Weekly macroeconomic and market update 25.08.16

Weekly macroeconomic and market update 25.08.16

Weekly macroeconomic and market update 25.08.16

A look back over macroeconomic events for the week ending 19/08/2016. The UK had some surprisingly strong economic data in July, whilst the Federal Open Market Committee (FOMC) minutes pointed to renewed tension over interest rates. More broadly, we look at the issue of inflation, which is likely to rise in the short-term on technical reasons in the UK – an expectation already priced in – but looks weaker on a long-term basis. With that in mind, it will be interesting to see what Federal Reserve (Fed) Chairwoman Janet Yellen says on Friday.

UK data for July were surprisingly robust in a round of closely-watched releases, the first ‘meaty’ updates following the EU referendum. Retail sales surged from -0.9% month on month to 1.4%, well ahead of expectations for a more subdued 0.2% gain (the year-on-year gain was 5.9%, up from 4.3%).

Job numbers also defied expectations, with the number of people claiming unemployment benefits falling by 8,600 in July, defying forecasts for a Brexit-induced increase of 10,000. Headline inflation ticked up 0.1% to 0.6% year on year, but core inflation – which excludes the more volatile and external factors such as fuel – fell 0.1% to 1.3% year on year.

The FOMC minutes highlighted what was already becoming evident from comments by some committee members – that there was a clear split in views. This is a theme we saw earlier in the year, with some members calling for an immediate interest rate hike, others advocating a cautious wait-and-see approach. The conflicting nature of the economic news, which we have discussed recently, is unsurprisingly fuelling confusion.

The committee broadly agreed the labour market was looking stronger, and external risks such as fallout from Brexit were diminishing, but concerns remain over hitting the inflation target – a concern borne out by the latest CPI inflation figures, which showed core inflation unexpectedly slipping by 0.1% to 2.2% year on year and headline inflation down 0.2% to 0.8% (0.9% expected). Although the minutes have generally been considered more dovish than expected, the return of the hawks has helped push sovereign bond yields up, and market estimates are close to 50/50 over whether or not there will be a hike this year.

Our view remains that interest rates are likely to remain subdued, given the weak and unsustainable nature of the US economy. Furthermore, the public disagreements between committee members have set the scene for what will be a closely-watched speech by Fed Chairwoman Janet Yellen at the Jackson Hole retreat at the end of the week.

There has been a lot of discussion and focus on inflation recently, with an apparent difference between increasing inflation concerns in the UK and lack of inflation strength in the US. In reality, these two issues are closely related, and we don’t see compelling reasons that inflation will be significantly stronger in the medium-term. In cases like this, it is generally more insightful to look at the inflation outlook and forecasts, rather than the headlines of where inflation has been.

Bringing the two themes together, technical factors such as ‘base effects’ and the recent commodity rally have provided a short-term boost to the inflation outlook, whilst Brexit-induced currency devaluation has created a spike in near-term expectations (though still a long way below what ‘high inflation’ has historically been). These are largely external factors, evidenced by their showing in the headline inflation figures, but not the core measures that exclude more volatile constituents such as oil, making them more domestically-orientated. We look at two different but related measures of inflation expectations in the market:

In both cases, we see that longer-term inflation measures are painting a more subdued picture, in line with our view that the economic outlook remains challenged and that the world will continue in a low-growth, low-inflation and low interest rate environment for the foreseeable future. In the US, the persistence of long-term forecasts below the 2% target is a major headache for the US Federal Reserve, and is at the crux of the current disagreements within the committee.

