Evelyn Partners is pleased to announce a trading update for the three months ended 30 September 2023. Despite a challenging market backdrop, the group continued to generate significant new business and grow year-on-year operating income.

Highlights

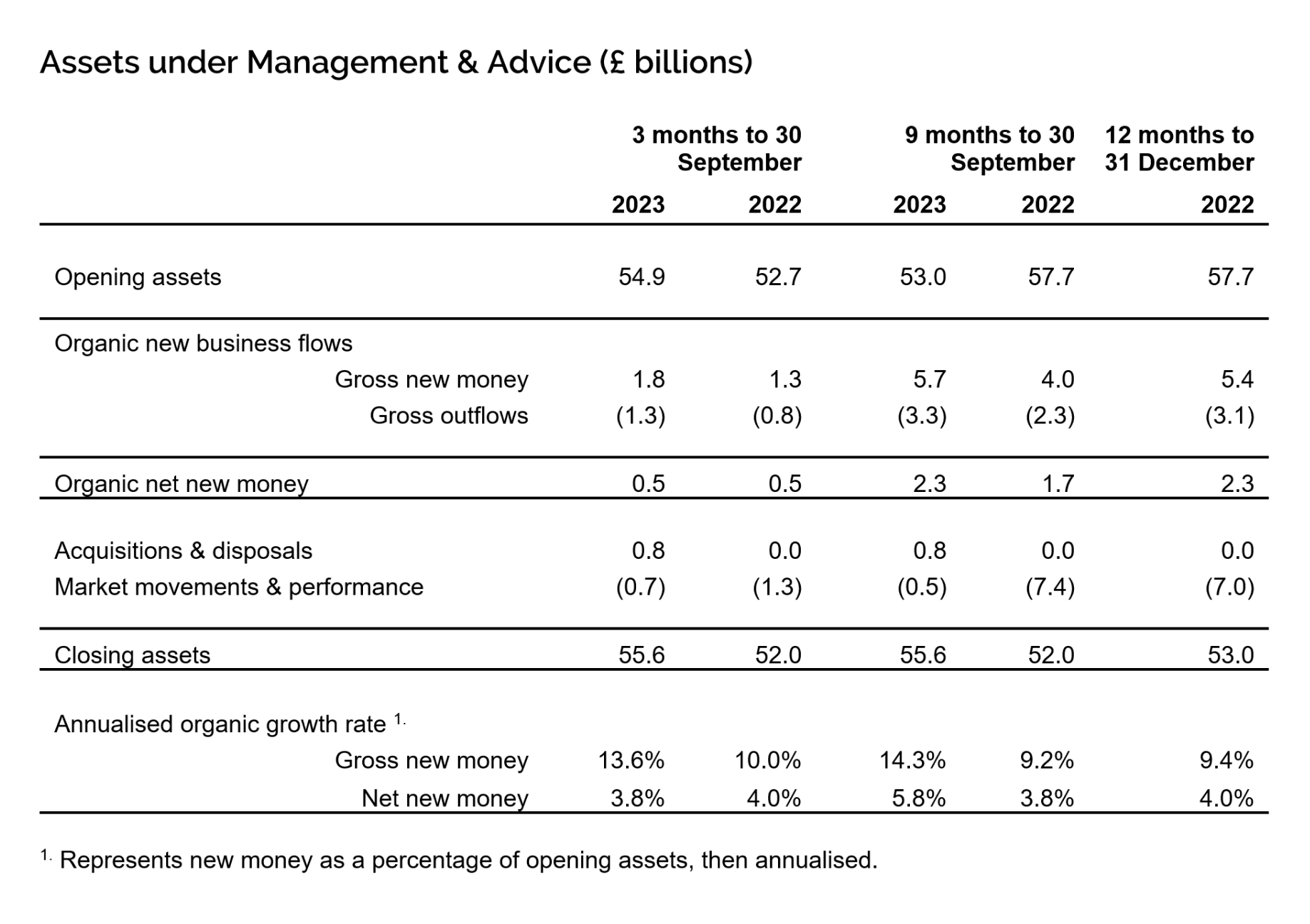

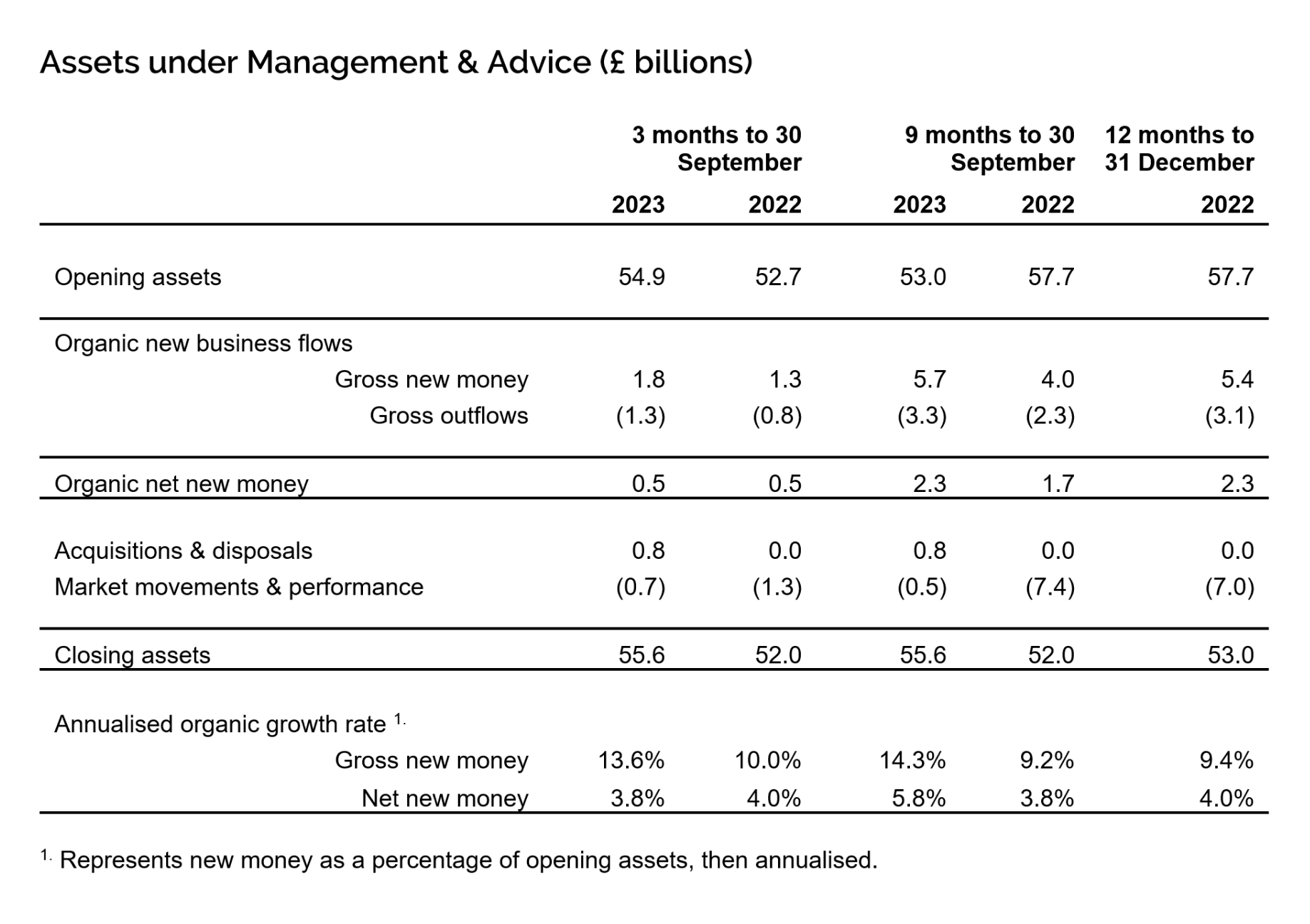

- Gross inflows of new assets in Q3 of £1.8 billion were 38% higher than the same quarter last year (Q3 2022: £1.3 billion). Year-to-date gross inflows of £5.7 billion are equivalent to an annualised growth rate of 14.3% based on opening assets.

- Net new asset inflows remained positive at £545.0 million in Q3 and were 2.6% ahead of the same period last year (Q3 2022: £531.0 million). Year-to-date net inflows of £2.3 billion are equivalent to an annualised growth rate of 5.8% based on opening assets.

