What’s next for UK stocks?

This is undoubtedly a precarious moment for the UK economy. However, when handled with care, we continue to believe there are opportunities within the UK stock market.

This is undoubtedly a precarious moment for the UK economy. However, when handled with care, we continue to believe there are opportunities within the UK stock market.

This is undoubtedly a precarious moment for the UK economy. However, when handled with care, we continue to believe there are opportunities within the UK stock market.

Recent data shows the UK economy is starting to slow. GDP rose just 0.1% between January and February1, while higher energy and food costs pushed inflation to a 30-year high in March2. To what extent will this impact the UK stock market?

The UK economy is facing a number of headwinds, including rising inflation, rising interest rates and decelerating growth. While UK GDP and the unemployment rate returned to pre-crisis levels at the start of this year, the balance of the economy still reflects the legacy of the pandemic: health and warehousing, for example, are operating above pre-crisis levels. Others, such as travel, remain well below their level prior to the pandemic.

Looking ahead, there are some potential bright spots: the Office for Budget Responsibility (OBR) forecasts that business investment will recover to pre-crisis level by the end of the year, having been weak for last two years3. The super-deduction, which allows companies to claim back tax on plant and machinery investments, should encourage companies to bring forward expenditure into this year. If supply chain pressures ease, the outlook for business could improve further.

