2021 did not pan out quite as many analysts had expected. The great US bull market forged on, China went into reverse and inflation returned more quickly than expected. Here we pick out six graphs representing key trends that underpinned the performance of investment portfolios this year.

'The year of vaccines was nowhere near as tumultuous as the year of lockdowns,' said Jason Hollands, managing director of online investing service, Bestinvest. 'But there were still some surprises, and some sectors and regions did a lot better than others.'

He added: 'What this all shows is that with the unpredictability of global markets – particularly in the time of Covid – investors must ensure their portfolios benefit from good diversification and an asset allocation approach that will stand up to various scenarios.'

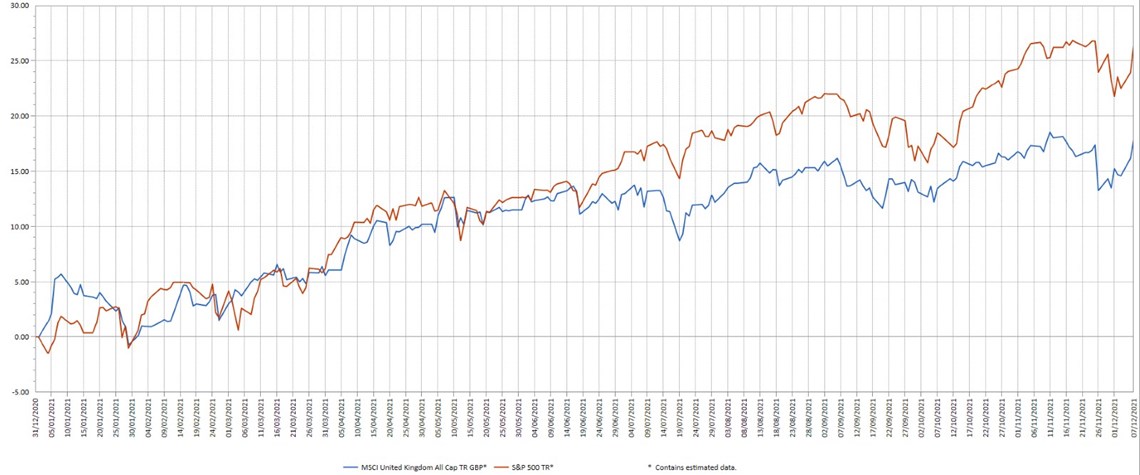

US BULL MARKET CHARGES AHEAD OF UK

Source: Bestinvest / Lipper, total return in local currency, 31/12/20 to 7/12/21

Many global equity analysts believed that the US stock market could not keep up the exceptional run of 2020 and the preceding years. But the S&P 500 has delivered a total return of 26.5% so far this year. That compares to a 17.9% total return for the MSCI United Kingdom All Cap index – lower but impressive nevertheless.

'UK equities were a much bigger laggard in 2020, due to the London market’s low exposure to technology and online stocks - areas which fared well during the lockdowns,' says Hollands. 'However, unlike US shares – where valuations have only been higher than now during the dot com bubble – UK equities are a bargain in comparison. A fact not lost on international private equity firms who have been engaged in a frenzy of bids for UK companies this year.'

