Weekly macroeconomic and market update 16.05.16

Weekly macroeconomic and market update

Weekly macroeconomic and market update

A look back over macroeconomic events for the fortnight ending 13/05/2016.

Although the Bank of England left monetary policy unchanged at its meeting on Thursday, it used the meeting itself (as well as the quarterly inflation report) to intervene surprisingly aggressively in the Brexit debate. Although there were no hard-and-fast numbers included, the Bank of England warned that Britain leaving the EU would likely materially lower growth, drive up inflation and harm UK employment. At the same time, the Central Bank estimated that around half of sterling depreciation since November last year was due to concerns over the EU referendum, and confirmed that it expects a “Leave” vote would cause a fresh wave of devaluation.

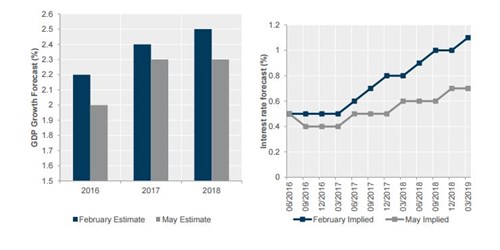

Away from the Brexit discussion, the Bank also lowered growth expectations for the next three years, now expected at 2% GDP growth for this year (down from 2.2%) and only 2.3% for the next two (down from 2.4% and 2.5%, see chart below left).

At the same time, the Bank also noted the collapse in market-implied interest rate expectations which have flattened significantly – markets now expect rates to be just 0.7% on a probability-weighted basis in three years’ time, down from expectations of 1.1% back in February. Our house stance remains cautious, with lower growth and a dovish interest rate outlook for the UK and US two of the six themes for 2016.

Source: Bank of England

Chinese data out over the weekend were also a disappointment. Industrial production slipped more than expected, falling 0.8% to 6.0% year on year (6.5% was forecast), whilst retail sales unexpectedly fell to 10.1% year on year (expectations were for an unchanged reading of 10.5%). Fixed Asset Investment also surprised to the downside, falling 0.2% to 10.5% year on year (expectations were for the opposite – an increase of 0.2% to 10.9%).

In line with the subdued newsflow, it was a fairly quiet week for the markets. Equities moved mostly sideways through the week, whilst sovereign bond yields ticked down once again. After recent weakness, the US dollar regained some strength.

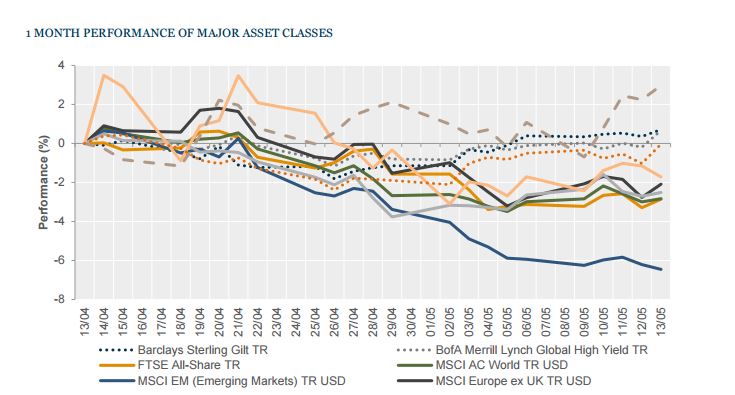

Developed western equity markets were fairly uneventful on the week. In the UK, the FTSE All-Share gained just +0.2%, while in the US the S&P 500 slipped -0.5% on the week. The FTSE Europe (ex-UK) index was also off -0.3%. Japan was the only major index to have a solid week, reversing earlier losses with a gain of +1.7%, while in Hong Kong the Hang Seng shed -2.0%.

Sovereign bond yields continued to tick lower. 10-year UK Gilt yields were down another 4bps to 1.38%, with 10-year US Treasuries down 8 bps to 1.70% and German 10-year Bunds ending the week at 0.12% (3 bps lower).

Given the supply-side pressures, particularly from events in Canada, Nigeria and Venezuela, oil prices strengthened on the week but were still short of the US$50 per barrel mark. Brent Crude finished the week at US$47.83. Copper continued to give up its recent strength, falling to US$2.08 per lb, whilst gold was slightly softer on the week, ending at US$1,271.90 an ounce.

Sterling slipped 0.5% against the US dollar which strengthened against all major currencies, and was last seen at US$1.43, but was up against the euro and yen, last seen at €1.27 and ¥155.81 respectively.

We have another relatively quiet week coming up. On Wednesday the Federal Open Market Committee meeting minutes will be released, which may provide further insight after the non-statement released at the meeting, whilst the equivalent European Central Bank (ECB) monetary policy meeting accounts are released on Thursday morning. On Tuesday night (UK time) Japan will release its Q1 GDP figures – forecast to come in at just 0.1% quarter on quarter. Given the -0.3% contraction in Q4, a disappointment here could indicate the economy is back in technical recession. Closer to home, on Thursday UK retail sales figures for April are forecast to have marginally slowed from 2.7% to a still healthy 2.5% year on year. Elsewhere:

There is nothing of note to report on Monday, except for Russian Q1 GDP which is likely to remain sharply contractionary. UK inflation is then reported on Tuesday morning, with headline inflation forecast to be unchanged at 0.5% and core inflation forecast as slightly softer at 1.4% (from 1.5% previously). In the afternoon the US reports inflation, with headline inflation forecasts as increasing from 0.9% to 1.1% but core expected to have softened from 2.2% to 2.1%. US industrial production figures for April will also be released, with markets hoping for an improvement on the -2.0% fall in March.

On Wednesday Chinese house price data are reported overnight, followed by UK unemployment data (expected to be unchanged at 5.1%). Late in the evening Japanese machine orders are reported, with forecasts for 0.5% month-on-month growth in March, following the sharp -9.2% fall in February.

Aside from UK retail sales figures and the ECB accounts, Eurozone construction output is reported on Thursday morning (the March reading, after February saw 2.5% year-on-year growth). The Philadelphia Fed Manufacturing index is also out in the afternoon.

On Friday morning the UK’s CBI reports industrial trends orders, whilst the only data of note in the afternoon is existing home sales in the US. However, Friday does mark the start of the two-day meeting of G7 Finance ministers and Central bank governors, which could provide some intrigue early next week.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.