With the start of May just days away, should investors follow the old adage of “Sell in May and go away, don’t come back till St. Leger Day”, which advocates getting out of the stock market for the summer months? The maxim has its origins from the days when brokers left the City for the “Season”, a period of summer sporting and social events including Royal Ascot, Wimbledon, Henley Royal Regatta, Cowes Week and which ended with the St. Leger flat race in mid-September.

This year the St. Leger race is set to take place at Doncaster on 13 September, and the total prize fund could top 2013’s huge £600,000 pot. With the FTSE All Share Index of UK shares delivering disappointing negative returns of -1.30% since the start of the year after a cracking 2013, is now the right time for stock market investors to cash in their portfolios or could they find themselves backing the wrong horse?

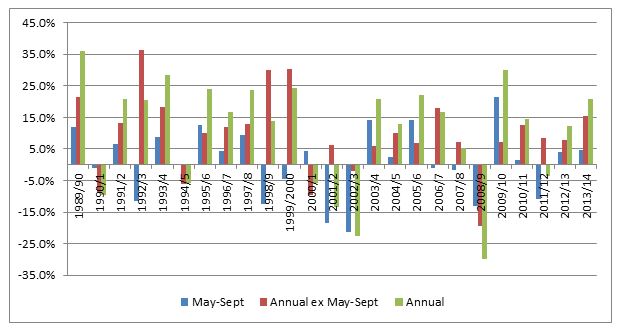

Looking over a 25-year period, research by Bestinvest suggests that while a number of market slumps have taken place over the summer months, a general strategy of exiting the market during this season is far from convincing.

During the period between 1 May and the second week of September, the FTSE All Share Index has delivered positive returns in 15 out of the past 25 years, meaning 60% of the time investors would have made positive returns by staying invested over the summer. Indeed over the last quarter of a century, average annualised market returns of 10.9% would have dropped to 9.8% for investors methodically exiting the market each summer (and that’s excluding the additional impact of transaction costs).

Notable summer periods when the market did fall sharply were 1992 (-11.6%), 1998 (-12.6%), 2001 (-18.4%), 2002 (-21.2%), 2008 (-13.0%), and 2011 (-10.9%).

Percentage returns on the FTSE All Share Index

Source: bestinvest.co.uk / Datastream

Jason Hollands, Managing Director, Bestinvest, said: “Gone are the days when the City brokers departed to spend a leisurely summer at sporting events. These days markets trade globally and around the clock. So if there was ever any truth in the ‘Sell in May’ theory, the evidence since the Big Bang City reforms suggests that while there have been a handful of significant summer sell-offs which mean ‘average’ returns for the summer months are low, there is no compelling case to automatically get out of the market each May; indeed such a strategy rigorously followed would have reduced average returns.

“Will this year see a poor summer for stock market returns? It is of course impossible to predict short-term movements in the markets with accuracy. However after a bumper 2013 when developed markets were supercharged by the tailwinds of ‘Quantitative Easing’ and valuations in some parts of the market have been looking a little stretched, we could be in for a period of choppier waters. Key concerns hanging over the markets are the slowdown in the Chinese economy, the prospect of future interest rates rises in the US and UK next year and of course the crisis over the Ukraine.

“In recent weeks there has been some evidence of a rotation out of more speculative ‘growth’ stocks, such as social media and internet companies. Time will tell whether or not this takes some of the heat out of the market. In the event of a broader correction, a canny strategy for long-term investors should be to buy rather than sell, on such dips. That’s the art of successful investing.”

- Ends -

About Bestinvest:

Founded in 1986, Bestinvest has grown to become a leading private client investment adviser, looking after £5 billion of assets. We offer a range of investment services from the Online Investment Service for self-directed investors to Investment Advisory and Investment Management services for clients who do not have the time or inclination to manage their own investments.

All of our services are underpinned by rigorous research aimed at identifying those fund managers we believe will deliver long-term superior performance. We also have a team of expert financial planners with nationwide coverage to help clients with their pensions, retirement or Inheritance Tax planning. At Bestinvest, we pride ourselves on offering the highest levels of professionalism and expertise with transparent, competitive prices. We are pleased that our greatest source of new business is from personal referrals from existing clients.

Bestinvest has won numerous awards including Stockbroker of the Year, Low-Cost Sipp Provider of the Year and Self-Select ISA Provider of the Year at The Investors Chronicle and Financial Times Investment Awards 2013. Bestinvest also won UK Wealth Manager of the Year 2013 and Best Wealth Manager for Investments at The Investors Chronicle and the Financial Times Wealth Management Awards 2013.

Headquartered in Mayfair, London, Bestinvest employs more than 200 staff and has an extensive network of regional offices. For further information, please visit: www.bestinvest.co.uk

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.