Research shows more see buy-to-let property as a better investment than a pensions or ISA, so will the new ‘pension freedoms’ see people cash-in their pensions to buy property? Live or die, you’ll probably regret it says Tilney Bestinvest’s Financial Planning Director David Smith

With the removal of restrictions on how much anyone aged 55 or over can withdraw from their pension individuals can now in theory cash in their entire pension fund (partly subject to tax) as a single lump sum.

One likely development of this change to pensions could be that a high number of individuals look to give up their purpose-built retirement savings plan to replace it with a buy-to-let property. Indeed new research commissioned by Tilney Bestinvest of over 1,800 GB adults aged 50+ who have paid into a pension plan showed that 38% of respondents considered a buy-to-let property more attractive for a long term investment versus 35% for a pension. 14% of respondents considered an Individual Savings Account (ISA) as most attractive.*

To determine whether a buy-to-let property can compete with a pension, David Smith, Financial Planning Director at Tilney Bestinvest looks at two hypothetical case studies:

Tom draws his pension fund out as a lump sum and buys a property to let

“Tom is 65 and has built up a pension fund of £150,000 during his lifetime. At retirement he will only receive 25% of his pension fund tax free (£37,500) - the remaining 75% (£112,500) will be taxed at his highest marginal rate of income tax. So, even if Tom receives nothing other than a state pension of £10,600 per annum but decides to withdraw his £150,000 pension as a lump sum, he would only receive £107,117 in his hand, with effective tax of up to 60% due to partial loss of Tom’s personal allowance as earnings for that tax year would be over £100,000, payable on part of the monies withdrawn. This effectively represents just 71% of his pension value.

“Tom now only has £107,117 to purchase a property including the costs associated with property purchase; solicitor’s fees, valuations, searches and stamp duty - not to mention any refurbishment costs. Let’s say in this example, the property cost £105,000, no refurbishments were required and the associated fees are covered by the remaining £2,117. Once the transfer of ownership completes the retiree now has a property worth £105,000 – so he’s already lost 30% of his pension!

“Never mind - the good news is that this Tom has a tenant lined-up who wants to stay in the property indefinitely and is willing to pay a healthy £525 per month rent (representing a 6% gross yield, but only 4.2% based upon the actual pension value of £150,000). Effectively Tom’s ‘pension’ is therefore now providing a gross income of £6,300 per annum but unfortunately tax of 20% will be payable on this amount, resulting in his net income being £5,040 and this does not take into account the costs associated with managing a buy to let property; maintenance, repairs, time spent and potential periods without tenants, all of which would lower this yield further. And remember, the more people who look to invest their pension monies in this manner, the more under pressure rental yields will become.

“To add insult to injury, upon sale of the property, any gain made on the value could potentially be subject to Capital Gains tax of up to 28%. But the property isn’t sold, as Tom unexpectedly dies just before selling it: He’s 70 years old, widowed and has no Inheritance Tax nil rate band available so, if the value of the house had grown to £120,000 at the date of death, his beneficiaries would pay tax of up to £48,000. Furthermore, HMRC would not allow the house to pass to Tom’s beneficiaries until after the inheritance tax has been paid.

“So within 5 years Tom has turned a £150,000 pension into an asset worth just £72,000 for his children excluding rental income.”

Harry keeps his pension fund intact

“Harry, also 65, decides to keep his £150,000 pension fund, draws a net income from it of £5,040 each year and achieves a net growth rate of 4% per annum.** Under such circumstances Harry would still have a pension fund of £149,000 at the end of five years and would have received a total net income of £25,200**. It is also important to note that part of Harry’s income will be funded from his tax-free cash entitlement, which reduces the income tax that his monthly income would be subject to.

“However, perhaps the biggest ‘win’, is the fact that Harry’s pension can potentially be passed to successive future generations inheritance tax free. Even in a worst case scenario the tax would only be payable at recipient’s marginal rate of income tax.”

