Weekly macroeconomic and market update 26 September 2016

Weekly macroeconomic and market update 26 September 2016

Weekly macroeconomic and market update 26 September 2016

Central bank meetings were the focus last week, with no policy changes announced, but plenty of discussion points coming out of the US Federal Reserve (Fed) and Bank of Japan meetings. Whilst the US Federal Reserve has moved closer to a rate hike, the latest median forecasts for rates from the committee members have moved lower, and still remain some way below market expectations (see chart below).

Even with these lowered figures, the forecasts still call for a single quarter-point rate increase by the end of the year. This was supported by comments that the case for such an increase had strengthened, and the fact that three of the 10 members dissented, calling for an immediate hike. There are two Fed meetings left this year, but November activity is considered unlikely, both since there is no press conference and given the potential sensitivities around the US Presidential Elections, leaving the final meeting of the year, on 13-14 December, as a focal point.

At its meeting, the Bank of Japan announced a shift in policy approach, continuing QQE – its asset-purchase programme – but now more explicitly targeting an interest rate of zero on the ten-year Japanese Government Bond, potentially allowing the longer end of the yield curve to steepen. We remain sceptical of monetary policy alone as a tool to rekindle economic growth, and it seems Central bankers are now trying to play for time, ahead of expected fiscal stimulus from governments.

In line with our secular stagnation investment theme, the Organisation for Economic Co-operation and Development (OECD) announced fresh downgrades to the global economic outlook. World GDP forecasts for 2016 and 2017 were trimmed by 0.1% from the forecasts released in June, to 2.9% and 3.2% respectively.

Most notably, US growth for 2016 was cut by -0.4% to 1.4%. The US Federal Reserve also cut its forecasts, but by just -0.2% to 1.8%. The UK’s 2017 GDP forecast was also cut a whole percentage point to 1.0%. The organisation admitted that the initial impact of the Brexit decision had been less serious than expected, and highlighted the prompt action by the Bank of England as softening the initial impact.

The Bank for International Settlements raised fresh warnings of trouble over China’s unsustainable debt build-up in a research report. The bank – often called the Central banks’ central bank – looked at Credit-to-GDP and compared it to long-term trends. The research found that credit growth by this measure was 30.1% above its long-term trend based on data to March this year, with a reading above 10% considered a danger sign.

Total debt in China, which includes government debt, has increased from 147% in 2008 to 255% by March 2016 – although this level is not all that high when compared with other nations (UK total Debt-to-GDP is 266%). Instead it is the rapid acceleration in recent years that gives particular cause for concern.

We continue to avoid exposure to China specifically and maintain underweight positions in Emerging Markets and Asia-Pacific equities more broadly, partly due to our concern over growing instability in the Chinese financial markets.

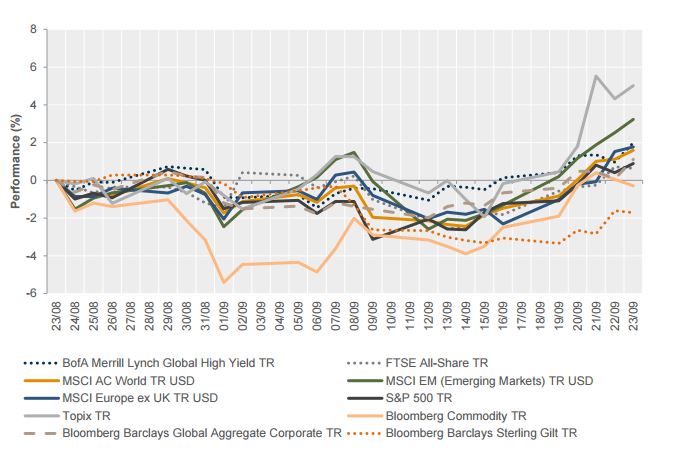

Another risk-on week, with equities and sovereign bonds both benefiting despite the mixed news flow. Gold was also a beneficiary, while the main weakness was the sterling.

1 MONTH PERFORMANCE OF MAJOR ASSET CLASSES

There are a few useful releases this week. On Wednesday the US Durable Goods Orders for August are expected to have fallen to -1.4% month on month after a very strong showing of 4.4% growth in July. This release comes hot on the heels of US PMI data for the Services sector, which is released alongside consumer confidence data on Tuesday and is forecast to have ticked up from 51.0 to 51.2. Thursday will see the latest Eurozone Business Confidence survey results, and the final Q2 GDP readings will be confirmed. Elsewhere:

On Monday morning German IFO surveys of the business climate are released, and in the afternoon the US Dallas Fed Manufacturing index will be updated for September. On Tuesday, as well as services PMI and consumer confidence data in the US, we will also have US house price data.

Little is due out in terms of data on Wednesday apart from US Durable Goods, although there will be notable appearances from ECB President Mario Draghi and US Federal Reserve Chairwoman Janet Yellen which could fuel discussion around Central bank thinking.

Away from the Eurozone business surveys and US GDP revisions, on Thursday UK mortgage approval rates and consumer credit data are released, with US pending home sales out in the afternoon.

UK consumer confidence is then reported overnight on Friday, as is an array of Japanese data including unemployment, inflation and industrial production. Later in the morning, UK house prices are updated, and the final reading of UK GDP for the second quarter is confirmed. After that, Eurozone inflation and employment data are released, and in the afternoon the US reports on PCE price inflation together with personal income and spending numbers.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.