The doves were back in town

The US Federal Reserve (Fed), Bank of Japan and Bank of England all held their monetary policy meetings a week after the ECB announced further unconventional easing measures. Although none of the Central banks made any changes to the policy – as expected – the rhetoric was decidedly more dovish than previous meetings.

In the US it is clear that the Fed shares broader market concerns over the economic slowdown, despite an apparent determination to hike rates. This was borne out by the latest quarterly projections. The glide path for interest rates (the Federal Funds Rate) was revised lower, and interestingly even the long-run estimate was revised from 3.5% to 3.3%. At the same time the GDP growth forecast was also revised down for this year and next.

In Japan, the Central bank kept interest rates at -0.1% having previously surprised markets with its foray into negative interest rate territory. The bank also downgraded its economic forecasts and it looks like further cuts are a matter of when, not if. Reinforcing the point, Bank of Japan Governor Kuroda reported to parliament that it would be possible to cut as far as -0.5% and that they were prepared to act without hesitation. The story was similar in the UK, where economic forecasts were downgraded during the UK Budget, prompting the Bank of England’s Monetary Policy Committee to vote unanimously to leave rates on hold at 0.5%.

Source: US Federal Reserve.

Industrial production updates

Industrial production gave a positive surprise in the Eurozone in January, undoing two months of slight contraction with a month-on-month increase of 2.1% ahead of an expected 1.7%. Year on year this was a 2.8% increase. Construction output was similarly buoyant, up 6% year on year in January from 0.4% in December.

Due to the different reporting schedule the US data was bleaker, but it actually related to February rather than January which, like Europe, was ahead of expectations. Being more recent, the data may also portend what to expect in the context of the global backdrop. Elsewhere in the US industrial production fell more than expected to -0.5% month on month in February, worse than the -0.3% forecast and down on the 0.8% growth in January. Year-on-year industrial production was -1.0%, and it has been below 0 since November.

Forward-looking measures were more positive though. Both the NY Empire State and Philadelphia Fed Manufacturing Indices were unexpectedly strong. The NY Empire State turned positive after seven months of strongly negative readings with a reading of 0.62, just ahead of 0.54 expected and much improved on February’s -16.64. The Philly Fed index produced a reading of 12.4, the highest since early last year. This was well ahead of forecasts for a fall of -1.7 after six months of falls, and an improvement of the previous reading of -2.8.

Last week’s other events

- Elsewhere in the US retail sales were also soft (but in line with forecasts) at -0.1% month on month from -0.4% previously. Consumer sentiment was also subdued, with the Michigan survey sliding from 91.7 to 90 (forecasts were for an improvement to 92.2). The Producer Prices index contracted 0.2% month on month in line with expectations. The core measure was flat against an expected slight expansion of 0.1%. CPI inflation was at 1.0% year on year whilst the core measure was 2.3%, slightly ahead of an expected 2.2%.

- UK average earnings (including bonuses) improved from 1.9% year on year in December to 2.1% in January, ahead of the 2.0% expected. Unemployment was unchanged at 5.1%.

- Eurozone employment increased 1.2% year on year (the forecast was for 1.1%), with another 0.3% added quarter on quarter.

- Japanese exports fell -4% year on year in February, a moderation on January’s -12.9% fall but still below forecasts for -3.1%.

The markets

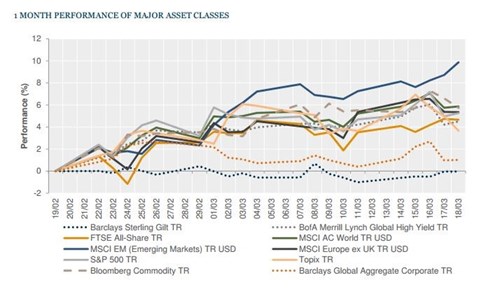

We had a fairly subdued week after the Central bank announcements. Equities (outside of Japan) generally drifted up and bond yields moved back down on the dovish notes.

Equities – FTSE All-Share gained 1.0%, S&P 500 was up 1.3%, and in Europe the FTSE Europe ex-UK finished up 1.2% on the week. Of the major developed markets it was only Japan that bucked the trend, where the Topix fell -1.1%, whilst in Hong Kong the Hang Seng index gained 2.3%.

Bonds – the dovish messages from Central banks helped push yields down on major government bonds. 10-year Gilt yields fell 13 bps to 1.45%, US 10-year Treasuries fell 10 bps to 1.88% and in Europe, German 10-year bund yields were 6 bps lower to 0.21%.

Commodities – general commodities were relatively uneventful, mostly moving sideways. Brent crude oil finished slightly higher than it started, last seen at US$41.23 per barrel, and gold was essentially unchanged at US$1,256.20 per ounce. Copper ended the week at US$2.28 per lb.

Currencies – in a week with lots of Central bank noise, the yen trended up against most other currencies. It gained 2.01% against a generally weaker US dollar, 1.39% against sterling and 1.04% against the euro. The US dollar, as well as falling against yen, slipped -0.62% against the pound and -0.94% against the euro.

The fortnight ahead

Ahead of Easter Weekend, this week we have a lot of PMI data but otherwise it will be relatively quiet. However, the PMI data could be interesting considering the theme of a mixed and potentially deteriorating economic picture that we wrote about last week.

The PMI updates begin on Tuesday when the Eurozone releases Services and Manufacturing Flash PMI readings, where forecasts are for both measures to hold more or less steady at 53.3 and 51.3 respectively. Thursday is the US’s turn, where last month the Markit Composite PMI was bang on neutral at 50, whilst Services PMI was contractionary for the first time since 2013 with a reading of 49.7. Markets will be hoping that these improve or at least stabilise.

The only other major events of note are the release of ZEW and Ifo economic surveys in Germany on Tuesday. These are expected to show an improvement in the business outlook. Elsewhere during the week:

On Monday there are some Central banker speeches from members of the committees of the Bank of Japan, ECB and US Fed. These could cause some interest given the current focus on Central bank rhetoric. In the afternoon US existing home sales numbers are released, as well as Eurozone consumer confidence which is forecast to have slightly improved from -9 to -8.3.

On Tuesday Japanese Manufacturing PMI and Industrial Activity is reported overnight, then in the morning Eurozone PMIs are reported together with Ifo and ZEW business survey results for Germany. UK inflation is also released in the morning, with forecasts for headline inflation unchanged at 0.3% year on year, and producer prices inputs remaining negative at -7.4% on the back of commodity weakness.

Wednesday morning will be quiet, with US updates on new home sales and the latest crude oil storage levels. On Thursday morning UK retail sales figures are released, and are expected to have slowed from 5.2% to 3.5% year on year in February. In the afternoon the US PMI figures are out, together with durable goods orders and initial jobless claims, then late in the evening Japan reports its inflation numbers. Most markets will then be closed for Good Friday – although this won’t stop the US reporting aggregate quarter-on-quarter corporate profits.

Remembering that Easter Monday isn’t a bank holiday in the US, the beginning of next week will see PCE inflation and pending home sales out. In Japan there are also unemployment and retail sales figures. On Tuesday there will be US house price data and consumer confidence then Japanese industrial production figures to look forward to. Midweek sees Eurozone business and industrial sentiment readings, then UK consumer confidence in the evening. Thursday gives us UK house prices data and consumer credit before the Eurozone releases inflation figures. Late in the evening we also have the Japanese Tankan measures of economic activity. Don’t be fooled on Friday 1 April, as in China both official and the Caixin PMI numbers come out, followed by US nonfarm payrolls and ISM manufacturing data.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.