Weekly macroeconomic and market update - 7 November 2016

Weekly macroeconomic and market update - 7 November 2016

Weekly macroeconomic and market update - 7 November 2016

A look back over macroeconomic events for the week ending 04/11/2016. There was no change to monetary policy at the meetings of the Bank of England, US Federal Reserve and Bank of Japan. But there was a clear theme away from looser monetary policy amid growing inflation concerns. The big event this week is, of course, the US Presidential election, which could be a trigger to release pent up tensions in the market.

As expected, there was no change to monetary policy from the Central bank meetings in the US, UK and Japan, but there was still plenty to talk about. The Bank of England was a particular talking point, as Mark Carney confirmed he would step down as Governor in 2019. This puts his departure after the Brexit negotiation period is expected to conclude, and a year beyond the initial five-year stint he announced when he took the role in 2013, but short of a full eight-year term.

The bank now forecasts faster acceleration of inflation, which is expected to peak at 2.8% in 2017 before falling back towards target. The bank also sees GDP growth of 1.4% in 2017 (up from 0.8% in the August report) and 1.5% in 2018 (down from 1.8% in August). Both are still some way below its pre-Brexit forecasts. Despite the improving economic data, the bank still believes the outlook is challenging, and the pain will now come a little later than initially expected.

That said, the Monetary Policy Committee now appears slightly more hawkish than it was before. The committee’s guidance that another cut could be on the cards was removed, with the committee members now expecting no change to the base rate in the near term, unless there are some very significant changes to the economic data.

In the US, the statement from the Federal Reserve pointed to a likely December rate hike. This highlighted the strengthening case for a rise in interest rates, but we believe they are waiting for further data (and, we infer, the outcome of the US Presidential election) before acting.

Looking further afield, the Bank of Japan confirmed no change to monetary policy. The bank also extended its expectation for inflation hitting its 2% target, from 2017 out to 2018. To our mind, this further reinforces the sense that Central banks no longer have faith in their unconventional monetary policies.

There was more support for a rate hike in October’s Non-Farm Payrolls. The headline figure of 161,000 fell short of the 175,000 target, but came with upward revisions to the August and September numbers. At the same time, average earnings grew at the fastest rate since January, up 0.4% month on month (from expectations of an unchanged 0.3% reading). Unemployment also fell 0.1% to 4.9% (in line with expectations and down from 5.0%).

This builds on a recent strengthening of the data, including GDP and PMI numbers that we have discussed in recent weeks. Whilst we continue to have concerns over the sustainability of the US economy, these near-term trends make a December rate hike more likely and arguably provide a boost to the Democratic Party ahead of the US election.

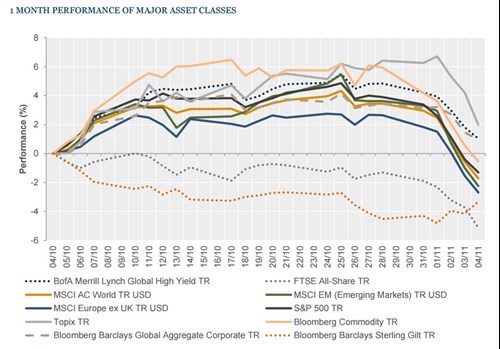

It was the turn of equity markets to suffer this week, spurring some short-term strengthening in sovereign bonds. Oil weakness persisted as doubts loomed over any agreement to cut production, whilst gold was also up, and sterling reversed some of its recent weakness.

As sterling strengthened UK equities suffered, with the FTSE All-Share falling -3.9%. Other major bourses were also down – in the US the S&P 500 was down -1.9%, and in Europe the FTSE Europe (ex-UK) index slipped -2.4%. In the Far East, the TOPIX index of Japanese equities returned -1.3%, and in Hong Kong the Hang Seng lost -1.2%.

Government bonds generally benefited from weakness elsewhere in markets. In the UK, ten-year gilt yields fell 13 bps to 1.13%. Ten-year US Treasury yields were down 7 bps to 1.75%, whilst the equivalent German bund yields were down 2 bps to 0.14%.

Oil continued its slide through the week, with Brent Crude falling back down to US$45.58 a barrel. Copper rallied to US$2.26 per lb, as did gold, which ended the week above the US$1,300 mark at US$1,303.30 per ounce.

Sterling regained some strength on the week, closing at US$1.25, €1.13 and ¥130, whilst the US dollar was generally weaker.

The only show in town this week will be the US presidential election on Tuesday, and even though there is no reason for an immediate impact on the market or economics, the highly unusual nature of this particular election means it could potentially act as a trigger for wider market jitters. Aside from the election, we will also have Eurozone Retail Sales on Monday (forecast to have grown 1.6% year on year in September from 0.6% previously), whilst in the UK on Tuesday we have Manufacturing and Industrial Production for September. Industrial Production is expected to have increased 0.1% to 0.8% year on year, though Manufacturing is forecast to have contracted, -0.2% from 0.5% growth previously. Elsewhere:

On Monday we have Eurozone retail numbers followed by the US Labor Market Conditions Index. Overnight on Tuesday Chinese trade data will include import and export growth numbers, and shortly afterwards Japan releases its Coincident Index and Leading Economic Index measures. UK Industrial and Manufacturing figures are out later in the morning, and in the afternoon US JOLTs Job Openings will feed into the view of the US labour market.

Chinese inflation is reported overnight on Wednesday. It is forecast to have increased 0.2% to 2.1% year on year, whilst the Produce Price Index is expected to have significantly firmed up from an extended negative run. Forecasts are for 0.8% year on year in October up from 0.1% in September.

We have a fairly quiet Thursday, with little of note scheduled. This is followed by a muted end to the week, with only Japan’s Tertiary Industry Index and UK Construction Output to look forward to on Friday.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.