continues to be popular within the emerging market and Asia space and continues to draw support from clients is the Stewart Asia Pacific Leaders, a longstanding top rated fund. The fund, now managed by David Gait, focuses primarily on investing in large companies with sustainable cash flows and robust balance sheets. Its highest weighting remains India (30.6%) followed by Taiwan (17.2%) but it has negligible exposure to China where concerns persist about the growth of debt.

“The Threadneedle European Select fund, run by Dave Dudding and Mark Nicholas, is consistently in our top 10 list. According to data from the Investment Association, European equity funds have seen a surge of inflows as the European economic outlook improves and concerns about political populism have eased. This fund retains a bias to the consumer goods, healthcare and consumer services sectors. The fund aims to seek out companies with strong brands that are less sensitive to price-based competition and as such the fund invests heavily in firms such as the world’s largest brewer Anheuser-Busch InBev and beverage company Pernod Ricard. It also holds large positions in consumer goods companies L’Oreal and Unilever.”

“The HSBC American Index continues to retain its position in our top ten as core choice for US equity exposure. The fund is a tracker fund that follows the S&P 500 index, has been the most popular choice Bestinvest clients investing in the U.S. This tracker has a very low ongoing charges figure of 0.08%.

“Managed by Anthony Cross and Julian Fosh, the Liontrust Special Situations fund has long held a highly coveted five-star rating from our research team and has managed to achieve both significant and consistent outperformance over the long term, but with less volatility than the UK market. The fund follows a well-articulated process, called the Economic Advantage approach, that looks for companies able to sustain a higher than average level of profitability for longer than expected. The companies the fund invests in have distinct characteristics, like ownership of intellectual property, strong distribution channels or significant recurring revenue streams whether they are large, medium sized or smaller companies. Although a UK equity fund, the revenues earned by companies in the portfolio is very international in nature. It is estimated that on a look-through basis, more than 60% of revenues earned by companies in the fund are derived outside of the UK. One such example is Renishaw, the mid-cap metrology specialist, whose expertise in high-tech precision measuring and calibration equipment is in demand globally from industries such as medical diagnostics, machine calibration and neurosurgery. In the year to 30 June 2017, 47% of its sales were to the Far East, 24% to Continental Europe, 21% to Americas and only 5% in the UK.

“The Artemis Global Income fund has returned to favour recently with Bestinvest clients. Manager Jacob de Tusch-Lec takes an unconstrained approach to investing in global equities. This means its top holdings are typically very different from competitor funds which are usually dominated by giant US companies. Instead, this fund's top holdings include the likes of Norwegian insurance company Storebrand, Italian communication infrastructure company EI Towers, Italian telecom company INWIT and US computer data storage company Western Digital. This fund has a much higher weighting to medium sized and smaller companies than most global funds. Tusch-Lec believes the global economy is shifting from a deflationary to reflationary environment and has adjusted the portfolio to reflect this.”

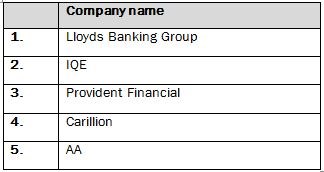

Investors remain with Lloyds shares

“While Bestinvest clients predominately choose funds, they can also purchase shares and investment trusts through the service. Lloyds Banking Group, one of the most domestically focused financial banks on the market, has remained the most popular stock for the fourth month running. IQE has jumped into our top five for the first time this month. The small Welsh tech company is reportedly making parts for Apple’s upcoming iPhone 8 and has seen its share price treble in the last year. Provident Financial meanwhile appeared on buyer radars after it saw its shares slump following a profit warning, showing some of our clients believe this could represent a bargain opportunity.”

Important Information:

The value of investments, and the income derived from them, can go down as well as up and you can get back less than you originally invested. Past performance is not a guide to future performance.

Different funds carry varying levels of risk depending on the geographical region and industry sector in which they invest. You should make yourself aware of these specific risks prior to investing.

We aim to provide investors with information to help them make their own investment decisions although this should not be construed as advice or an investment recommendation. If you are unsure about the suitability of an investment or if you need advice on your specific requirements, we strongly suggest that you consider professional financial advice.

Underlying investments in emerging markets are generally less well-regulated than the UK. There is an increased chance of political and economic instability with less reliable custody, dealing and settlement arrangements. The market(s) can be less liquid. If a fund investing in markets is affected by currency exchange rates, the investment could both increase or decrease. These investments therefore carry more risk.

Smaller companies shares can be more volatile and less liquid than larger company shares, so smaller companies funds can carry more risk. The property market can be illiquid; consequently, there can be times when investors will be unable to sell their holdings. Property valuations are subjective and a matter of judgement.

Tracker funds track the performance of a financial index and as such their value can go down as well as up, much like shares, and you can get back less than you originally invested. Some are more complex so you should ensure you read the documentation provided to ensure you fully understand the risks.

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.