Macro headlines

There were fresh signs of market stress last week, fueling a sense of unease amongst skittish investors.Brentcrudeoil slipped below US$38 per barrel to a seven-year low amid high inventory levels and a report that actual OPEC production had increased to 31.7 million barrels per day compared to a target of 30 million. At the end of last week we also saw the failure of a major distressed debt fund (Third Avenue Management) with over US$700 million, and rumours began to circulate that a US$400 million credit hedge fund might also be in trouble. Whilst these funds are very much at the periphery, it has served to highlight some of the tensions around the edges of markets, and has not been helping sentiment.

There was plenty of excitement to come out of China last week, with a sharp fall of US$87 billion in the level of foreign exchange reserves, and the authorities laying the groundwork for fresh depreciation of the currency. Despite this fall, the official reserves still stood at US$3.43 trillion in value at the end of November, and according to reports the US$87 billion drop equates to roughly US$57 billion of actual sales by the Peoples’ Bank of China (the remaining US$30 billion is accounted for by the foreign exchange market effects for non-US dollar holdings). Given that the trade surplus for November was US$54.1 billion, that suggests another month of capital outflows more than US$100 billion, as we witnessed at points over the summer when investors in China had a clear imperative to get their capital out. Fears over the potential for fresh currency devaluation appear to have been well-founded: at the end of the week the Peoples’ Bank of China announced it would look to measure the value of the Renminbi against a basket of currencies instead of just the US dollar. Given the dramatic strengthening of the US dollar, and therefore the Renminbi, against other major currencies, this change would clearly give them scope to allow the Renminbi to devalue against a strong US dollar whilst making it hard for others to level accusations of ‘unfair’ currency manipulations, particularly from the US. As we’ve said previously, given the Renminbi already appears over-valued when measured against a broader basket of currencies, and as the US appears set to embark on a new interest rate cycle, this could well be the prelude to a fresh bout of currency depreciation.

The final reading for Japanese third quarter GDP was dramatically revised up from a -0.8% annualised fall to a +1.0% annualised gain. The revision means that Japan hasn’t been in a recession, and brings back into question the reliability of the authority’s estimate methodology. The revision comes as a number of other economic indicators have also been suggesting a more positive outlook. Recent surveys of both the current economic condition and the near-term outlook suggested there was broad optimism in the wider economy (initial Concident Index reading of 114.3 in October from 112.3 in September, The Leading Economic Index was at 102.9 from 101.6). Machinery orders were also supportive, accelerating to 10.7% month-on-month growth for October, from 7.5% the month before and comfortably ahead of expectations for a contraction. It wasn’t all roses though, with some notes of caution evident in the outlook of large manufacturing, where the BSI Large Manufacturing Index slipped from 11 to 3.8. The Economy Watchers surveys, which polls the mood as gauged from those servicing consumers directly, such as cab drivers, slipped on both the current conditions and outlook, with readings of 46.1 and 48.2 respectively, indicating continued pessimism.

Other macro events

- Chinese trade data for November continued to point towards a global slowdown, though the magnitude started to fall. Exports were only slightly attenuated down -6.8% year on year from -6.9% the month before, whilst imports were down -8.7% year on year, a noteable improvement on the -18.8% fall in October. Inflation as measured by the Consumer Prices Index picked up 0.2% to 1.5% year on year, though factory gate pricing remained deeply in the red, with another falloff -5.9% year on year. Domestic retail sales and industrial production were robust and ahead of expectations.

- The Bank of England left rates as they were at 0.5% by a vote of 8-1, whilst the minutes were relatively dovish, highlighting the lack of domestic cost pressure, and the expectation that any lift off would be more gradual than in previous cycles. UK industrial production was firm, with 1.7% year-on-year growth, up from 1.5% previously, though manufacturing was -0.1% lower than a year ago.

- The US JOLTS survey showed 5.38 million job openings in October, slightly down from 5.53 million the month before. Initial jobless claims for the week ending 5th December also ticked up to 282,000 from 269,000 the week before. Retail sales also slowed to 1.4% year on year in November from 1.7% in October

Markets

Negative sentiment hit markets pretty hard last week, sending equities lower with investors heading into the perceived safe arms of sovereign bonds.

