Budget 2016: Stealth shift away from upfront tax relief on pensions

On Budget day we all get caught up with snap reactions to this or that item, but sometimes you need to sleep on it all to crystallise your thinking and see the bigger narrative. And that, in my view, is the shift away from the traditional system of upfront tax relief on pensions in favour ISAs. In other words the Chancellor is seeking to achieve by stealth, the very overhaul he had reportedly dropped a few weeks ago.

Turbo-charged ISA is only a partial offset for those being hit by pension raids

Take, for example, the surprise announcement of a turbo-charged £20,000 ISA allowance from April 2017, which has prompted hoots of joy from the financial services industry. In itself, this is very clearly welcome. In my view more is always better when it comes to beer and Christmas cake and the same is true when it comes to legitimate ways of sheltering assets from the tax man.

But it is also important to see the context here before lionising the Chancellor as the savers undisputed hero: wealthier investors are getting a bigger ISA allowance against a backdrop where there have been very steep cuts to the annual and lifetime pension allowances, and from 6 April, those earning more than £150k, are about to have their access to pensions curtailed further through the new tapering arrangements, to as little as £10,000 a year – so a bigger ISA is only a partial offset for this pillaging of their pension allowances.

Nevertheless for a couple to be able to tuck away £40k per annum in ISAs, is an astonishing amount of money. When combined with the fact that the additional reforms to tax on interest from savings accounts, which provides basic rate taxpayers with tax-free interest on their first £1,000 and higher rate taxpayers with £500 of tax free interest, most Britons need not pay any tax on their savings and investments.

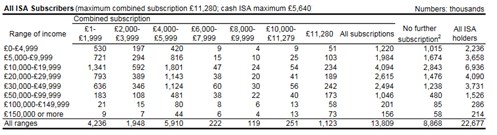

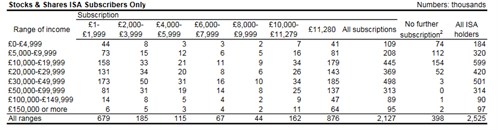

Very few couples of course have a spare £40k of cash knocking around each year out of taxed income to invest. According to HMRC data, the average ISA subscription in 2014/15 was £6,064 (£6,593 for Stocks & Shares ISAs) and in the last detailed set of figures released on the profile of ISA investors (for the year 2012/13) just 5% of ISA investors were using the full allowance – and this was when it was £11,280, though this rose to 35% of those investing in Stocks & Shares ISAs (see tables below).

Source: HMRC

Source: HMRC

ISA confusion?

The new Lifetime ISA, was broadly welcomed yesterday – but the devil will be in the detail and the myriad of tax efficient savings accounts that has sprung up in recent years is getting confusing. The Government has in effect created a potential competitor to pensions auto-enrolment. The ISA “brand” has now been slapped on a lot of Mr. Osborne’s savings initiatives: “Junior” ISAs, “New” ISAs, “Help to Buy” ISAs, “Innovative Finance” ISAs and now the “Lifetime” ISA. One can’t help thinking this is becoming very confusing and at some point, maybe under this Government or a future one, under the banner of simplification there will be an almighty overhaul.

Of course, if the Lifetime ISA proves a roaring success, this could be a prelude for the Government to revisit the issue of tax relief on pensions – from which it made a tactical withdrawal. It has in effect, set up a live experiment for the much mooted pensions ISA. But there remains the possibility of a much more rapid return to a full frontal assault on upfront tax relief on pensions, given talk of a £50 billion hole in the Chancellor's projections for achieving a budget surplus by the end of the parliament - so the future of tax relief on pensions could be back on the table once the small matter of the Brexit referendum is out of the way.

Capital gains tax changes will help those having to look “beyond pensions”

One of the other pleasant surprises yesterday were the cuts to Capital Gains Tax (CGT), from 28% to 20% at the higher rates. We had been fearful that CGT rates would move the other way, to align with income tax bands, as the Chancellor scrabbled around for new tax revenues.

Yet the CGT changes can also be seen through the prism of the carving back of access to pensions for wealthier investors, who need to look beyond pensions and ISAs either because they have hit the lifetime allowance or are going to be caught by the tapering regime. Yes, there are other forms of tax efficient investments they can explore, such as Venture Capital Trusts or Enterprise Investment Schemes, but the specialist nature of these means they are only going to be part of the answer.

For investors who have maxed out on pensions and are already fully funding ISAs, increasingly they are going to have to invest in a taxable environment where investment in growth rather than income generating investments and regularly crystallising capital gains is going to be an increasingly important source of providing cash in their retirement. Of course some may be able to achieve complete tax efficiency through using their annual capital gains allowance, but for those needing to go further, a 20% capital gains tax is much more palatable than taking income and being hit with 40% income tax. A sensible strategy for these investors could be to focus on yield generating investments within ISAs and capital return funds outside of tax-wrappers, while avoiding drawing on their pensions for as long as possible given their efficiency from an inheritance tax perspective.

We do see the lower CGT rate as likely to stoke interest in EIS, as a capital gains tax liability can be deferred by investing in EIS and the liability only recrystallizes when the EIS shares are exited – but at the prevailing rate of CGT at that time rather than the one in place when the gain was originally made. Importantly, gains made up to 36-months before the EIS shares are subscribed to can be deferred in this way, so those who have made large gains on the sale of shares or other assets (but not buy-to-let property) now have an additional incentive to explore CGT deferral through EIS - and, by the way, get an 30% Income Tax credit in the process.

- ENDS -

Important Information

The value of investments, and the income derived from them, can go down as well as up and you can get back less than you originally invested.

This article is not advice to invest or to use our services. If you are in doubt as to the suitability of an investment please contact one of our advisers.

The above article is based on our interpretation of the Budget 2016 and related legislation; it is not intended as advice, and the impact of any changes to tax rates or allowances will depend on your personal circumstances.

Press contacts:

Jason Hollands

0207 189 9919 / 07768 661382

jason.hollands@tilneybestinvest.co.uk

Gillian Kyle

0203 818 6846 / 07989 650 604

gillian.kyle@tilneybestinvest.co.uk

About Tilney Bestinvest

Tilney Bestinvest is a leading investment and financial planning firm that builds on a heritage of more than 150 years. We look after more than £9 billion of assets on our clients’ behalf and pride ourselves on offering the very highest levels of professional client service with transparent, competitive pricing across our entire range of solutions.

We offer a range of services for clients whether they would like to have their investments managed by us, require the support of a highly qualified adviser, prefer to make their own investment decisions or want to take more than one approach. We also have a nationwide team of expert financial planners to help clients with all aspects of financial planning, including retirement planning.

We have won numerous awards including Stockbroker of the Year, Execution-only Stockbroker of the Year and Self-select ISA Provider of the Year 2015, as voted by readers of the Financial Times and Investors Chronicle. We are pleased that our greatest source of new business is personal referrals from existing clients.

Headquartered in Mayfair, London, Tilney Bestinvest employs over 400 staff across our network of offices, giving us full UK coverage, and we combine our award-winning research and expertise to provide a personalised service to clients whatever their investment needs.

The Tilney Bestinvest Group of Companies comprises the firms Bestinvest (Brokers) Ltd (Reg. No. 2830297), Tilney Investment Management (Reg. No. 02010520), Bestinvest (Consultants) Ltd (Reg. No. 1550116) and HW Financial Services Ltd (Reg. No. 02030706) all of which are authorised and regulated by the Financial Conduct Authority. Registered office: 6 Chesterfield Gardens, Mayfair, W1J 5BQ.

For further information, please visit: www.tilneybestinvest.co.uk

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.