Commenting on results, Paul Geddes, Group Chief Executive, said:

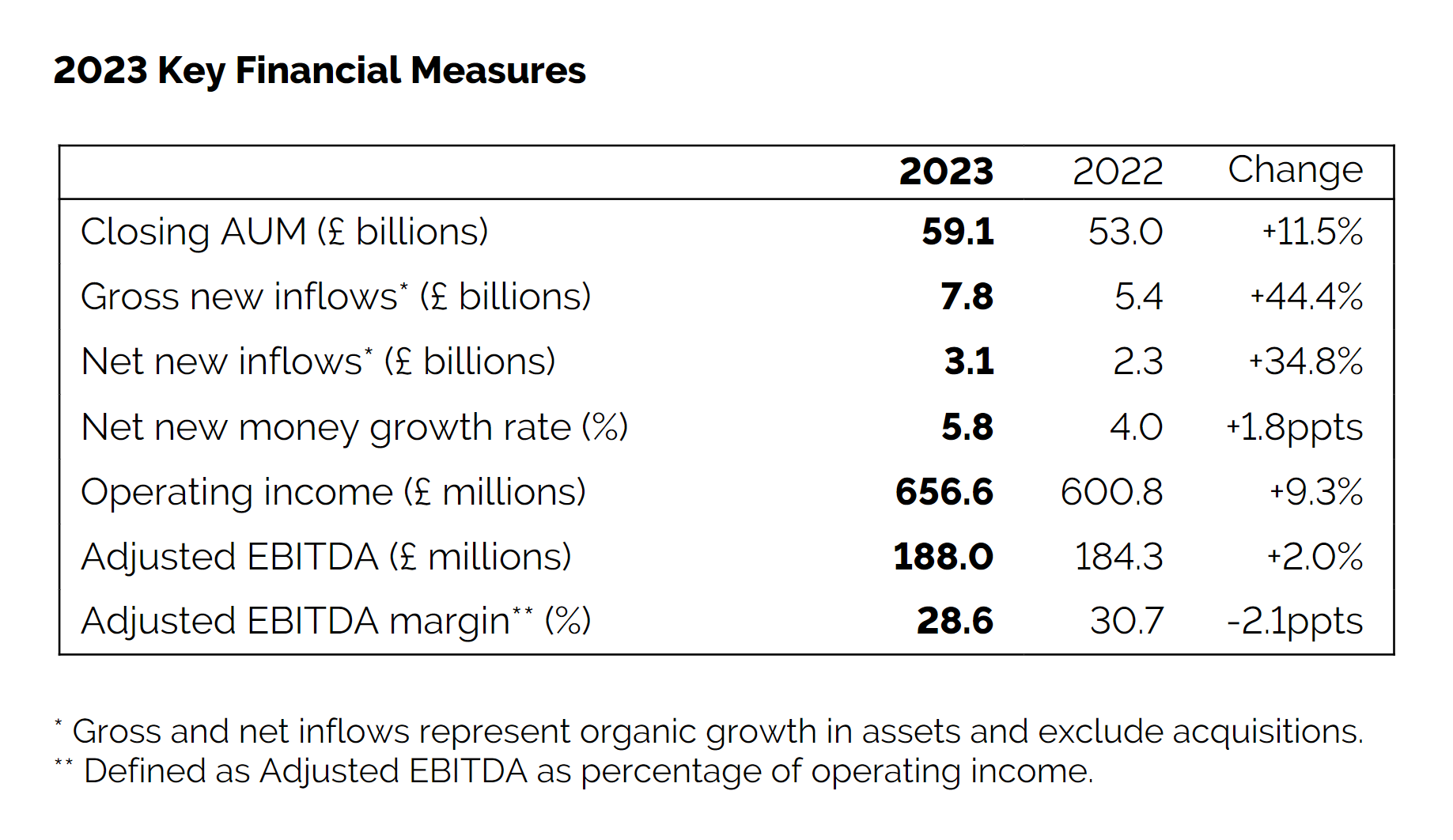

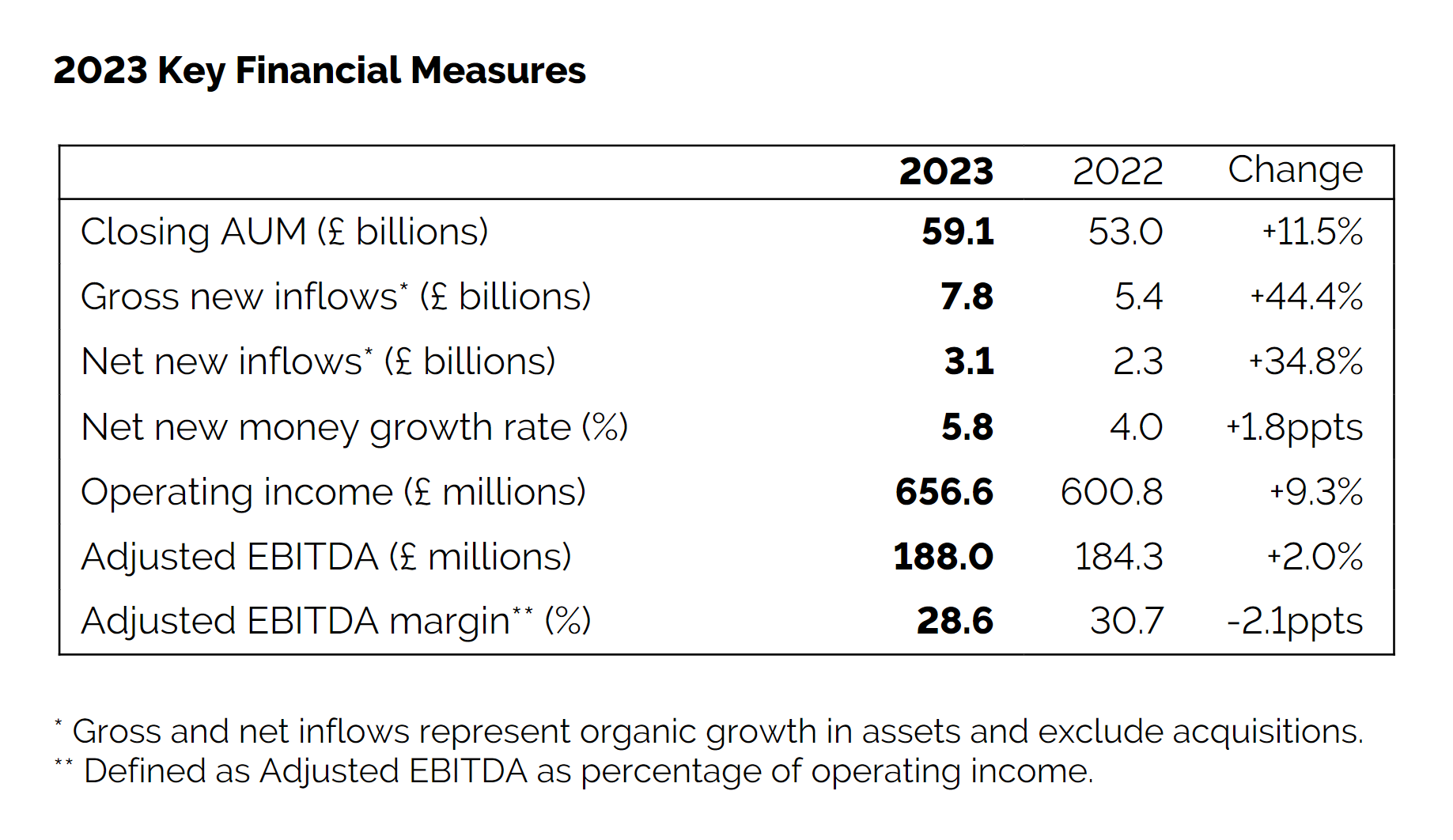

“Against the challenging macroeconomic backdrop of high inflation, rising interest rates and conflicts in Ukraine and the Middle East, Evelyn Partners delivered another strong year in 2023, attracting record new business and generating Adjusted EBITDA [1] of £188.0 million. Alongside robust financial performance, we made strong progress with our digital transformation programme, further enhanced our range of services, and acquired several high-quality businesses.

"Looking to the future, a key area of focus in Financial Services is to grow our presence as a provider of investment solutions to the IFA market. We look forward to Edward Park joining us in April as Chief Asset Management Officer, to help drive this. For direct clients who do not currently have an adviser, we will look to deepen the service we provide to them by introducing a financial planning relationship where it is appropriate. Evelyn Partners employs 291 financial planners and 331 investment managers and has a market-leading position in offering such a ‘dual expert’ approach. We passionately believe that good financial advice matched with a well-managed investment strategy is a powerful combination that will lead to strong client outcomes.

"In our fast-growing Professional Services business, priorities include enhancing the value and range of services we provide to our largest clients through our Key Account programme, the development of new digital services and growing our international presence. We will also continue to explore further acquisition opportunities that extend our regional footprint.

"With inflation on a downward trend and possible interest rate cuts on the horizon, we are cautiously optimistic on the outlook for 2024, albeit elections are a source of uncertainty. Helping clients with their evolving and increasingly complex needs is at the heart of everything we do and with the breadth of our expertise we are well placed to support clients in navigating periods of change.”

Key drivers of financial performance were strong fee growth in Professional Services, fee savings from the migration of assets to our in-house custody platform and higher interest on cash. Higher operating expenses were principally driven by staff costs as we continued to add headcount to support future growth.