The story in numbers…

Use pension to buy BTL | Maintain Pension | |

Starting value of pension | £150,000 | £150,000 |

Tax on lump sum withdrawal | (£42,883) | N/A |

Cost to fund BTL purchase | (£2,117) | |

Value of ‘pension’ after BTL purchase | £105,000 | N/A |

Total net income after five years | £25,200 | £25,200** |

Value of ‘pension’ after five years / date of death | £120,000 | £149,000** |

IHT Payable on death | (£48,000) | £0 |

Net Proceeds to beneficiaries | £72,000 | £149,000 |

Growth / loss to estate over five years | £72,000 + £25,200 - £150,000 = £46,800 loss (31.2%)*** | £149,000 + £25,200 - £150,000 = £24,200 growth (16.1%)*** |

**Illustrative purposes only, investments can go down in value and returns are not guaranteed

***Compounded over five years

“As you can see from the figures, these are two very contrasting stories. Over the course of the five years, the pension has provided exactly the same level of net income, and yet even at modest growth rates, the pension would broadly maintain its value and ultimately give Harry’s beneficiaries £77,000 more than Tom’s beneficiaries upon death.

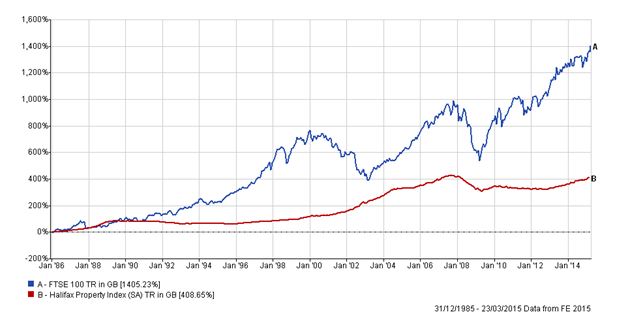

“Ah! But I know I’ll make money on a house - That’s more than you can say for the Stock market. Really? The chart below speaks for itself…

To discuss this issue or any other financial planning topic please contact David Smith on 0191 269 9970 / david.smith@tilneybestinvest.co.uk

Appendix:

* All figures relatating to long-term investment choices, unless otherwise stated, are from YouGov Plc. Total sample size was 2,311 adults aged 50 or over of which 1,851 have paid into a pension plan. Fieldwork was undertaken between 25th - 27th March 2015. The survey was carried out online. The figures have been weighted and are representative of all GB adults.

Q. If you had to choose, which ONE of the following types of investment would you say is more attractive for a long term investment?

A buy-to-let property | 38% |

A pension | 35% |

A Individual Savings Account (ISA) | 14% |

Don’t know | 13% |

- ENDS -

Important information:

The value of investments, and the income derived from them, can go down as well as up and you can get back less than you originally invested. This press release does not constitute personal advice. If you are in doubt as to the suitability of an investment please contact one of our advisers.

Prevailing tax rates and reliefs are dependent on your individual circumstances and are subject to change.

Before making a decision on your pension it is important to consider all of your options, especially in light of the new reforms. If you are unsure of your options you should seek professional financial advice or visit Pensionwise.gov.uk.

Press contacts:

Roisin Hynes

0207 189 2403

07966 843 699

roisin.hynes@tilneybestinvest.co.uk

Matthew Gray

0207 189 2492

matthew.gray@tilneybestinvest.co.uk

About Tilney Bestinvest

Tilney Bestinvest is a leading investment and financial planning firm that builds on a heritage of more than 150 years. We look after more than £9 billion of assets on our clients’ behalf and pride ourselves on offering the very highest levels of professional client service with transparent, competitive pricing across our entire range of solutions.

We offer a range of services for clients whether they would like to have their investments managed by us, require the support of a highly qualified adviser, prefer to make their own investment decisions or want to take more than one approach. We also have a nationwide team of expert financial planners to help clients with all aspects of financial planning, including retirement planning.

We have won numerous awards including UK Wealth Manager of the Year, Low-cost SIPP Provider of the Year and Self-select ISA Provider of the Year 2013, as voted by readers of the Financial Times and Investors Chronicle. We are pleased that our greatest source of new business is personal referrals from existing clients.

Headquartered in Mayfair, London, Tilney Bestinvest employs almost 400 staff across our network of offices, giving us full UK coverage, and we combine our award-winning research and expertise to provide a personalised service to clients whatever their investment needs.

The Tilney Bestinvest Group of Companies comprises the firms Bestinvest (Brokers) Ltd (Reg. No. 2830297), Tilney Investment Management (Reg. No. 02010520), Bestinvest (Consultants) Ltd (Reg. No. 1550116) and HW Financial Services Ltd (Reg. No. 02030706) all of which are authorised and regulated by the Financial Conduct Authority. Registered office: 6 Chesterfield Gardens, Mayfair, W1J 5BQ.

For further information, please visit: www.tilneybestinvest.co.uk

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.