Great Expectations: £330k average gulf in pension pots revealed

£330k average gulf in pension pots revealed

£330k average gulf in pension pots revealed

Research commissioned by investment and financial planning group Tilney Bestinvest shows a huge gulf between peoples’ targeted levels of retirement income and the amounts they are saving to achieve this.

The consumer research survey* carried out by YouGov for Tilney Bestinvest of over 1,800 GB adults aged 50+ who have paid into a pension plan, revealed that the most common pension pot size was up to £19,999, with 17% of respondents choosing this option. 9% of respondents said the overall value of their pension was £20,000 to £39,999; the second most popular option.

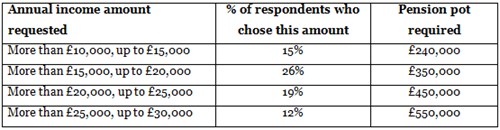

However, when asked what they thought an adequate and comfortable annual income in retirement was, ‘more than £15,000, up to £20,000’ was chosen by 26% of those surveyed. A pension pot of £350,000 would be required to reach this figure.

To demonstrate the disconnect further, Tilney Bestinvest has crunched the numbers to show the pension pots required for the four most popular annual income bands in the survey. Overall, 72% of those surveyed chose these four options.

Assumes 65 year old male, single life, level annuity that includes a 10-year guaranteed period is purchased. Annuitant is in good health and does not smoke.

David Smith, Financial Planning Director at Tilney Bestinvest commented: “A huge gulf exists for many between how much is required to save and the reality of how much they are putting away. People approaching retirement are often underprepared with how to cope with the gap in these assets, and can vastly overestimate the income they will have in retirement.

“There are only three ways to address this; working longer, saving considerably more and achieving strong investment performance. For many continuing to work in retirement may be a positive lifestyle choice, for others this will simply be a financial necessity. For those who want to enjoy a restful retirement, the only answer is to save and invest considerable sums during working life and to make sure the investments are firing on all cylinders.”

For further comment David Smith can be contacted at david.smith@tilneybestinvest.co.uk / 0191 269 9970

Appendix:

*All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 2,311 adults aged 50 or over of which 1,851 have paid into a pension plan. Fieldwork was undertaken between 25th - 27th March 2015. The survey was carried out online. The figures have been weighted and are representative of all GB adults.

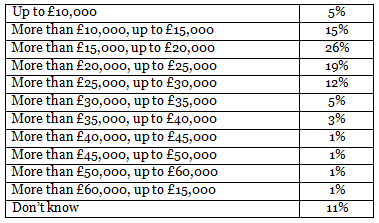

Q: Approximately, how much annual income (in today’s value) do you feel would be adequate to live off comfortably, not extravagantly, in your retirement? (Please select the option that best applies)

- ENDS -

Press contacts:

Roisin Hynes

0207 189 2403

07966 843 699

roisin.hynes@tilneybestinvest.co.uk

Matthew Gray

0207 189 2492

matthew.gray@tilneybestinvest.co.uk

About Tilney Bestinvest

Tilney Bestinvest is a leading investment and financial planning firm that builds on a heritage of more than 150 years. We look after more than £9 billion of assets on our clients’ behalf and pride ourselves on offering the very highest levels of professional client service with transparent, competitive pricing across our entire range of solutions.

We offer a range of services for clients whether they would like to have their investments managed by us, require the support of a highly qualified adviser, prefer to make their own investment decisions or want to take more than one approach. We also have a nationwide team of expert financial planners to help clients with all aspects of financial planning, including retirement planning.

We have won numerous awards including UK Wealth Manager of the Year, Low-cost SIPP Provider of the Year and Self-select ISA Provider of the Year 2013, as voted by readers of the Financial Times and Investors Chronicle. We are pleased that our greatest source of new business is personal referrals from existing clients.

Headquartered in Mayfair, London, Tilney Bestinvest employs almost 400 staff across our network of offices, giving us full UK coverage, and we combine our award-winning research and expertise to provide a personalised service to clients whatever their investment needs.

The Tilney Bestinvest Group of Companies comprises the firms Bestinvest (Brokers) Ltd (Reg. No. 2830297), Tilney Investment Management (Reg. No. 02010520), Bestinvest (Consultants) Ltd (Reg. No. 1550116) and HW Financial Services Ltd (Reg. No. 02030706) all of which are authorised and regulated by the Financial Conduct Authority. Registered office: 6 Chesterfield Gardens, Mayfair, W1J 5BQ.

For further information, please visit: www.tilneybestinvest.co.uk

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.