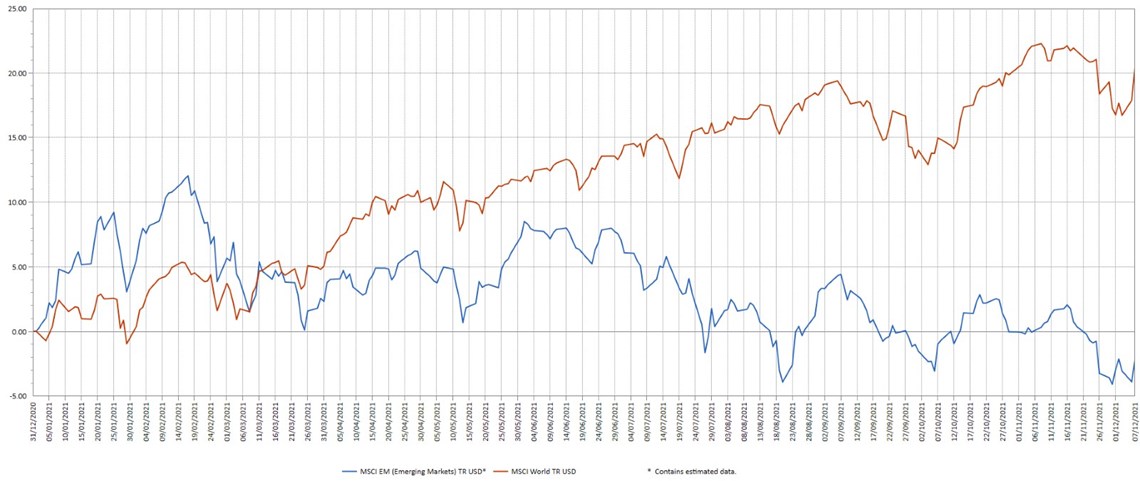

DEVELOPED WORLD BEATS EMERGING MARKETS

Source: Bestinvest / Lipper, total return in US Dollars, 31/12/20 to 7/12/21

2021 has been a great year in many equity markets as COVD19 vaccination programmes created a route map out of relentless lockdowns and economies reopened, backed by formidable stimulus packages from both governments and central banks.

However, the rally in equity markets wasn’t uniform across the globe. While developed markets, as measured by the MSCI Word Index, have returned a thumping 20.5% so far, the MSCI Emerging Markets Index ticked down by –2%.

Hollands observes that beneath the surface however: ‘Indian and Taiwanese equities had a great year, respectively returning 22.8% and 23.3%. But it has been a tough year for the other significant emerging markets.

'In particular Chinese equities, the largest component of the emerging market index, have had a torrid year in marked contrast to a great 2020,' he adds. '2021 has seen something of a reckoning for China stocks.'

A range of legal and regulatory crackdowns by the Chinese authorities, concerns about the fragility of its property sector and the regime’s aggressive stance towards Taiwan have spooked fund managers and other investors.

'Holders of many emerging markets funds and trusts will have suffered poor performance this year as China holdings make up a sizeable chunk of most of them,' said Hollands. 'Those relying on passive emerging markets - and Asian - funds will have been particularly affected, as Chinese companies represent a third of the index but Taiwan and India just 16% and 12%.'

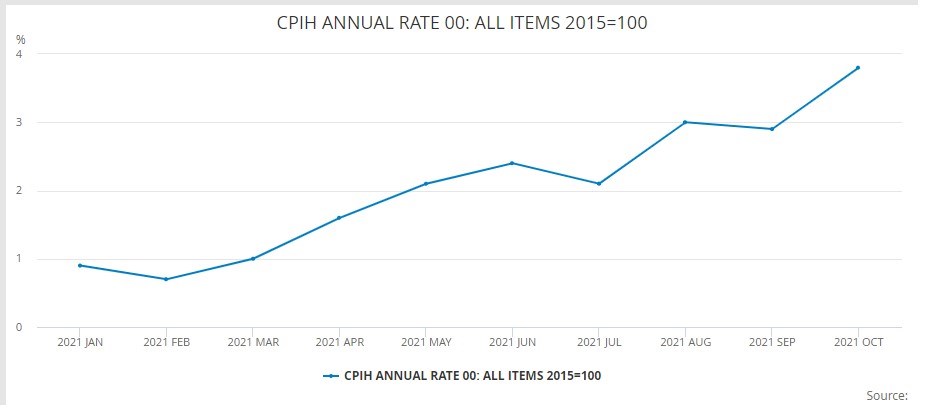

THE RAPID RETURN OF INFLATION

Source: Office for National Statistics

The headline inflation rate for UK consumers has more than quadrupled this year from around 1% to 4.2% at the last reading (for October, released in November). Caused by a combination of post-lockdown economic recovery, supply chain bottlenecks and soaring oil and energy prices, the inflationary environment has proved to be less transitory than many policymakers had assumed. The Bank of England deputy governor this week said inflation would surge above 5% into next year.

'As well as eating into household budgets, inflation devours the value of money, making it all the more important to consider alternative homes for spare cash away from savings accounts that pay negligible rates of interest,' said Hollands. 'While interest rates are set to rise next year, this brings little comfort to cash savers in reality as once inflation is factored in, the real returns on savings will still be sharply negative.'

He added: ‘For those already invested, it is not recommended to take drastic action to short or even medium-term trends. But self-directed investors who like to manage their own portfolios might seek out funds with exposure to commodities, financials and even income-paying sectors like infrastructure. On the government debt side of things inflation-protected bonds have done well this year – but it makes more sense to invest in these when inflation isn’t a problem rather than after the event.’

COMMODITIES AND NATURAL RESOURCES VERSUS RENEWABLES

Source: Bestinvest / Lipper, total return in US Dollars, 31/12/20 to 7/12/21

The renewables sector was boosted by a lot of exuberance in 2020 and also a flood of money into ESG funds. However, fortunes have changed in 2021, despite the renewed focus on cutting greenhouse gas emissions and plans outlined by governments at COP26.

