‘Annuities’ may be a dirty word but they are still what the majority of retirees want

Annuities may be a dirty word but they are still what the majority of retirees want

Annuities may be a dirty word but they are still what the majority of retirees want

Research from Tilney Bestinvest has revealed that while the majority of people believe the most important criteria in retirement is to have a high degree of certainty over the income they'll receive, conversely, when the word annuity is mentioned, a large chunk perceive these negatively.*

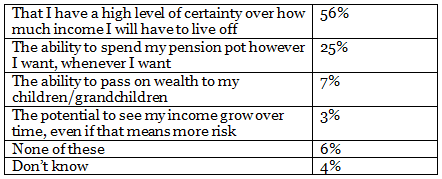

The YouGov survey of 2,311 GB adults aged 50+ carried out between 25th – 27th March 2015, showed that 56% of respondents who have paid into a pension plan, but not yet retired believed that the most important thing to them financially in retirement was that they ‘have a high level of certainty over how much income I will have to live off.’ The second most popular statement was the ‘ability to spend my pension pot however I want, whenever I want’ (25%). Following someway behind these responses was ‘the ability to pass on wealth to my children/grandchildren’ (7%) and ‘the potential to see my income grow over time, even if that means more risk’ (3%).

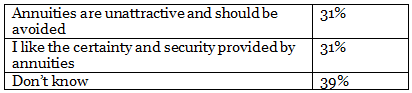

However, when asked a direct question with regards to annuities, some 31% of pension holders agreed with the statement that ‘annuities are unattractive and should be avoided’, while the same percentage said they ‘liked the certainty and security provided by annuities’.

David Smith, Financial Planning Director at Tilney Bestinvest commented: “Annuities have had a bad press in recent months however they are likely to remain a mainstay of the retirement income market. Indeed, as our research shows, having certainty in retirement is an attractive proposition to many.

“Given the increased choice on how to take pensions now available to retirees, it is more important than ever that those approaching retirement consider their individual circumstances before making any decisions; indeed it is one of the most, if not the most important decisions of an individual’s financial life.”

For further comment David Smith can be contacted at david.smith@tilneybestinvest.co.uk / 0191 269 9970

Appendix:

*All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 2,311 adults aged 50 or over. Fieldwork was undertaken between 25th - 27th March 2015. The survey was carried out online. The figures have been weighted and are representative of all GB adults.

Q: Which ONE, if any, of the following do you think will be the MOST important to you financially in retirement?

Base: All GB Adults 50 plus who have ever paid into a pension plan and are not currently retired (970)

Q: Which ONE, if any, of the following statements do you agree with MOST?

Base: All GB Adults 50 plus who have ever paid into a pension plan (1851)

- ENDS -

Important Information:

The value of investments, and the income derived from them, can go down as well as up and you can get back less than you originally invested. This press release does not constitute personal advice. If you are in doubt as to the suitability of an investment please contact one of our advisers.

Once set up, an annuity cannot normally be changed or cancelled. Therefore it is important to consider all of your options, especially in light of the new pension reforms. If you are unsure of your options you should seek professional financial advice or visit Pensionwise.gov.uk.

Press contacts:

Roisin Hynes

0207 189 2403

07966 843 699

roisin.hynes@tilneybestinvest.co.uk

Matthew Gray

0207 189 2492

matthew.gray@tilneybestinvest.co.uk

About Tilney Bestinvest

Tilney Bestinvest is a leading investment and financial planning firm that builds on a heritage of more than 150 years. We look after more than £9 billion of assets on our clients’ behalf and pride ourselves on offering the very highest levels of professional client service with transparent, competitive pricing across our entire range of solutions.

We offer a range of services for clients whether they would like to have their investments managed by us, require the support of a highly qualified adviser, prefer to make their own investment decisions or want to take more than one approach. We also have a nationwide team of expert financial planners to help clients with all aspects of financial planning, including retirement planning.

We have won numerous awards including UK Wealth Manager of the Year, Low-cost SIPP Provider of the Year and Self-select ISA Provider of the Year 2013, as voted by readers of the Financial Times and Investors Chronicle. We are pleased that our greatest source of new business is personal referrals from existing clients.

Headquartered in Mayfair, London, Tilney Bestinvest employs almost 400 staff across our network of offices, giving us full UK coverage, and we combine our award-winning research and expertise to provide a personalised service to clients whatever their investment needs.

The Tilney Bestinvest Group of Companies comprises the firms Bestinvest (Brokers) Ltd (Reg. No. 2830297), Tilney Investment Management (Reg. No. 02010520), Bestinvest (Consultants) Ltd (Reg. No. 1550116) and HW Financial Services Ltd (Reg. No. 02030706) all of which are authorised and regulated by the Financial Conduct Authority. Registered office: 6 Chesterfield Gardens, Mayfair, W1J 5BQ.

For further information, please visit: www.tilney.co.uk

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.