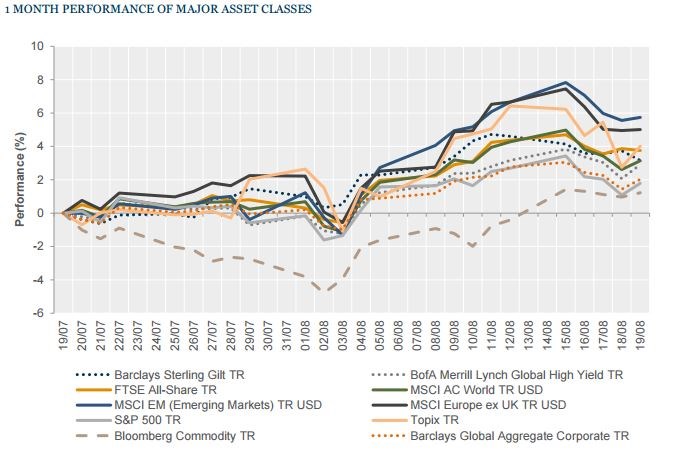

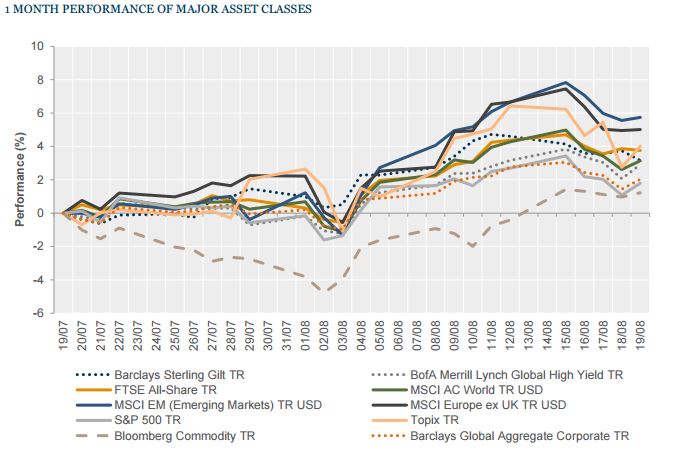

It wasn’t a great week for risk assets, with most major equity markets flat or slightly down, and sovereign bonds giving up some recent gains as the effects of recent events subside. The only gains of note came from oil, where rumours are once again circulating of a potential plan to curtail production.

Equities – US equities as measured by the S&P 500 were effectively flat again last week, whilst UK and European equities were slightly softer, down -0.7% and -0.5% as measured by the FTSE All Share and FTSE Europe ex-UK respectively. Japanese equities fell -2.1% but in Hong Kong the Hang Seng was up by 0.7%.

Bonds – ten-year gilt yields increased 9 bps to 0.63%, with the equivalent US treasuries up 7 bps to 1.58%. German ten-year bund yields increased 7 bps, but were still below zero at the end of the week at -0.03%.

Commodities – oil rallied through last week, with Brent Crude back above the US$50 mark at US$50.96 a barrel on the back of rumours of supply action from some of the major producing nations. Gold was relatively unchanged, closing at US$1,340.40 an ounce, as was copper which ended the week at US $2.17 per lb.

Currencies – sterling strengthened against the generally weaker US Dollar to close the week at US$1.31, and also rose against the yen, closing at ¥132. However, a stronger Euro saw sterling slip to €1.15.

Ahead of Janet Yellen’s address at Jackson Hole on Friday, there are some potentially insightful data releases this week. Tuesday has manufacturing and services PMI readings out of the Eurozone, expected to be fairly unchanged at 52.0 and 52.8 (from 52.2 and 52.9) respectively, with Eurozone Consumer Confidence in the afternoon and US Manufacturing PMIs (forecast at 52.7 from 52.9). On Thursday, US Durable Goods will be closely watched, with forecasts that the -4.0% month-on-month fall in June will bounce back to a 3.3% gain in July, and these data will be followed up by the US Service PMI reading (51.4 to 52.0 forecast). Elsewhere:

After a quiet start to the week, we get manufacturing PMIs for Japan and the Eurozone. These are followed by UK industrial trend orders from the CBI, then following on from US manufacturing PMI and Eurozone consumer confidence, we have data on US new home sales.

Wednesday will be fairly quiet, with the final reading of Q2 GDP for Germany released first thing in the morning and US existing home sales in the afternoon. On Thursday morning the Ifo surveys of the German business climate come out, then in the afternoon – aside from the Durable Goods and Services PMI – the US will update on the initial jobless claims situation and the Kansas Fed Manufacturing Activity gauge.

We have a pretty busy end to the week on Friday, with Japanese inflation released overnight, German retail sales first thing in the morning and then UK Business Investment. We also have the first revision to UK GDP growth in the second quarter, with the US doing the same in the afternoon, before Janet Yellen’s Jackson Hole speech which is scheduled for 4pm UK time.

Data correct as at 25/08/2016. Source: Lipper.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.