- The latest Spot the Dog list from online investing service Bestinvest has revealed 86 underperforming equity funds

- This is a slight increase on the 77 paw performers named and shamed in August 2021’s report – but with some big beasts in the list, assets held in the doghouse are up by 54%

- Based on their current size and ongoing fees, the latest dog list would generate annual fees for £463 million in a flat market

- Many of the 12 lumbering canines managing over £1billion in assets are in the Global and Global Equity Income sectors, with equity income funds widely barking up the wrong tree

- JP Morgan’s US Equity Income controls a vast £3.92 billion of investors’ money and underperformed its North America index by -32%

- St James’s Place, abrdn and Jupiter are well represented with six funds apiece in the Dog list. But while Jupiter’s six funds only total £988.6 million in assets, abrdn’s comprise £1.84 billion and St James’s Place a hefty £5.74 billion

- The strength of global equity markets in recent years means it can be tougher for investors to identify weak funds, with even poorly managed vehicles generating gains

- The full document is available from the link below, and in order to give readers free access to this extensive report, it would be great if online coverage could link back to it:

https://www.bestinvest.co.uk/research/spot-the-dog

Investors need to make sure that each part of their portfolio is pulling its weight. And online investing service Bestinvest provides an essential resource to help savers review their investments and see if they are being hounded by terrible returns. This latest Spot the Dog report that names and shames poorly performing equity funds – the guide fund managers would love to ban.

The much-anticipated bi-annual list will reveal 86 funds that have consistently and significantly underperformed in recent years [1] – together with the sectors and regions most plagued by laggards.

It is a reminder that with less than two months to go before the end of the tax year, it’s essential that Individual Savings Account (ISA) and Self-Invested Personal Pensions (SIPP) investors shine a bright and sometimes cruel light into the corners of their accounts. This is not to say that savers need necessarily to switch out of a Dog fund: they might well have good reasons to forgive a fund’s recent travails and to believe things will rapidly improve – but owning a Dog fund is certainly a reason to reconsider whether to hang on or move elsewhere.

Based on their current size and ongoing fees, the latest Dog list would generate whopping fees of £463 million in a flat stock market, providing lucrative rewards for investment firms.

While the number of funds in this Spot the Dog list is only nine higher than the previous count in August, our spotlight reveals a 54% surge in assets held in dogs from £29.6 billion to £45.4 billion.

Where are the dog funds?

Nearly £18.5 billion of that is to be found in the Global and Global Equity Income sectors, which accounted for 39 of the 86 dog funds. Jason Hollands, Managing Director of Bestinvest, says this is partly because the US has come to dominate the indices by which many funds are measured.

‘The MSCI World, for example, has around two-thirds of its market capitalisation in the US,’ he says. ‘Also, the technology sector has become increasingly important, particularly the mega cap technology names such as Meta (formerly Facebook), Apple, Microsoft and Amazon.’

‘This has presented a dilemma for active managers: either hold significant amounts in the US and technology stocks with the resulting lack of diversification and income, or risk weakness versus the benchmark,’ he adds.

There are 25 Global dogs from a total universe of 177 such funds widely available to UK investors. Things are as rough over in the Global Equity Income doghouse, where 14 of the world’s 37 funds in that sector linger.

‘The US is a low-yielding market (current yield is 1.27%) and has been led in recent years by growth stocks, many of which have never paid a dividend,’ says Hollands. ‘As such, it’s been near impossible for Global Income funds to beat the main global indices – they tend to be underweight both the US and growth stocks in particular.’

It is noteworthy that there was just one emerging market Dog fund in the latest report (from St James’s Place) and only one UK smaller companies sector Dog (the tiny MI Sterling Select Companies). There were no North America, European or Japanese smaller companies vehicles qualifying as dog funds.

‘This suggests active fund managers do a better job in less researched parts of the market,’ says Hollands.

