What a summer we have had, with temperatures at times hotter than the Med and a brief period when many dared to dream that football might be “coming home” and that England actually stood a chance of winning the win the World Cup. This summer has also seen the US stock market reach its longest ever bull-run, turbo-charged by a strong reporting season and record share buybacks. When combined with the effects of strengthening Dollar, the S&P 500 Index of US shares has delivered a total return in Sterling terms of 15.1% from the start of May to the end of August, making it the undisputed winner this summer.

But it hasn’t been such a positively sunny everywhere this summer: The MSCI Europe ex UK index delivered a more modest 2.7% rise, Japan’s Topix index has nudged up 1.5% and the UK’s FTSE All Share Index has trailed behind somewhat, eking out a mere 0.9% return. For Emerging Markets the investment climate has been decidedly wintry, with the MSCI Emerging Markets Index generating a negative return of -3.5% since May as concerns about trade wars and the impact of a stronger Dollar has hit home.

Should investors breathe a sigh of relief that - in the main - the old adage suggesting investors should “Sell in May” and get out of the stock-market until mid-September looks like it will once again prove wrong, or will this September herald a drop off in the market?

Of course it is virtually impossible to predict short term market movements, however looking at historical data September has periodically been the most volatile month of the year. Jason Hollands, Managing Director at Bestinvest, the online investment service, discusses:

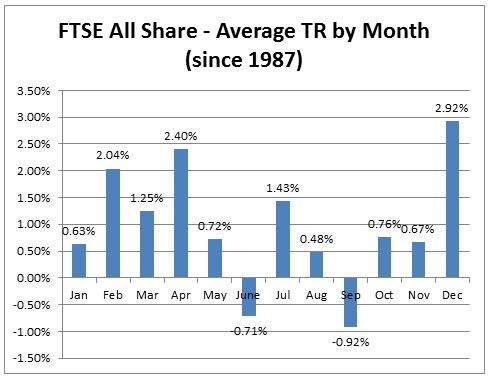

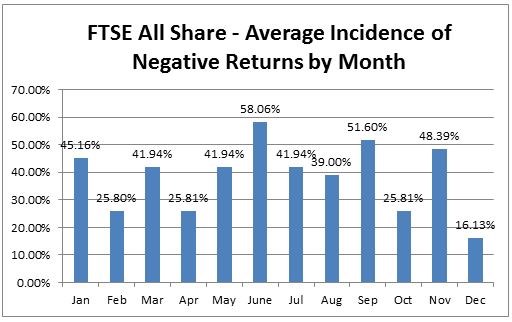

“Research from Bestinvest reveals that looking back over the long-term, September is a month that has witnessed a disproportionate number of dramatic market slides. Since the 1990s, there have been no fewer than seven notable slumps in September including Black Wednesday, the aftermath of the 9/11 attacks and the collapse of Lehman Brothers ten years ago this year (a full list is provided below). The charts below show that based on twenty years of data from 1986 to 2017, September is the month with the worst average total return on the FTSE All Share Index (-0.92%) and it is the second worst month (after June) for incidences of delivering negative returns from equities (51.6% of the time).

“Of course no one can predict for certain what will happen this September. On the one hand the US economy remains firing on all cylinders, but on the other trade tensions with China remain high and politics continues to loom large over the markets, However, the key thing to remember in the event of any market sell-off is to hold your nerve and if you have funds available to invest, consider buying into the market. Investing is a long term game and buying when others are selling can prove a canny move."

-Appendix-

FTSE All Share Index – Average Total Returns by Month (Since 1987)

Source: Lipper/Bestinvest

FTSE All Share Index – Average Incidence of Negative Returns by Month (Since 1987)

Source: Lipper/Bestinvest

September – danger month:

Much of the reason for the low average figures cited above comes down to the impact of seven notable summer crashes – five of which occurred in September:

- 1992 (-11.6%) – when high German interest rates were putting strain on the European Exchange Rate Mechanism and the UK was additionally squeezed by a rapid depreciation of the dollar. Things finally cracked on Black Wednesday on 16 Septemberwhen the UK was ejected from the ERM, which ultimately marked a turning point in UK’s fortunes

- 1998 (-12.6%) – on 17 August Russia devalued its currency, defaulted on domestic debt and declared a moratorium on payments to foreign creditors, sparking a global sell-off

- 2001 (-18.4%) – markets crashed followed the 11th Septemberterrorist attacks on the World Trade Center and Pentagon

- 2002 (-21.2%) – this was the second leg of the bursting of the “dot com” bubble, stocks began to slide again in March, but dramatic sell offs happened in July and September

- 2008 (-13.0%) – the credit crisis was playing out dramatically. This period was followed on 15 September by Lehman Brothers filing for bankruptcy and the US Fed bailing out of AIG on 15 September

- 2011 (-10.9%) – sharp sell-off in August due to fears over contagion in the Euro debt crisis and the loss of the USA’s AAA-credit rating on 6 August

- 2015 (-8.05) – Over August and September due to China’s economic slowdown and its ramification for global growth, along with the prospect of monetary tightening by the US Federal Reserve

-ENDS-

Important information:

The value of investments, and any income derived from them, can go down as well as up and you may get back less than you originally invested. This press release does not constitute personal advice. If you are unsure about the suitability of any investment, you should seek professional advice. Past performance is not a guide to future performance.

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.