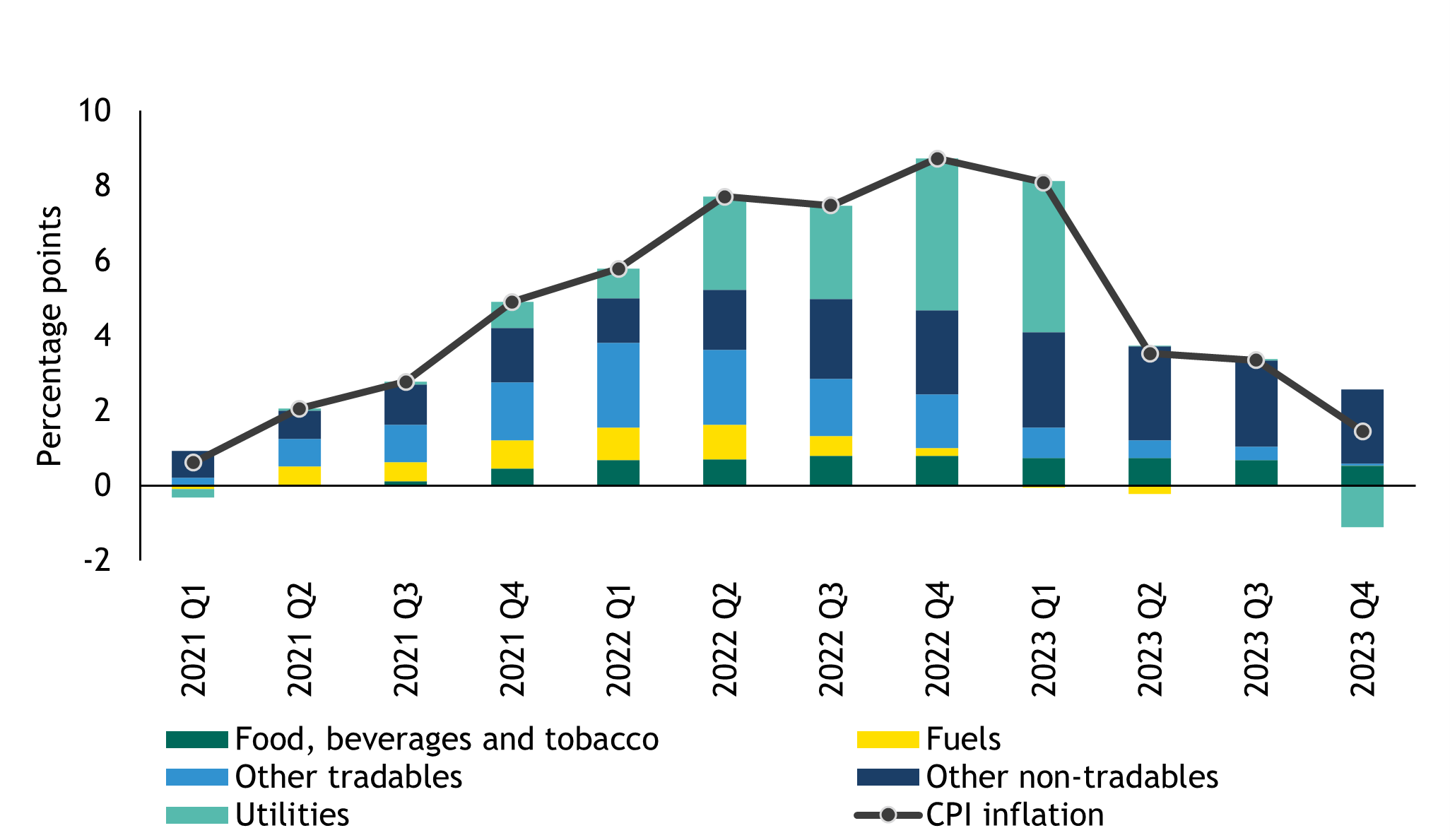

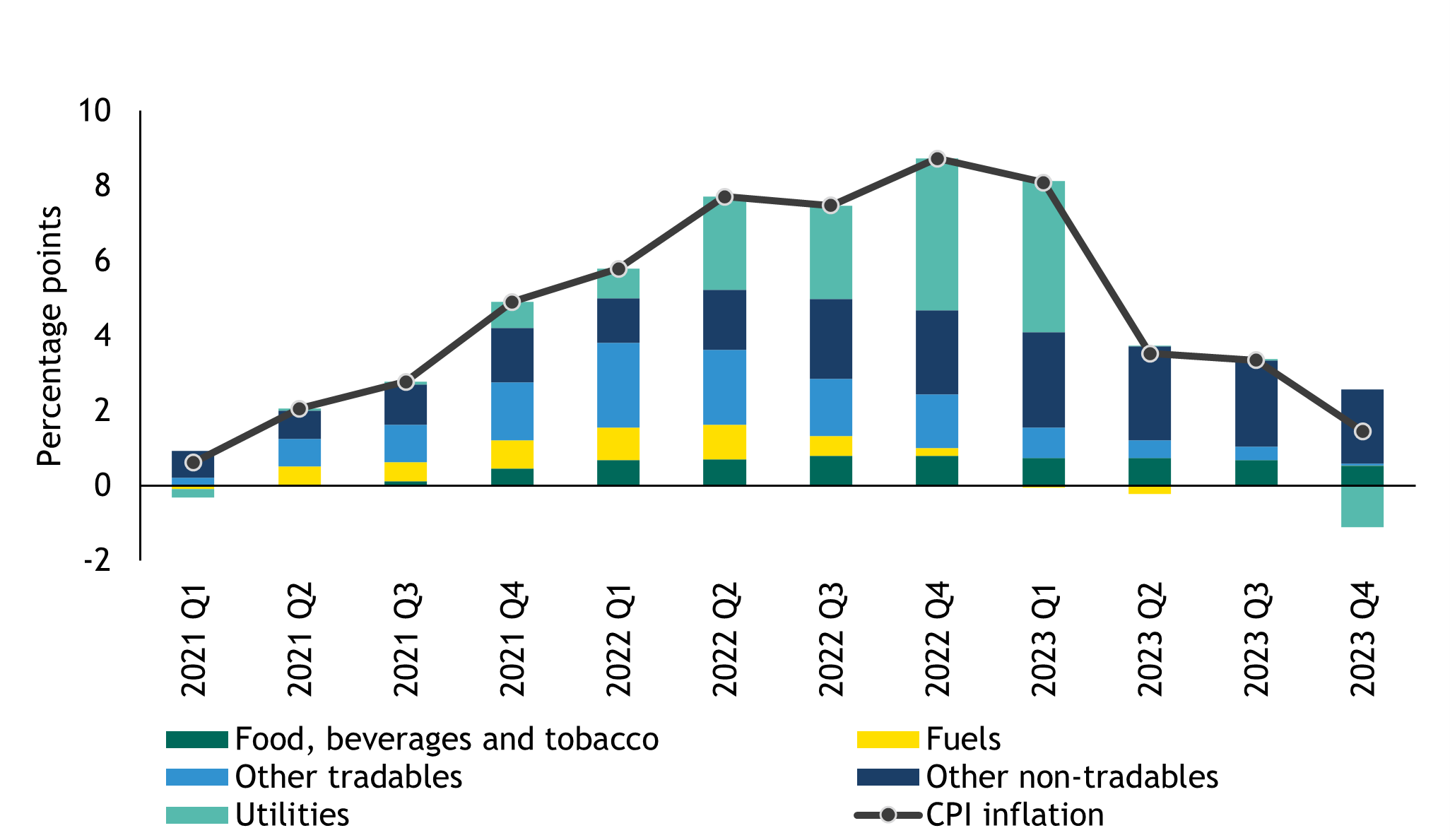

However, it is a very different picture for the UK consumer. As a net energy importer, the UK is exposed to shifts in energy prices. This is pushing inflation higher as seen in the March CPI print, with inflation hitting a 30-year high of 6.2% (year on year)4. Moreover, there is a lag between rising input costs in manufacturing and rising consumer prices, so it is likely that higher consumer prices will persist into the second half of the year. The OBR now believes that CPI will peak at close to 9% in the fourth quarter of this year5. This will continue to erode the purchasing power of UK consumers.

