Strong economic indicators coming out of the US

An upward revision to third quarter US GDP set the positive tone for a week of generally strong economic indicators coming out of the United States. On an annualised basis, the revised estimate was that the economy grew at 2.1% in the third quarter, from an initial estimate of 1.5%. Although some of this uplift came from a build-up in inventories – not always a good sign, particularly mid-to-late cycle – the improvement was also the result of better-than-expected business capital expenditure. Elsewhere, durable goods orders grew more than expected in October, increasing 3% from the month before, and services PMI data came in ahead of expectations with a reading of 56.5, well ahead of October’s 54.8 (although the manufacturing PMI slipped more than expected to 52.6).

Housing data were much more mixed, with monthly sales of existing homes contracting sharply but new home sales improving markedly. Overall the housing market still looks fairly buoyant, with house prices (as measured by the CaseShiller index) up 5.5% from a year earlier.

However, it was the all-important consumer that provided cause for concern out of the releases. Personal income was again trending upwards strongly with a 0.4% month-on-month increase in October – but evidently people were feeling less inclined to spend, as personal spending was up only 0.1% whilst the savings rate ticked up to 5.6%. The Conference Board’s consumer confidence survey supported this theme of subdued consumption, showing confidence slipping from 99.1 to 90.4. And while it is too early to have a clear picture of retail spending over the post-Thanksgiving period (which now includes Cyber Monday as well as Black Friday), there are suggestions that in-store sales are down from a year earlier. The consumption component was also a detractor in the recent revision of GDP.

The UK’s latest economic releases

In the UK, third quarter GDP was confirmed at 0.5% quarter on quarter – in line with forecasts and a slight slowdown from 0.7% quarter on quarter in Q2. This corresponds to an increase of 2.3% from a year earlier, continuing a theme of gradual slowing. Whilst domestic consumption and business investment remained strong, it was overseas trade that dragged the measure lower as the UK economy suffered from a slowdown in global economic growth and relative currency strength.

Last week we also had the UK’s Autumn Statement and Spending Review – you can read our review here. The main takeaway was the chancellor’s insistence that the books would balanced by 2019/20, despite a number of give-away measures.

Last week’s other events

- US aggregate corporate profits were shown to have fallen -1.6% quarter on quarter.

- Eurozone manufacturing PMI increased to 52.8 from 52.3 in November, whilst services PMI also ticked up by 0.5 to 54.6. Business and industrial sentiment in the Eurozone continued to fall, the former slipping from 0.44 to 0.36 and the latter from -2 to -3.2. However, the overall economic sentiment index (which includes consumer sentiment) stayed strong with a reading of 106.1, matching the previous month.

- Japan’s headline inflation surprised with a reading of 0.3% year on year, despite a flat reading previously and expectations for more of the same. However, core inflation remained underwater at -0.1% year on year, the third consecutive month of negative readings. Unemployment also fell by 0.3% to 3.1%.

- Reports in China suggested that authorities were investigating brokerages suspected of breaching margin lending rules.

