Jason Hollands, Managing Director at the Tilney Group, looks at which funds proved most popular with clients using the group’s Bestinvest Online Investment Service in April.

At a glance: The most popular funds selected by clients using the Bestinvest Online Investment Service in April 2017:

*As a matter of policy Tilney does not star-rate its own in-house managed Multi-Asset Portfolio funds. However each of these invests in a diversified selection of circa 20 top-rated underlying funds selected by the Tilney research team.

Hollands comments: “The beginning of April saw the end of the 2016/17 tax year, with the flurry of people using the final remaining minutes to fill the remaining of their Isa’s and Sipps. In the new tax year, investors have a vastly increased £20,000 allowance which they can fill their boots with this year, many of our clients did so on the very first day of the new tax year. Once again it was funds primarily focused on equities that proved most popular with Bestinvest clients and once again the list was dominated by funds managed by seasoned active managers. Neil Woodford’s new fund, the Woodford Income Fund, was only launched in March and yet it has already gained a position in our top ten, although overall clients favoured his existing CF Woodford Equity Income fund.

“The most popular fund with our clients in April remained - the Fundsmith Equity fund, a position it has retained since June last year. Bestinvest clients just can’t get enough of tell-it-like-it-is manager Terry Smith who recently came in to update us on the fund. Smith believes that trying to predict market and economic events is a fool’s game and told us: “I deploy most of my time and effort on things I can control. Two of those are whether we own good companies and what valuation we pay to own their shares”. He has an invest-and-hold strategy focused on a concentrated portfolio of 29 quality growth stocks from across developed markets. He sums this up as: “Buy shares in good companies; don’t overpay; do nothing.” He currently has Microsoft, Pepsico and Paypal among his top ten holdings. The fund has a high weighting to consumer staples, 32.2%, healthcare, 29.1%, and technology, 23.5%.

“The Tilney Bestinvest Growth was the second most popular fund and is a ready-made portfolio for investors with a long investment time horizon. It invests into a portfolio of funds and ETFs selected by our research team which include the likes of JO Hambro UK Opportunities, Liontrust Special Situations, Majedie UK Equity, Vanguard S&P 500 ETF and Artemis European Opportunities. 57% of the portfolio is invested in equities, with the remainder in absolute return funds, bonds, commercial property and gold.

“There is understandably a fair amount of caution towards emerging markets and Asia at the moment given President Trump’s views on raising import tariffs to protect American jobs. One fund in this space that continues to draw support from clients however is the Stewart Asia Pacific Leaders, a longstanding top rated fund. The fund, managed by David Gait, focuses primarily on investing in large companies with sustainable cash flows and robust balance sheets. Its highest weighting remains India (31.6%) followed by Taiwan (17.8%) but it has negligible exposure to China where concerns persist about the growth of rapid growth of debt.

“Gaining in the ranks back up to the fourth spot after dropping down to the ninth position in February was the eponymous CF Woodford Equity Income fund, managed by Neil Woodford. While his flagship fund does dabble in riskier small growth businesses, it primarily focuses on resilient companies that are less affected by the global economic cycle and are more in charge of their own destiny. Longstanding top holdings include healthcare multinationals AstraZeneca and GlaxoSmithKline, and he continues to invest very significantly in the tobacco industry with big positions in industry giants Imperial Brands and British American Tobacco.

“The Tilney Bestinvest Aggressive Growth Portfolio takes a more adventurous investment approach than the Growth portfolio, with a larger exposure to shares in small companies and overseas companies. It is also designed for investors with a high tolerance for risk and a long investment time horizon.

“The hotly anticipated new Woodford fund enters into our list in sixth position in its first month since launch but behind its established sibling. The CF Woodford Income Focus fund will differentiate the fund from his flagship Woodford Equity Income product by targeting a higher level of income – target dividend is 5p over the first year with a longer-term payout of 120% of the UK stockmarket yield. The fund will also be more focused than the Equity Income fund and have a higher level of overseas exposure, though the bulk of the portfolio will be invested in the UK.

“Managed by Julian Fosh and Anthony Cross, the Liontrust Special Situations fund has long held a highly coveted five-star rating from our research team and has managed to achieve both significant and consistent outperformance over the long term, but with less volatility than the UK market. The fund follows a well-articulated process, called the Economic Advantage approach, that looks for companies able to sustain a higher than average level of profitability for longer than expected. The companies the fund invests in have distinct characteristics, like ownership of intellectual property, strong distribution channels or significant recurring revenue streams whether they are large, medium sized or smaller companies.

“US equity funds have seen increased interest since the election of Donald Trump as US President as investors bet on a combination of aggressive tax cuts, deregulation and massive infrastructure spending to boost the US economy. The HSBC American Index, a tracker fund that follows the S&P 500 index, has been the most popular choice Bestinvest clients investing in the U.S. The US stock market is notoriously hard for active fund managers to beat and this tracker has a very low ongoing charges figure of 0.08%.

“The Threadneedle UK Equity Income fund is another popular choice for core UK equity exposure. Manager Richard Colwell has a pragmatic approach, focused on total return rather than yield per se. The fund is currently very underweight financials and overweight industrials compared to its FTSE All-Share benchmark. Companies within its top ten holdings include healthcare multinationals GlaxoSmithKline and AstraZeneca, and consumer goods companies Unilever and Imperial Brands.

“The Threadneedle European Select fund is consistently in our top 10 list. The fund retains a bias to the consumer goods, healthcare and consumer services sectors. The fund aims to seek out companies with strong brands that are less sensitive to price-based competition and as such the fund invests heavily in firms such as the world’s largest brewer Anheuser-Busch InBev and beverage company Pernod Ricard. It also holds large positions in health care companies Roche Holding and Fresenius Medical Care.”

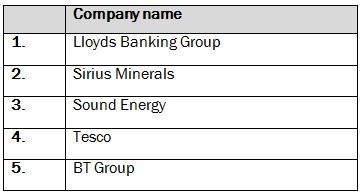

Investors ride the rollercoaster of the Lloyds shares

“While Bestinvest clients predominately choose funds, they can also purchase shares and investment trusts through the service. The most popular stock in April was Lloyds Banking Group. During April it announced it would close 100 branches as well as having to pay £100m in fraud compensation, with the impact of these announcements causing the share price to both rise and fall respectively. Sirius Minerals joined the FTSE 250 towards the end of April after announcing it was its intention to move from AIM in March. It recently reached a market cap of over £1billion, with many analysts believing it will continue in its exponential growth to reach the FTSE 100.”

Important Information:

The value of investments, and the income derived from them, can go down as well as up and you can get back less than you originally invested. This press article does not constitute personal advice. If you are in doubt as to the suitability of an investment please contact one of our advisers. Past performance is not a guide to future performance.

Different funds carry varying levels of risk depending on the geographical region and industry sector in which they invest. You should make yourself aware of these specific risks prior to investing.

Underlying investments in emerging markets are generally less well-regulated than the UK. There is an increased chance of political and economic instability with less reliable custody, dealing and settlement arrangements. The market(s) can be less liquid. If a fund investing in markets is affected by currency exchange rates, the investment could both increase or decrease. These investments therefore carry more risk.

Smaller companies shares can be more volatile and less liquid than larger company shares, so smaller companies funds can carry more risk. The property market can be illiquid; consequently, there can be times when investors will be unable to sell their holdings. Property valuations are subjective and a matter of judgement.

Tracker funds track the performance of a financial index and as such their value can go down as well as up, much like shares, and you can get back less than you originally invested. Some are more complex so you should ensure you read the documentation provided to ensure you fully understand the risks.

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.