Chart 1: Utilities are expected to be the main driver of CPI

Source: OBR/Smith & Williamson Investment Management LLP, data as at 20 April 2022

Another challenge for UK households is that the Bank of England is expected to continue raising interest rates over the near term. The OBR forecasts interest rates will average 1.6% in the final quarter of 20226; while financial markets suggest they may reach 2% by the end of the year7. Whether or not they reach it, this level remains to be seen. The UK’s central bank has been clear that its priority today is tackling inflation via higher interest rates, though it may be forced to hit the pause button later in the year if the economy continues to slow.

The combination of higher inflation and higher taxes, driven by the increase in national insurance contributions, means household disposable income is set to fall by 2.2% in the 2022/23 tax year8. This is the largest fall since the 1950s. It would have been higher, but to try and offset the squeeze on incomes, Chancellor Rishi Sunak introduced a number of new policies, including increasing the NI threshold, a temporary cut in fuel duty and help on energy bills.

As this squeeze intensifies, households are already saving less and using some of the cash they banked during the pandemic. The war chest built up over successive lockdowns may cushion the impact a little, but much of it is held by wealthier households, which have a lower propensity to spend.

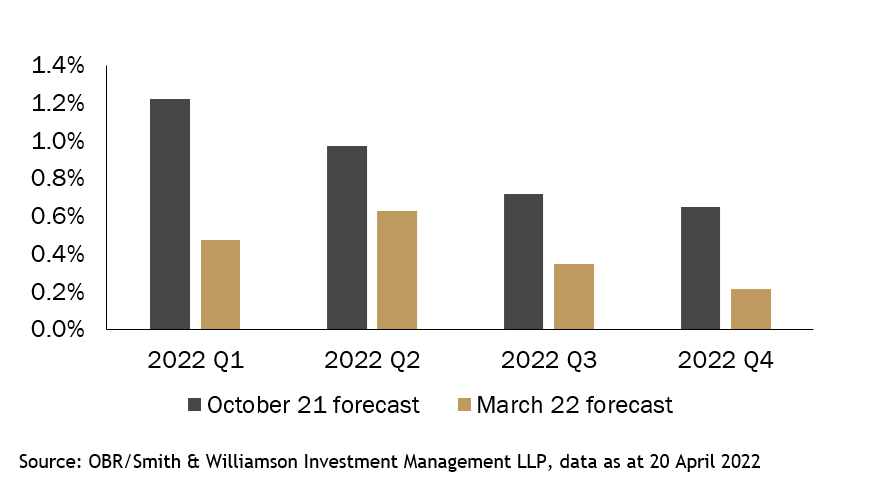

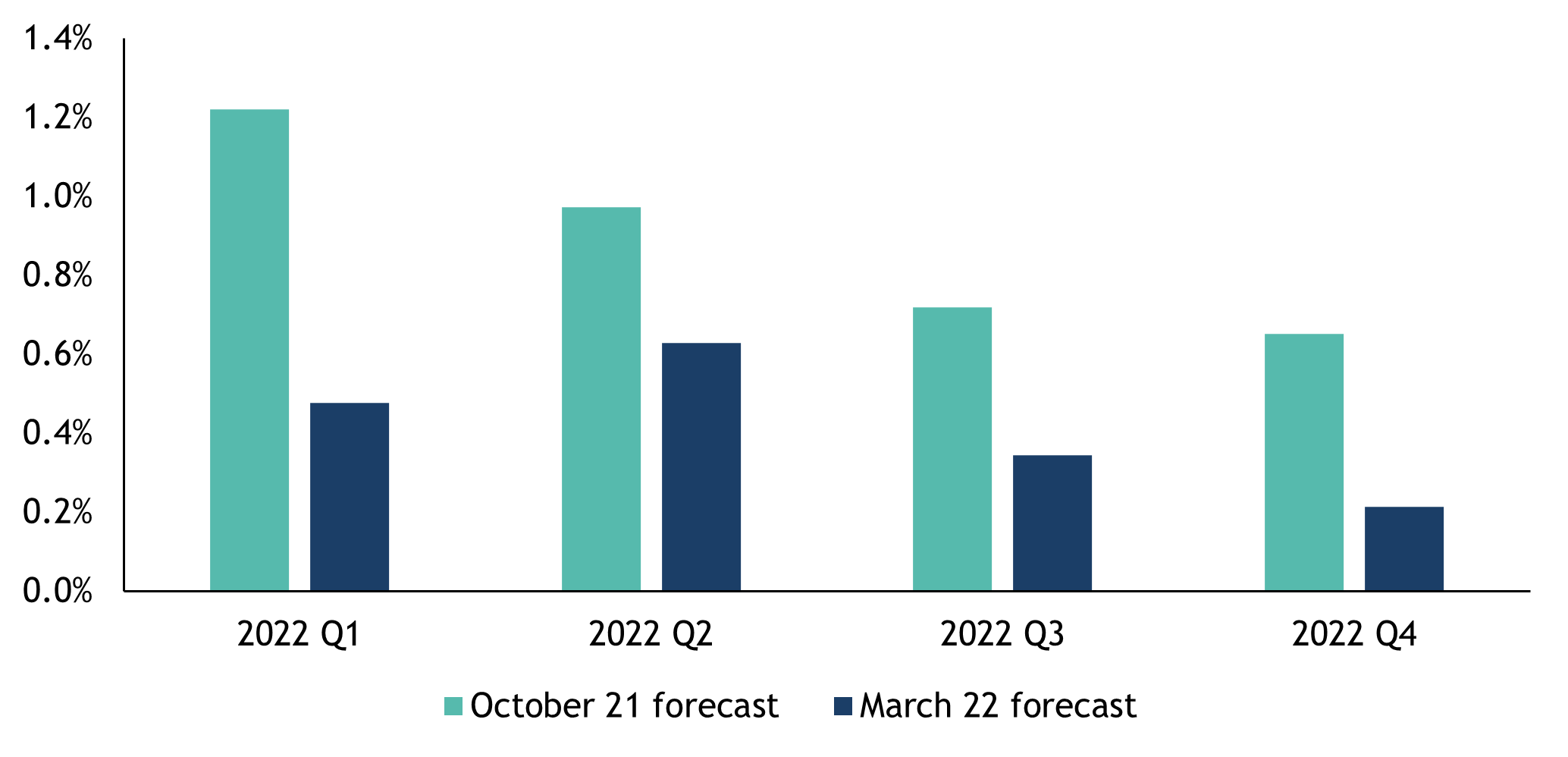

The economic picture is worsening, with the OBR revising its 2022 UK real GDP growth forecast down from 6% to 3.8%9. Similarly, this week the IMF revised its 2022 forecast down from 4.7% to 3.7%10. However, the UK economy is not the stock market. Many of the largest companies in the UK stock market draw their earnings from overseas; indeed, around two-thirds of FTSE 100 earnings are from abroad11. This means that many companies have relatively low exposure to domestic economic performance. Equally, the UK stock market continues to look cheap relative to many of its peers.