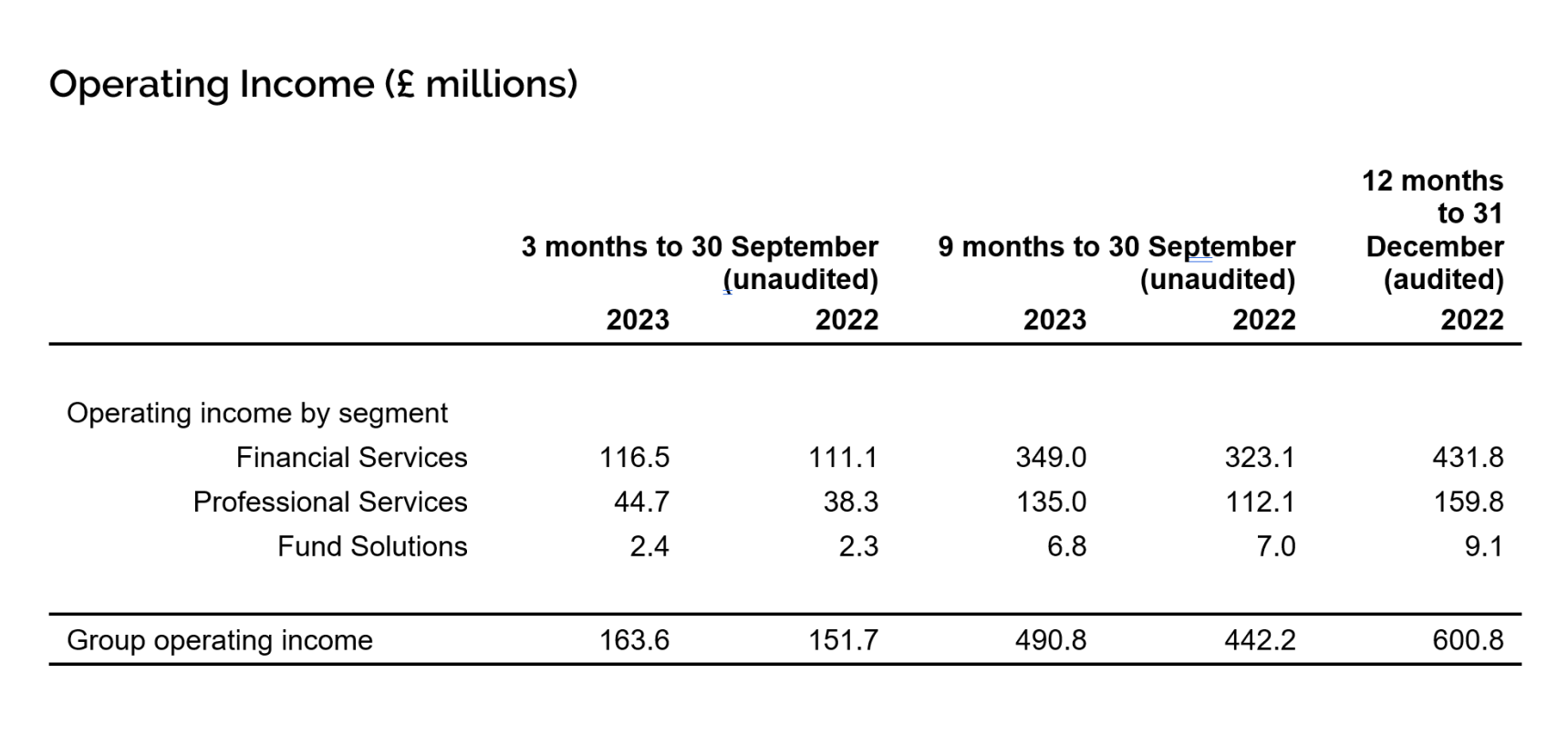

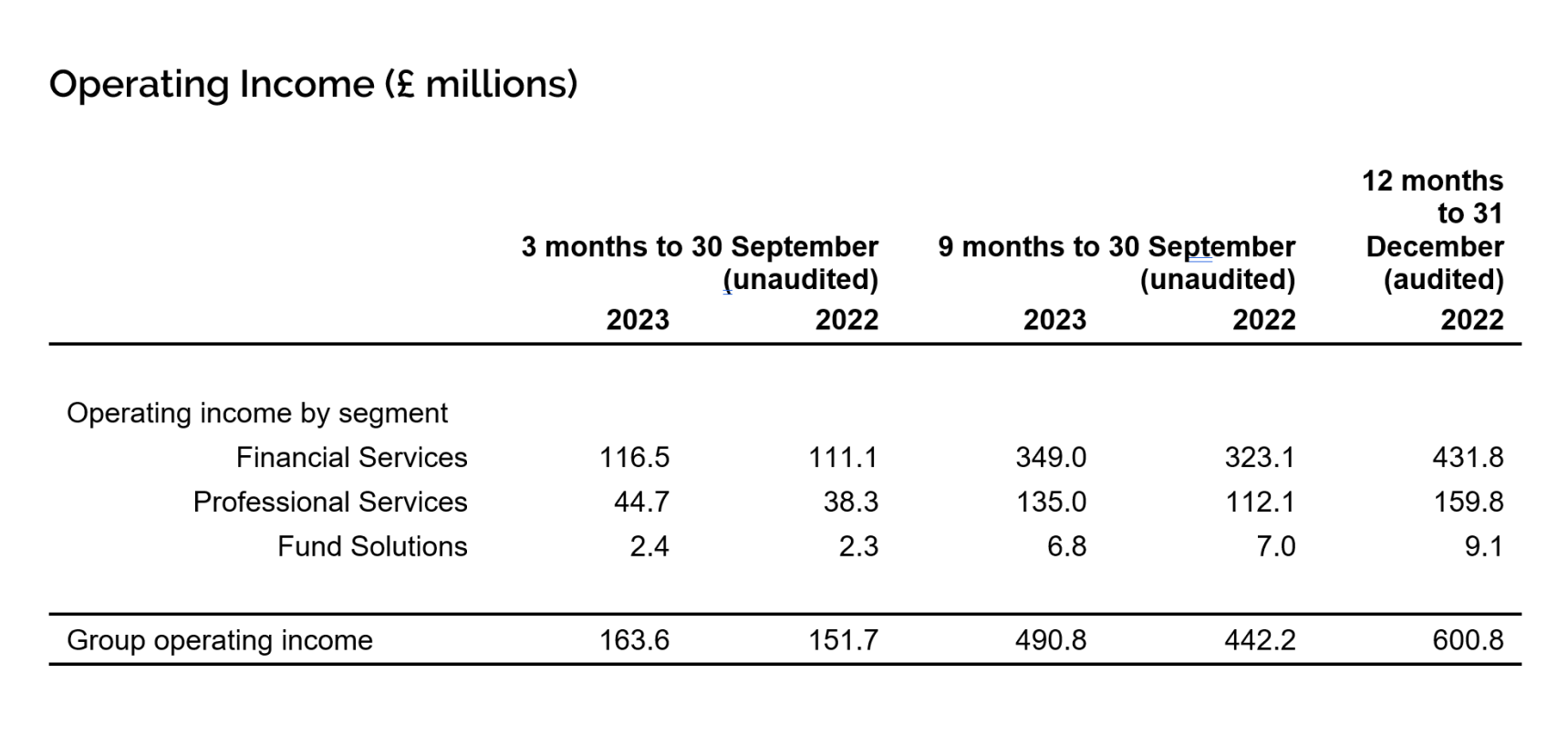

- Group operating income in Q3 of £163.6 million was 7.8% ahead of the same period last year (Q3 2022: £151.7 million), with increases across each of our three operating segments (Financial Services, Professional Services and Fund Solutions).

- Year-to-date group operating income for the first nine months of 2023 of £490.8 million is 11.0% ahead of the same period last year.

- Acquisition of Dart Capital completed on 31 August, adding £755.0 million of assets.

- Assets under Management & Advice (AuMA) increased to £55.6 billion at 30 September and were up 6.9% year-on-year (Q3 2022: £52.0 billion).

Paul Geddes, Group Chief Executive, commented:

“It’s a privilege to be the new CEO of Evelyn Partners. These strong results for the third quarter are testament to the team’s expertise and hard work for our clients. Since joining in July, I’ve visited 14 of our offices to meet many of our talented people and fully immerse myself in our business. I’ve been impressed to find a company with a clear purpose and colleagues who are highly professional and committed to delivering the best outcomes for clients. Our purpose of ‘placing the power of good advice into more hands’ explains everything you need to know about what we do and what we are trying to achieve. During a challenging period for both the economy and financial markets, we’re putting our experience to work to help people and businesses shape and protect their futures.

