Leading private client investment and financial planning group Tilney Bestinvest have identified the top five fund managers based in Scotland as part of a landmark report into the Top 100 equity fund managers managing funds available to retail investors.

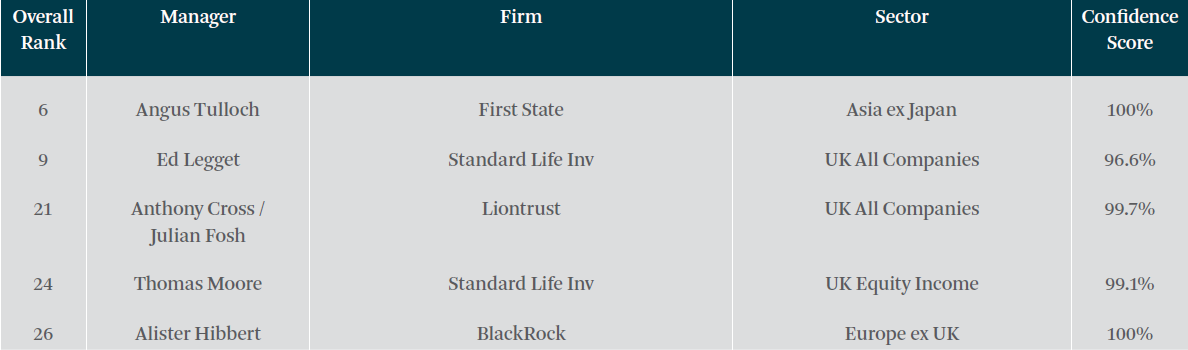

The Top 100 Fund Managers report looked at the entire career history of fund managers, across the firms they have worked at and funds managed in their given sector. The managers were then ranked on a blend of average monthly outperformance, a ‘confidence score’ based on the statistical probability that their success was due to skill rather than luck and with a weighting to recognise length of track record.

Topping the list is Edinburgh based Angus Tulloch, Head of Asia Pacific Equities at First State Stewart (FSS), part of First State Investments, whose primary focus is stock selection and portfolio construction for FSS’s Asia Pacific funds. With over 26 years in the sector Tulloch has made his name as a cautious manager, but a colourful character, who in the early 2000’s set up a charitable foundation promoting Scottish financial education.

Hot on Tulloch’s heels are four fund managers who all have impressive track records and varying levels of experience. Ed Legget and Thomas Moore’s presence on the list proves Scotland is harbouring some of the United Kingdom’s most promising up-and-coming talent, as they can also be found on Tilney Bestinvest’s rankings of top fund managers under 40 years old. The pairing of Anthony Cross and Julian Fosh from Liontrust have earned a stellar reputation for their co-management of UK companies funds, while Alister Hibbert receives a 100% confidence score for his work in the European (excluding UK) sector.

Jason Hollands, Managing Director at Tilney Bestinvest, said “Scotland has a rich andillustrious asset management heritage with a large number of major houses, such Aberdeenand Standard Life Investments, and a plethora of boutique groups calling it home. Withsome of the strongest younger talent in the industry, such as Standard Life’s Ed Legget and Thomas Moore, managing money from Edinburgh, it bodes well for Scotland’s continued to success as a leading global centre for asset management.

“Investors need to be very selective when choosing active fund managers as many simply donot deliver the goods over the long term, the Top 100 Fund Manager report highlights thosemanagers who have added significant value over their careers and consistently so. Of course,when selecting a fund it is vital to take a view on its future prospects and not just pastsuccess, so other factors such as the size of assets now being managed by a fund manager willcome into play. However, we hope investors will find the report of interest as a starting pointin their quest.”

Rankings – Scottish-based Fund Managers

A copy of the full report, which contains profiles of the top 25 managers, ‘vital stats’ for each of the 100 managers and lists the current funds they manage isavailable to download free of charge at www.bestinvest.co.uk/top100

- ENDS -

Important information:

The value of investments, and the income derived from them, can go down as well as up andyou can get back less than you originally invested. Current or past yield figures providedshould not be considered a reliable indicator of future performance. This article is not adviceto invest or to use our services.

Funds may carry different levels of risk depending on the industry sector(s) in which they invest. You should ensure that you understand the nature of any fund before you invest in it.

Due to their nature, specialist funds can be subject to specific sector risks. Investors should ensure they read all relevant information in order to understand the nature of such investments and the specific risks involved. Please note that ethical funds may, by definition, have a limited investment universe; this may affect performance.

Press contacts:

Jason Hollands

0207 189 9919

07768 661 382

Jason.hollands@tilneybestinvest.co.uk

Matt Gray

0207 189 2492

matthew.gray@tilneybestinvest.co.uk

About Tilney Bestinvest

Tilney Bestinvest is a leading investment and financial planning firm that builds on a heritage of more than 150 years. We look after more than £9 billion of assets on our clients’ behalf and pride ourselves on offering the very highest levels of professional client service with transparent, competitive pricing across our entire range of solutions.

We offer a range of services for clients whether they would like to have their investments managed by us, require the support of a highly qualified adviser, prefer to make their own investment decisions or want to take more than one approach. We also have a nationwide team of expert financial planners to help clients with all aspects of financial planning, including retirement planning.

We have won numerous awards including UK Wealth Manager of the Year, Low-cost SIPP Provider of the Year and Self-select ISA Provider of the Year 2013, as voted by readers of the Financial Times and Investors Chronicle. We are pleased that our greatest source of new business is personal referrals from existing clients.

Headquartered in Mayfair, London, Tilney Bestinvest employs almost 400 staff across our network of offices, giving us full UK coverage, and we combine our award-winning research and expertise to provide a personalised service to clients whatever their investment needs.

The Tilney Bestinvest Group of Companies comprises the firms Bestinvest (Brokers) Ltd (Reg. No. 2830297), Tilney Investment Management (Reg. No. 02010520), Bestinvest (Consultants) Ltd (Reg. No. 1550116) and HW Financial Services Ltd (Reg. No. 02030706) all of which are authorised and regulated by the Financial Conduct Authority. Registered office: 6 Chesterfield Gardens, Mayfair, W1J 5BQ. For further information, please visit: www.tilneybestinvest.co.uk

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.