- Equities – Major bourses had a tough week across the board. The UK arguably bore the brunt, as the FTSE All-Share fell -4.2%, but other markets weren’t far behind with Europe (excuding the UK) down -2.7%, US falling -3.8%, and even in the far east pain was evident with Japanese equities down -1.6% and equities in Hong Kong returning -3.5%

- Bonds – Sovereign bonds rallied in the weak sentiment. UK ten-year gilt yields fell 12 bps to 1.81%, US ten-year treasury yields were 14 bps lower at 2.13% and ten-year German bunds were 15 bps lower to 0.54%

- Commodities – Brent crude went crashing through the US$40 per barrel to a nine-year low, ending the week at US$37.93 per barrel. Copper actually achieved something of a rally to end at US$2.10/lb whilst gold softened slightly through the week, finishing at US$1076/ounce

- Currencies – The big movers of the developed markets were the US dollar and the Japanese yen. The US dollar was down 0.71% against sterling and 0.94% against the Euro but was almost 2% weaker against the Yen, which itself surged 1.23% relative to sterling during the week.

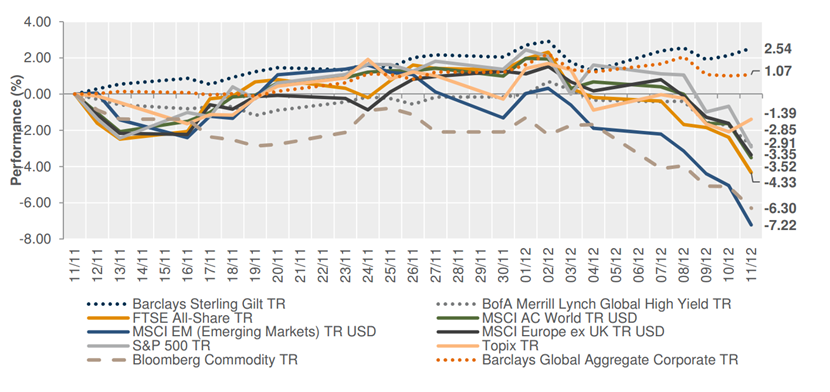

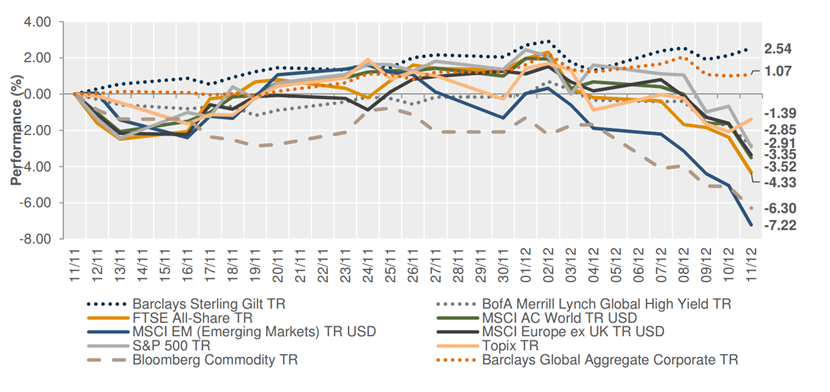

1 MONTH PERFORMANCE OF MAJOR ASSET CLASSES

Week ahead

Arguably the most important macroeconomic event of the year on Wednesday we are expecting the US Federal Reserve to finally increase interest rates for the first time in almost a decade. Markets are generally expecting a standard 25 bps hike to 0.5%, although there remains plenty of scope for surprise and disappointment. Aside from any variation in the actual hike (would they risk a half-hike of 10-15 bps or could they even delay at this juncture?), the statement and press conference will be crucial for market sentiment, with any excessively dovish or hawkish overtones likely to elicit a strong market reaction.

Monday: The Eurozonereports on industrial production, with growth expected to have accelerated from 1.3% to 1.7%

Tuesday: UK inflation in the morning is forecast to have increased 0.2% to just about positive at 0.1% year on year. Later in the morning is the ZEW economic surveys from Germany and in the afternoon US inflation is reported, expected at 0.5% year on year at a headline rate, with core inflation at 2.0%.

Wednesday: Notthatanyone is likely to be looking at anything else, but aside from the FOMC result, flash Manufacturing and Services PMI in the Eurzone are expected to remain stable in the early-to-mid 50s. UK earnings and unemployment will also be reported. Along with the US FOMC interest rate decision, we will also have fresh FOMC projections and some supporting mid-level economic data.

Thursday: As markets digest the FOMC output, German Ifo business survey data are released, together with UK retail sales.In the afternoon, US leading index and initial jobless numbers are updated.

Friday: A quiet end to an important week is expected. Overnight Chinese house price data are released, along with the Bank of Japan’s interest rate decision. In the afternoon, US Flash Services and Composite PMI from Market see us out.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.