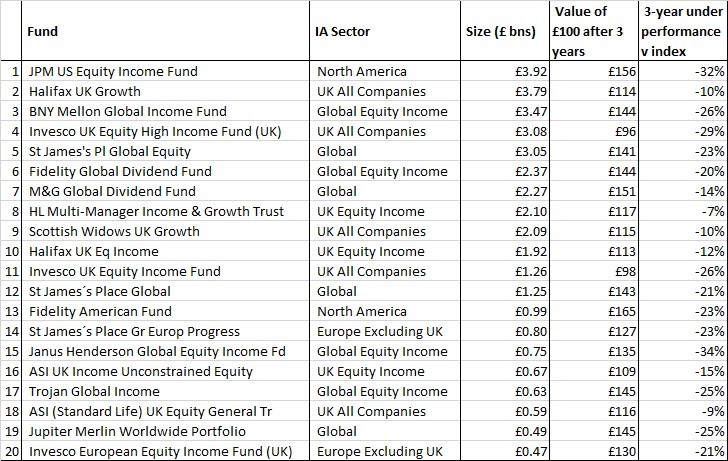

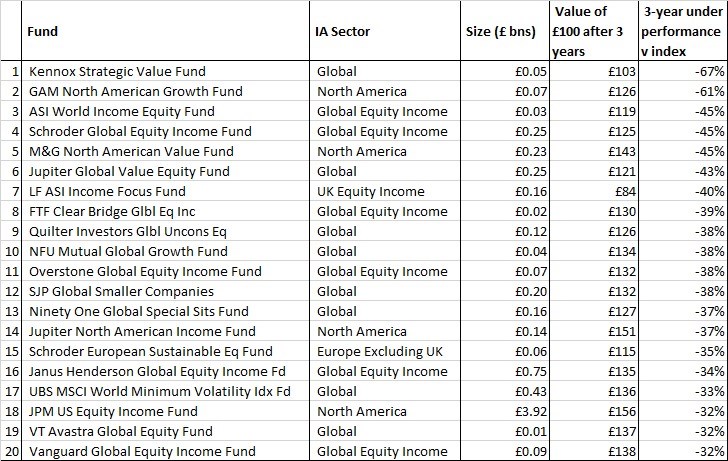

The biggest and worst dogs

Some of the worst-performing dogs are very small funds that are held by few retail investors. The culprits on the lists that do most wide-ranging damage to portfolios are popular mega funds. [See tables below.]

The only fund with more than £1 billion in assets that appears in the top 20 worst performers is JP Morgan’s US Equity Income fund, which controls a vast £3.92 billion in investors’ money and underperformed its North America index by -32%.

But that is not the only Great Dane-sized fund in the 86, as four others exceed £3 billion in assets. The biggest Global Equity Income dog is BNY-Mellon Global Income Fund at £3.47 billion, which lagged its benchmark by 26%.

The biggest UK dog-funds meanwhile are Halifax UK Growth (£3.79 billion, -10%) and Invesco UK Equity High Income (£3.08 billion, -29%), which though absent from the previous report is no stranger to Bestinvest’s kennel of shame.

The fifth giant is the biggest Global equity dog: St James’s Place Global Equity with £3.05 billion in assets did return 41% to investors but that was 23% worse than the index. The only other fund apart from JPM US Equity Income to appear in the 20 worst performers list as well as the 20 biggest dogs is Janus Henderson Global Equity Income (£750 million, and -34%).

There are 12 funds in the list that control more than £1 billion in assets and other than those already noted, Invesco UK High Income (£1.256 billion, -26%) is worth a mention. Like its stablemate, Invesco UK Equity High Income, it not only significantly underperformed its benchmark but also lost investors money in absolute terms – the only two of the 20 biggest Dogs to do so over the three years.

In terms of companies with the most funds on the list, that distinction is shared between St James’s Place, abrdn and Jupiter with six funds apiece. However, Jupiter’s six funds only total £988.6 million, while abrdn’s are £1.84 billion. This compares to £5.74 billion for St James’s Place.

Schroders is also worth a mention here. While it has five funds under its own name, housing £1.02 billion in assets, it also manages a number of funds for HBOS and Scottish Widows, which together add another £8.6 billion to its paw print.

Jason Hollands, Managing Director of Bestinvest, comments:

'Unsurprisingly, Spot doesn’t win any popularity awards with fund managers, particularly those with the funds in the list who will soon be howling out their excuses. But it has helped shine a spotlight on the problem of the consistently disappointing returns delivered by many investment funds. In doing so, not only has it encouraged hundreds of thousands of investors to keep a closer eye on their investments, but it has also pushed fund groups to address poor performance.

‘£45.4 billion is a lot of savings that could be working harder for investors rather than rewarding fund companies with juicy fees. At a time when investors are already battling inflation, tax rises and jumpy stock markets it is vital to make sure you are getting the best you can out of your wealth. While turbulence has increased recently, that’s no excuse for consistently failing to match benchmark returns, sometimes by drastic margins.

