Weekly macroeconomic and market update 12 October 2015

Weekly macroeconomic and market update

Weekly macroeconomic and market update

No changes to monetary policy

Largely as expected, the Bank of Japan and Bank of England both kept monetary policy unchanged at their meetings last week. Some had been hoping that the Bank of Japan – currently engaged in aggressive monetary easing, along with the European Central Bank – would offer a hint that the scope and/or scale of the stimulus programme could be increased as the ECB did previously. However, these people were disappointed as the Governor of the Bank of England highlighted continued signs of strength in the domestic economy as reasons to stay the present course. Despite this, updates are due out at the end of the month on the growth and inflation outlook, and if there are downgrades as expected, this could provide cover to increase easing at the next meeting.

Conversely, many expect the Bank of England to start tightening rates in the medium term – and although the minutes were relatively dovish, Governor Mark Carney appeared to question markets that were pricing in no interest hike through all of 2016. Specifically, he highlighted strong labour conditions with low unemployment and building wage pressures, as well as reminding the world that the Bank has previously hiked rates ahead of the Federal Reserve, so rising US interest rates were not a precondition. Meanwhile, minutes from the Federal Open Market Committee meeting were dovish as expected, and taken with the subsequently weak jobs data further pushed down expectations for a US rate hike by the end of the year.

The latest from the Governor of the Bank of England

Even as the Bank of England Governor talked up the domestic economy, the latest output painted a bleaker picture. UK Services PMI numbers unexpectedly slipped to 53.3 against expectations for an increase to 56, whilst construction fell -1.3% versus forecasts for 1.4% growth. The balance of trade also remained wide at £3.3 billion in August, but an improvement from £4.4 billion in July. The only ray of sunshine from the data was Industrial Production growth which accelerated to 1.9% year on year (1.2% was the forecast) though this was offset by worse than expected manufacturing production, coming in at -0.8% against -0.1% expected.

Last week’s other events

The markets

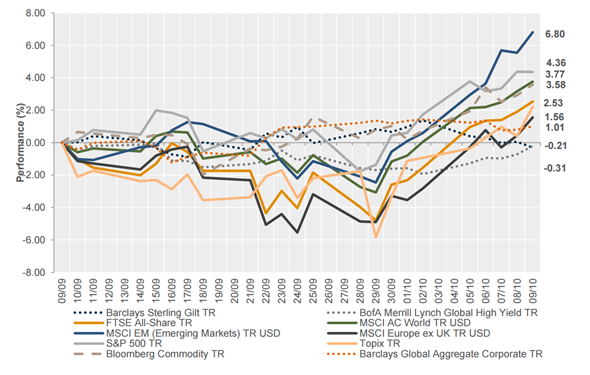

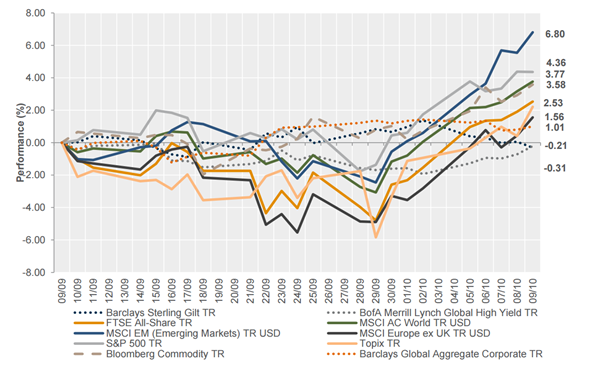

Amid dovish central bank noises and some weak economic data, there was something of a relief rally last week. Equities and commodities benefited from fresh optimism and bond yields softened.

Equities – A strong rally on the week with European equities leading the way, up 5.8%, and the FTSE All-Share index slightly behind, rising 4.1%. The US made 3.3% gains, returning it to around the 2,000 mark that it breached during the sell-off in August. In Asia, Japan’s Topix index rose 4.8% and the Hang Seng index of equities in Hong Kong gained 4.5% for the week.

Bonds – US 10-year treasuries were back above 2%, increasing 11 bps to 2.09% whilst in the UK 10-year gilts expanded 15 bps to 1.86% and German bunds were similarly wider at 0.61%.

Currencies – The euro was broadly stronger last week, rising 0.42% against sterling and 1.30% against the US dollar. Conversely the Japanese yen weakened, falling 1.08% against sterling, 1.08% against the dollar and 1.44% against the strong euro. Conversely the sterling appreciated 0.87% against the US dollar.

Commodities – Commodities were generally stronger across the board. Oil rallied on the week and Brent crude finished at US$52.85 per barrel. Copper was also stronger on the week at $2.42 per pound and gold continued its rally to finish the week above the US$1,150 mark at US$1,156 per ounce.

The week ahead

We begin the week very quietly, with no expected releases for Monday. On Tuesday morning we can look forward to Chinese trade data, where both exports and imports are expected to have fallen -6.3% and -15% year on year respectively. The trade surplus is also expected to have fallen from US$60 billion in August to around US$47 billion in September. Later on Tuesday and UK inflation is expected to remain flat year on year, although core inflation is expected to be stronger at 1.1% from 1.0% in August. These data will be followed by German ZEW economic business survey results.

We have another busy day on Wednesday, beginning with Chinese annual inflation – which is expected to have fallen from 2.0% to 1.8%. Also on Wednesday morning, UK employment data are forecast to show average earnings increase at a rate of 3.1% up from 2.9% previously. Later in the morning European industrial production figures are released and in the afternoon the US updates us on factory-gate pricing levels and retail sales figures. Then, in the evening the Fed’s beige book of economic conditions is released.

On Thursday US inflation data are expected to show headline deflation of -0.1% year on year from +0.2% in August. Core inflation data will also be released, followed by the latest reading from the Philadelphia Fed Manufacturing Index. We finish the week with Eurozone balance of trade and inflation data on Friday morning, then US capacity utilisation, industrial production and JOLTS job openings later in the afternoon.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.