Chart 2: OBR October 2021 forecast vs March 2022 forecast (Real GDP growth % q/q)

Source: OBR/Smith & Williamson Investment Management LLP, data as at 20 April 2022

However, it does require careful navigation. From our work on the type of sectors that do well in a high inflation and medium growth scenario ─ our base case ─ we favour energy, healthcare and consumer staples. Helpfully, these sectors are relatively cheap and should also perform well in a weaker environment, where inflation is high and growth is low. Within these sectors, we favour companies with high and stable profit margins and pricing power, which allows them to protect those margins.

In contrast, our analysis suggests that cyclical sectors that are sensitive to consumer demand, such as consumer discretionary, don’t do as well in this type of macroeconomic environment. While some companies in this sector will be able to push through these headwinds, on balance, we believe value-oriented sectors should perform better.

This is undoubtedly a precarious moment for the UK economy. However, when handled with care, we continue to believe there are opportunities within the UK stock market, particularly for companies that earn revenues from overseas. We are focusing on those sectors that have historically performed well in a climate of high inflation and low/medium growth. When combined with careful stock selection, it’s possible to identify companies that can thrive whatever the economic weather.

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.’

The value of an investment, and the income from it, may go down as well as up and you may get back less than you originally invested. Past performance is not a guide to future performance.

1 ONS

2 ONS

3 OBR

4 ONS

5 OBR

6 OBR

7 Bloomberg

8 OBR

9 OBR

10 IMF

11 Reuters

Ref 22049500

This article was previously published prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.