Weekly macroeconomic and market update 19 October 2015

Weekly macroeconomic and market update

Weekly macroeconomic and market update

Concerns in Chinese trade data

Chinese trade data proved somewhat concerning. Exports fell slightly less than expected, down 3.7% from a 5.5% fall the month before (expectations had been for an accelerated fall to 6.3%). Year on year imports figures were sharply lower than predicted, down 20.4% from a 13.8% fall in August (expectations were for a 15% fall). The steep fall in imports raised concerns that domestic consumption in China was stalling, which could prompt fresh stimulus from the government.

On the back of these data, the balance of trade increased slightly for September, to US$60.34 billion. Further fuelling concerns of economic cooling, inflation was 0.4% lower to 1.6% year on year, worse than forecast.

US consumer data

US consumer data provided some reasons for optimism, with retail sales growth increasing to 2.4% in September from 2.0% in August. Much of this was driven by auto sales, although this was slightly lower than estimates. The Michigan Consumer Sentiment index also reversed its summer slide, improving from a reading of 87.2 to 92.1 in October.

Inflation in the US was also marginally ahead of expectations. Headline inflation slipped to a flat 0% – better than forecasts for a fall into deflation – but the more closely watched core inflation measure ticked up 0.1% to 1.9%. However, the producer price index disappointed, falling more than expected by dropping 0.5% month on month. Industrial activity also detracted from the positive sentiment – the Philadelphia Fed Manufacturing Index remained negative at -4.5 and monthly industrial production was also down -0.2%.

Last week’s other events

The markets

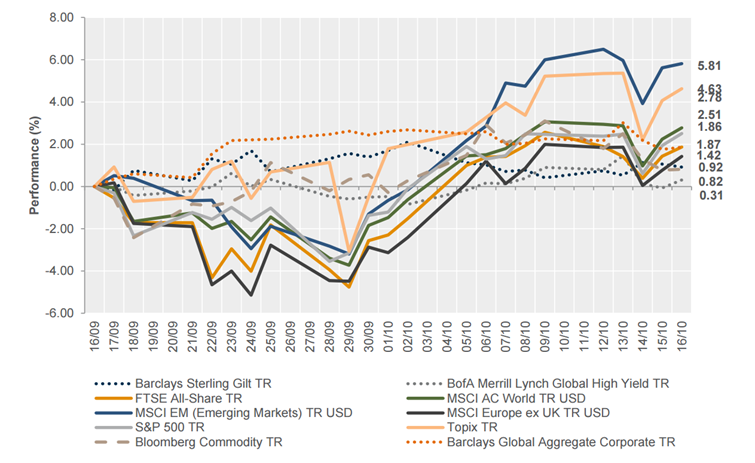

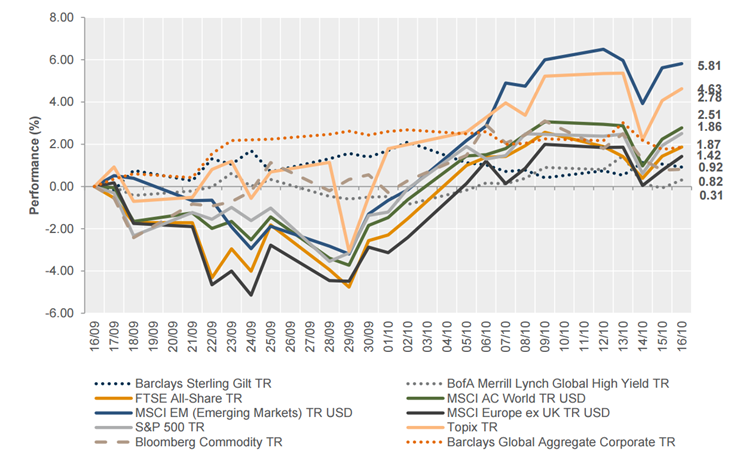

Markets were relatively uneventful last week, with equities generally marginally stronger and bonds marginally weaker, though in reality there was little of any magnitude as markets paused for breath after the recent risk-on rallies.

Equities – UK equities were marginally lower with the FTSE All-Share returning -0.68%, whilst US and European equities were slightly more positive as the S&P 500 returned +0.90% and the FTSE Europe ex-UK returned +0.84%. There was more magnitude in Asia – the Topix returned +4.16% and the Hang Seng returned +2.81%.

Bonds – 10-year gilts were 6 bps tighter to 1.8%, while 10-year US treasuries tightened 5 bps but were still above 2% at 2.04%. German 10-year bunds were similarly moved, with a yield of 0.55% on Friday.

Commodities – Oil gave up some of its recent strength, but was still in the US$50s. Brent crude was last seen at US$50.46 per barrel on Friday. Copper was relatively unchanged at US$2.41 per pound whilst gold continued to strengthen, finishing the week at US$1,183.60 per ounce.

Currencies – The sterling and euro were the main movers on the week. Sterling strengthened 0.80% against the US dollar and 0.86% against the euro, which experienced broad weakness, and was 0.81% weaker against the Japanese yen.

The week ahead

On Monday China releases GDP figures for the third quarter, which are expected to have slipped to 6.8% as the world’s second largest economy continues its slowdown. At the same time a range of other data will be released, including fixed asset investment, industrial production and retail sales. Although such official figures are generally taken with a healthy amount of scepticism, there will be a lot of interest in these figures, given recent concerns about a slowdown. Later in the morning, Eurozone construction figures are released.

The main draw will be the US housing data on Tuesday, with hopes that building permits and housing starts will both have increased to 1.17 million and 1.15 million respectively. Later in the afternoon, speeches from the Federal Reserve Chair Janet Yellen as well as two other key Fed members will be closely watched.

Wednesday will be fairly quiet, with only the Japanese balance of trade and export figures released. Exports are expected to have been boosted, leading to a small surplus. Much of Thursday’s attention will be on the ECB policy committee meeting, and any statement of indication from the associated press conference around the scale and scope of the Central bank’s QE programme. Ahead of this, the UK releases retail sales numbers, with estimates for further improvements, then in the afternoon the Eurozone release consumer confidence numbers and the US reports on the Conference Board’s Leading Index and existing home sales.

Finishing the week, China reports on its house prices before the Eurozone releases its flash readings for Manufacturing and Services PMI, with the US following suit on Manufacturing PMI in the afternoon to finish the week. Forecasts point to more scores in the low 50s, suggesting continued modest expansion.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.