Weekly macroeconomic and market update 16 November 2015

Weekly macroeconomic and market update

Weekly macroeconomic and market update

Macro headlines

Further weak data from China unsettled markets with signs that the rate of economic slowdown was faster than markets have been anticipating. The export rate contracted a further 6.9% year on year in October from 3.7% in September, upsetting hopes that the rate of loss would moderate to 3%. Imports were also sharply down for the second consecutive month, falling 18.8% - again, worse than expected - whilst industrial production growth slowed 0.1% to 5.6%, the lowest level since the depths of the global financial crisis. The inflation rate fell to 1.3% whilst factory gate prices contracted for the 44th consecutive month, -5.9% lower than a year ago. The only sliver of hope came from Retail Sales growth, which was marginally stronger and ahead of expectations, up 11.0% year on year.

Flash GDP readings for the Eurozone showed the region’s GDP grew at a rate of 1.6% year on year in the third quarter, a slight acceleration on the previous quarter’s 1.5% growth but just shy of market forecasts. European economic recovery has been gaining strength through the last year, but a slowing global economic backdrop has raised concerns over the durability of the recovery, which has been apparent from recent survey data. Despite these worries about the future, industrial production in the region beat expectations, increasing 1.7% year on year for September, though this was slightly slower than the 2.2% growth seen for August.

Other macro events

Markets

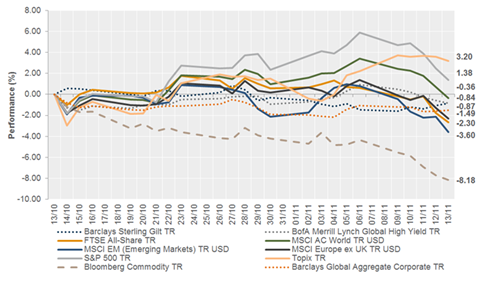

It was a pretty bleak week for risk assets with little reason to cheer. Equities and bonds suffered as sovereign bond yields fell.

Week ahead

Looking to the coming week, highlights will be the output from Central banks – on Wednesday the US Fed’s FOMC minutes will provide more information on discussions at the recent meeting which was read as surprisingly hawkish. We then have the Bank of Japan’s decision as well as a range of mid-level economic data releases.

Monday: Little of interest at the start of the week

Tuesday: Start with UK inflation, expected to be just below zero for the headline number, but steady at 1% on the core measure. This is followed by economic sentiment out of Germany, where concerns have been mounting about the global economic outlook, despite solid economic data currently. The afternoon brings a slew of US data, including inflation, capacity utilisation, industrial production and housing data which extends into Wednesday.

Wednesday: The focus in the afternoon will be the release of the FOMC meeting minutes, where analysts will be digging through the detail that led to something of a change of tone from the committee at the latest meeting. Also of some note is the update on Eurozone construction output, which has been poor recently.

Thursday: Overnight, the bank of Japan releases its monetary policy decision. Forecasts as mixed, with some forecasting further stimulus at this meeting or the next. Later in the morning, it’s the UK’s turn to release retail sales numbers, expected to be softer than the previous readings but still strong at around 4.2% year on year.

Friday: Closing the week, the Eurozone consumer confidence reading is published which is forecast to remain subdued.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.