Market movements and the timing of inflows have a major impact on the recurring fees earned from managing client assets. While AUM increased 11.5% across the year, market gains were skewed towards the end of the year.

Business highlights

- We continued to focus on operational and digital transformation to improve client experience, increase productivity and ensure the scalability of our business operations. Significant developments were made to our Financial Services platform including cloud migration to enhance resilience, scalability and security, financial crime screening and the automation of suitability reviews.

- In the first half of the year, we launched new online portals and an App for both Apple and Google mobile users. This has enhanced client experience, improved stability and provides market-leading security.

- We made further progress with the digitalisation of our Professional Services business. The implementation of a new automated solution for the on-boarding of Professional Services clients has significantly reduced manual processes and the time to onboard clients, while our practice management system has improved productivity and efficiency.

- Enhancements to our proposition included the launch of a new Multi-Asset Fund range investing in direct securities, a Cash & Cautious Bond strategy, a new digital tax tool, further features for Bestinvest and a workplace financial wellbeing service.

- Developments in our office network included new presences in Beaconsfield, Harrogate and Tunbridge Wells as a result of acquisitions and the relocation to new premises with excellent sustainability credentials in Glasgow and Belfast. We also signed leases for new premises in Bracknell, Bristol and Leeds, with moves expected to complete in 2024.

- We continued to acquire high quality businesses to augment organic growth. In our Professional Services business we acquired Leathers, the Ashcroft Partnership, Creaseys Group and Harwood Hutton, as well as a specialist forensics team from KPMG UK. In Financial Services, we acquired Dart Capital, which added £754.7 million of AUM, and acquired the assets of three businesses under our Retiring IFA programme.

[1] Adjusted Earnings, Before Interest, Tax, Depreciation and Amortisation.