‘In recent years, it has been tougher for investors to identify weak funds, with low interest rates and central bank money-printing programmes pushing share prices higher. Most funds investing in equities have generated gains irrespective of the skill of their managers. This rising tide has helped to disguise some bad decisions from fund managers who have earned handsome fees in the process.

'As economies have reopened from the COVID-19 lockdowns and bounced back, inflation has also reared its head, forcing the hands of central banks to raise borrowing costs. There is a whole generation of investors who have never experienced the current levels of inflation before and this will be followed by much higher interest rates too. This seismic shift is starting to challenge the long-term dominance of growth sectors like tech where valuations had become quite bloated, and markets are starting to reassess under-rated “value” areas such as banks and other financial shares. At the margins, this may push quite a few funds in or out of the doghouse over the coming year.

‘The UK has been an unloved market for the last few years, but in the calendar year 2021, the top fund rose 39.4%, while the worst eked out a meagre 0.5%. This highlights the need to be super selective when choosing a fund manager to look after your savings and, once invested, how important it is to continue to regularly monitor your investments and check whether they are delivering value for money.’

'While many people are enthusiastic about selecting and reviewing their investments from the thousands of options available on services like Bestinvest, others find they have neither the time or inclination to do so. For these investors, it might time to swap their litter of investments for a ready-made portfolio instead. These provide a ‘one-stop shop’ approach, where you will get accessed to a portfolio of funds, blended to suit a risk portfolio which is then regularly review and rebalanced on your behalf [2].

-ENDS-

[1] How a fund becomes a Dog

We only look at the fund universe of open-ended funds (unit trusts or OEICs), and only those available to UK retail investors.

To make the list a fund must first have failed to beat its benchmark over three consecutive 12-month periods, to highlight consistent underperformance. Second, the fund must have underperformed the benchmark by 5% or more over the entire three-year period of analysis – which in this case ends on 31/12/2022.

[2] Ready-made portfolios

Alongside providing investors with access to thousands of funds, Exchange Traded Funds, investment trust and shares to choose from, Bestinvest also offers a selection of ready-made portfolios designed to suit different investor risk profiles. It’s new Smart range of five low-cost ready-made portfolios each invest across a diverse selection of passive investments funds, giving investors exposure to a wide range of markets and asset classes – including equities, bonds and gold - at very low cost and without relying on the stock picking skills of fund managers. The Smart funds ongoing annual charges are between 0.34% and 0.37% and investors pay a highly competitive Bestinvest account fee of 0.20% - whether in an ISA, SIPP, Junior ISA or General account, meaning total costs are around a third less than most “robo-advisers” and a considerably less than the fees on the actively managed funds that appear in Spot the Dog.

The Biggest Beasts in Spot the Dog by Fund Size

The Most Significant Underperformers in Spot the Dog versus the Market

Note: Three-year underperformance is the extent to which a fund lagged the market it invests in, not the absolute return delivered by the fund. All data is total return (including dividends reinvested) for periods to 31 December 2021.

About Bestinvest – new features coming

Bestinvest is an award-winning, digital investment platform for people who choose to make their own investment decisions but with the support of tools, insights and qualified professionals. It offers access to thousands of funds, investment trusts, ETFs and shares through a range of account types, including an Individual Savings Account, a Junior ISA for children, a Self-Invested Personal Pension and General Investment Account.

Alongside providing investors access an extensive choice of investments, Bestinvest also offers a wide range of ready-made portfolios for people seeking a managed approach that suit their risk profile, saving them the need to select and monitor their funds themselves. These include a highly competitively priced ‘Smart’ range that invests through low costs passive funds, as well as an ‘Expert’ range that invests with ‘best-of-breed' managers. Investors in ready-made portfolios benefit from a low-cost account fees of no more than 0.20% pa.

Bestinvest has announced a major relaunch that will go live early in Spring of 2022. This will provide a unique range of new features and services to help people better manage their long-term savings, including free investment coaching from qualified financial planners, low-cost advice packages and advanced tools to help people plan goals and monitor progress towards achieving them

Bestinvest is part of Tilney Smith & Williamson, the UK’s leading wealth management and professional services group. Tilney Smith & Williamson’s clients are private investors, charities, professional intermediaries, trusts and businesses for whom it manages over £56 billion of assets.

For further information, please visit: www.bestinvest.co.uk

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.