Despite difficult market conditions, we continued to generate significant new business, with £1.8 billion of gross inflows and £545 million of net inflows during the third quarter. In both cases these are ahead of the same period last year. Over the nine months to end of September, our net new assets have grown at 5.8% of opening assets, compared to 3.8% over the same period last year.

Pleasingly, we also saw growth in operating income across each of our three business segments, including continued double-digit growth from our fast-growing Professional Services business which has seen operating income over the first nine months of 2023 increase by 20.4% compared to the same period last year. Having acquired Leathers LLP and Ashcroft LLP in the first half of the year, we continue to explore further opportunities to expand our regional Professional Services presence by acquiring high quality accountancy and tax advice firms.

We also made further progress with both selective wealth management acquisitions and our succession planning programme for adviser-owned businesses seeking a long-term home for their clients and teams. In August, we completed both the acquisition of Dart Capital in London and a deal which has seen the team from Millen Capital join us in Liverpool. We are delighted to welcome both teams and their clients to Evelyn Partners.

The third quarter also saw us implement our Consumer Duty programme ahead of the 31 July deadline for the implementation of this important and wide-reaching new regulatory principle.

While the macro-economic environment is clearly experiencing headwinds, these are times when clients greatly value trusted expert advice and professional investment management. With our unique breadth of expertise, we are well positioned to help our clients navigate these challenges and tailor our services to enable them to achieve the best long-term outcomes.”