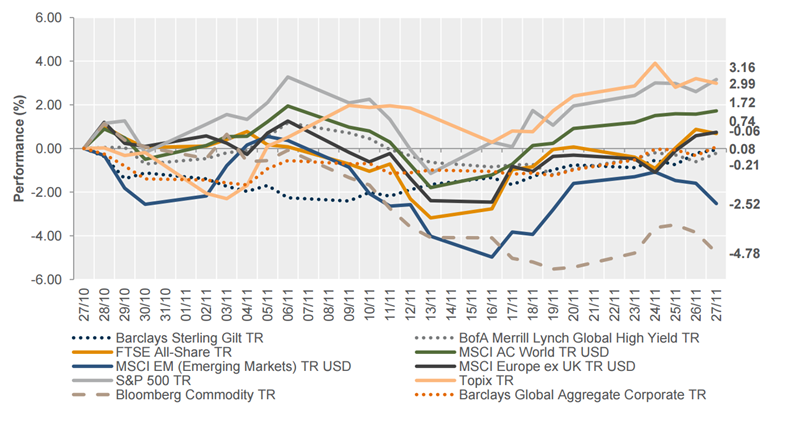

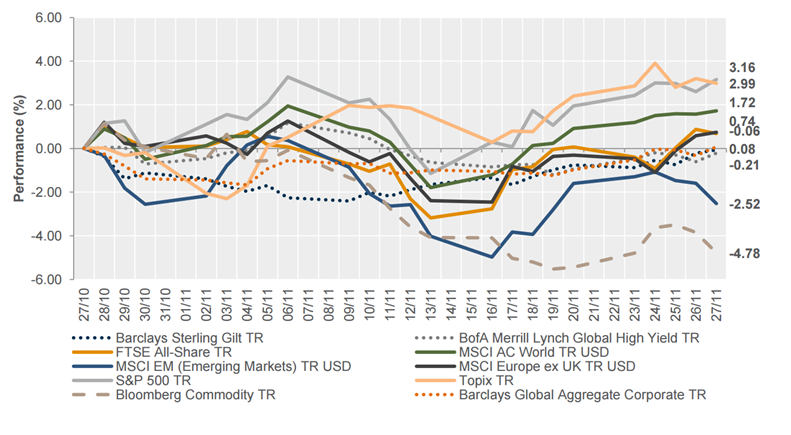

The markets

Markets were fairly uneventful given both the US holidays and anticipation of the range of key events expected over the next few weeks. Equities and bonds were marginally stronger, whilst commodity weakness remained and sterling slid against other major currencies.

Equities – Most major developed markets were marginally up on the week. In the UK, the FTSE All-Share returned +0.57%, whilst the US and Europe (excluding the UK) were up +0.06% and +0.12% (as measured by the S&P 500 and FTSE Europe ex-UK indices respectively). In the Far East the Japan Topix rose +0.53%, however the dark spot was centred on China and the latest margin lending reports – in Hong Kong, the Hang Seng fell -2.99%.

Bonds – Yields drifted slightly lower over the week. 10-year UK gilt yields were down -6 bps to 1.82%, US 10-year treasuries fell -4bps to 2.22%, and 10-year German bund yields were -3 bps lower at 0.46%.

Commodities – Weakness persisted across commodities. Overall oil was little changed on the week, with Brent Crude remaining below US$45 at US$44.84 per barrel. Copper remained subdued and barely moved at US$2.07 per pound, whilst gold slipped to US$1056.9 per ounce.

Currencies – Sterling was the main mover over the course of the week, sliding -1.0% against the US dollar and -0.57% against the euro.

The week ahead

We are expecting a very busy week for the markets, with several key events coming up. The focus will be on the ECB’s monetary policy meeting and press conference on Thursday, where expectations are for further loosening of the monetary policy. This could well include a double-whammy of interest rates being cut further into negative territory, at the same time as some sort of increase in the QE programme – be that in size, duration or scope. The ECB should also help to provide some market framing for the US decision a fortnight later, but with that in mind, non-farm payroll numbers on Friday look likely to be the last major release from the US that could move the dial on the interest rate decision.

As if non-farm payrolls weren’t enough, there is also an important meeting of the Organisation of the Petroleum Exporting Countries (OPEC) on Friday, where tensions are rising for the group to start acting on the oil price. Ahead of all that, however, we have some geopolitical intrigue on Monday when the International Monetary Fund will decide whether to add the Chinese renminbi to the Special Drawing Rights basket that effectively defines what is and isn’t a global reserve currency.

Other data this week include:

Monday – As well as the the IMF’s decision on the Chinese renminbi, we’ll be looking out for German retail sales and US pending home sales, which should be interesting given the mixed messages last week. In the UK we also have mortgage data due out.

Tuesday – There is plenty of data out on Tuesday, starting with PMIs from China. Both the official and Caixin readings are released and are forecast to remain indicative of a contracting economy. In the UK we have the Bank of England’s financial stability report which will cover the latest bank stress tests, followed by manufacturing PMI which is forecast to have increased to 55.5 (from 54). Later in the day we will also have Eurozone unemployment data, the US ISM Manufacturing PMI reading and then construction spending.

Wednesday – European inflation is expected to be just about positive, whilst core inflation is expected at around 1.1%. In the afternoon we will get a first look at the US Federal Reserve’s Beige Book of anecdotal economic conditions.

Thursday – Away from the main draw of the ECB decision on Thursday, there is also services PMI data from China and the UK, retail sales data from the Eurozone then non-manufacturing and factory orders in the US.

Friday – German factory orders are out in the morning, but the main event is the release of US non-farm payrolls and other employment data at 13:30 GMT. After 271,000 jobs were added on October, expectations are for 200,000 more in November. Hitting this target will likely reduce any remaining doubts about a December rate hike, although a significant divergence from this number could have a significant impact on market sentiment. OPEC will also meet, as pressure grows on the group to take some affirmative action to address issues in the oil market.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.