The MSCI Alternative Energy Index slumped -12.6% in 2021 after rising sharply in 2020. In contrast, the MSCI World Energy Index, which is dominated by oil and gas giants, has rocketed 43.9% as oil and gas prices have soared as factories have reopened and people started to travel again. Supply bottlenecks have exacerbated the price effects for both businesses and consumers.

'Changes in fortune like this show why it is risky for investors to back individual sectors or themes too heavily, particularly ones that are relatively new,' said Hollands. 'More diversified funds with an investment strategy that cuts across sectors are less likely to be vulnerable to short-term changes in the way the wind’s blowing.'

THE RETURN OF VALUE INVESTING

Source: Bestinvest / Lipper, total return in US Dollars, 31/12/20 to 7/12/21

With the approval of vaccines beginning in November 2020, global investors started looking for companies that were undervalued and likely to benefit from the forthcoming economic recovery. Conversely, the 'growth' sectors like tech and online businesses that had been in vogue for at least a decade - culminating in stellar growth during the pandemic as people worked, shopped and entertained themselves at home – were expected to suffer from rising inflation, which makes their projected future earnings look less certain.

'This year however, as economies have reopened, undervalued business and those hit hard by the recessions of 2020 came soaring back in the first half the of the year, while “growth” companies wobbled before regaining their stride. Year to date, the global returns from “growth” and “value” stocks are pretty much neck and neck,' said Hollands.

'From here we may see a less extreme divergence in performance, or even a renewed outperformance from sectors like financials and commodities, which typically do well in periods of higher inflation and rising interest rates.

'Many investors may have become, perhaps unwittingly, too exposed to one style of investment in their holdings. There has been huge enthusiasm in recent years for growth sectors, and the funds and trusts that are committed to them.

‘But self-directed investors who hold only these vehicles must expect some fallow years, if not some significant reversals. So it may be worth moving to a more balanced approach, including some funds that have a greater focus on identifying undervalued companies, especially at a time when parts of the market look quite expensive.'

'Value' funds that make Bestinvest’s 'Best Funds List', include Artemis UK Select, Jupiter UK Special Situations and Fidelity Special Situations.

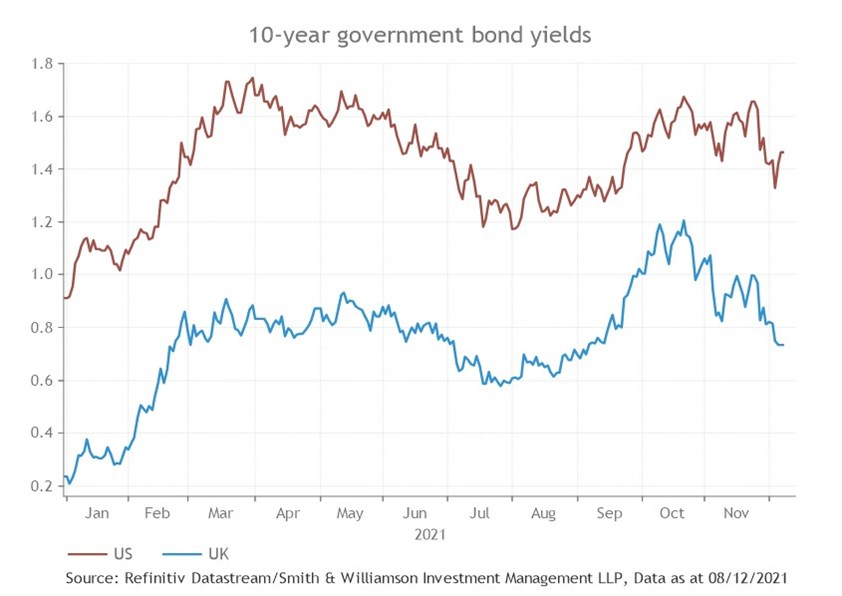

BOND YIELDS DISAPPOINT

The yields on government bonds remain dismally low, despite rising since the start of the year as inflation has surged. With government bond yields offering negative real returns after inflation is factored in, it is hard to see the attraction. This has led to much talk of the 'end of 60-40' - the traditional portfolio asset allocation of 60% to riskier equities and 40% to safe-haven bonds.

'Holding such a large proportion of one’s money in an asset class that offers negative real returns is indeed problematic,' says Hollands. 'It has led many self-directed investors to seek out alternative avenues of diversification like private equity assets, infrastructure and even music rights. These more illiquid types of assets are typically available through investment companies listed on the stock exchange.

'However, savers who do not have the time or inclination to follow such trends can let the professionals monitor asset allocation and adjust their investments, by investing in a diversified multi-asset fund or seeking out a discretionary investment manager. '

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.