Terry Smith triumphs in the battle of the fund Big Beasts

2017 has been a year dominated by politics, with the start of the Trump administration in the US, a snap UK General Election seeing the Conservatives lose their parliamentary majority, the start of Brexit negotiations and a volley of elections across Europe including the Netherlands, France, Austria and Germany. Despite this background noise, 2017 has shaped up to be another positive year for investors, with double-digit returns across many equity regions and with market volatility as calm as a mill pond. As such a poignant year draws to an end, award winning online investment platform Bestinvest, has revealed which investment funds proved the most popular during the year with clients who make their own investment decisions.

Jason Hollands, Managing Director of Bestinvest, commented: “The funds favoured by Bestinvest clients during 2017 – excluding our own multi-asset portfolios - were wholly or predominantly dominated by equity funds, with not a bond fund, absolute return fund nor property fund in sight. Notably three passive based investment funds made it into the top ten choices reflecting the growth in demand for low cost choices that track general market movements. But overall, the table was still dominated by actively managed funds run by well-known managers with strong long-term track records.

“Terry Smith’s Fundsmith Equity Fund was the clear and decisive winner, taking the top spot for the second year running and consistently leading the table in every single month across 2017, a position his fund has now held for over twenty months in succession. He has certainly developed a considerable fan club of investors who like his no nonsense buy-and-hold approach and the fact that he doesn’t sit on the fence with his views. Earlier in 2017, some were calling time on the types of “quality growth” companies that Smith backs, anticipating a resurgence instead for the fortunes of value stocks and cyclical businesses on the back of the “reflation” of the global economy. But the year turned out to be another strong one for managers with a quality growth style bias and this has been yet another period of top decile performance for the FundSmith Equity fund.

“In second place this year was the CF Woodford Equity Income fund, managed by Neil Woodford, another heavyweight manager, but as the year progressed it has slipped down the monthly rankings. This is perhaps unsurprising as 2017 has shaped up to be an annus horribilis for Woodford, with some high profile stock blow ups and a run of severe underperformance which has pushed this fund - the largest in the IA UK Equity Income sector - right to the bottom of the performance tables. Woodford will surely be hoping for a turnaround in 2018 and is taking a contrarian view that is much more upbeat about the UK domestic economy than consensus opinion. He has also been warning about an overvaluation “bubble” in global stock markets centered on companies with dependable growth characteristics, the sorts of companies favoured by Terry Smith and the Nick Train, manager of the Lindsell Train Global Growth fund, another popular choice. Time will tell who is right – it will be a fascinating showdown.”

Which sectors performed best?

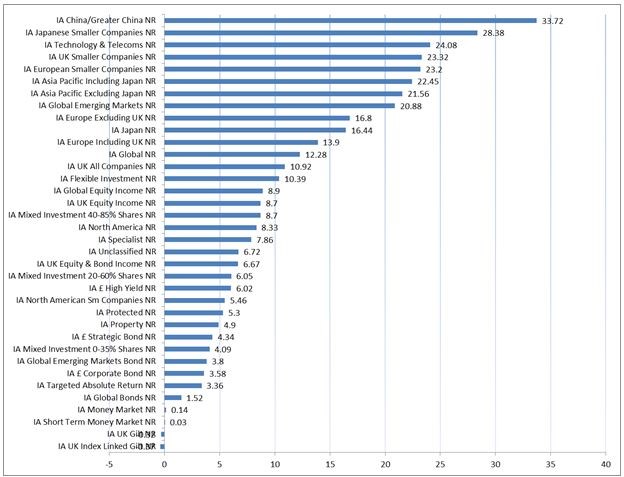

“Looking at the average returns from funds from the Investment Association sectors, 2017 turned out to be a particularly stellar year for funds exposed to riskier areas such as Asia and Emerging Markets, technology and smaller companies. It was a dull one for bond funds and defensive targeted absolute return funds – areas which have begun to find favour again with investors in recent months.

Note: Sector average % total returns during 2017 until end of November 2017

Hollands concluded: “It seems that many investors are growing anxious about a possible stock market “correction” having enjoyed yet another year of buoyant returns on their stock market investors in in 2017. It is undeniable that this bull market has gone on for a long-time, but is also the case that bull markets do not merely die of old age – they typically end when there is either a deterioration in macro-economic outlook or a shock trigger event to spook investors.

“While no one of us has a crystal ball to predict the future, the economic outlook is benign. We finish 2017 with the global economy in pretty decent shape, with markets having weathered both the various political uncertainties of the year and gradual shift in policy direction from central banks well, plus the prospect that the US will institute major tax cuts in the near year. And while undoubtedly parts of the market do look expensive compared to longer term trends, this is not a universal phenomenon by any means. In particular, valuations on Global Emerging Market shares continue to trade below their longer-term trend despite the strong returns made this year and currently unloved UK equities are also broadly fair value.”

If we can help with any further comment on reviews of the market in 2017 or the outlook for 2018, please do get in touch.

- ENDS -

Important Information:

The value of investments, and the income derived from them, can go down as well as up and you can get back less than you originally invested. Past performance is not a guide to future performance.

Different funds carry varying levels of risk depending on the geographical region and industry sector in which they invest. You should make yourself aware of these specific risks prior to investing.

We aim to provide investors with information to help them make their own investment decisions although this should not be construed as advice or an investment recommendation. If you are unsure about the suitability of an investment or if you need advice on your specific requirements, we strongly suggest that you consider professional financial advice.

Underlying investments in emerging markets are generally less well-regulated than the UK. There is an increased chance of political and economic instability with less reliable custody, dealing and settlement arrangements. The market(s) can be less liquid. If a fund investing in markets is affected by currency exchange rates, the investment could both increase or decrease. These investments therefore carry more risk.

Smaller companies shares can be more volatile and less liquid than larger company shares, so smaller companies funds can carry more risk. The property market can be illiquid; consequently, there can be times when investors will be unable to sell their holdings. Property valuations are subjective and a matter of judgement.

Tracker funds track the performance of a financial index and as such their value can go down as well as up, much like shares, and you can get back less than you originally invested. Some are more complex so you should ensure you read the documentation provided to ensure you fully understand the risks.

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.