Weekly macroeconomic and market update 09 November 2015

Weekly macroeconomic and market update

Weekly macroeconomic and market update

US employment figures were strong

Last week the focus very much turned to the US, where employment figures were strong with 271,000 new jobs created in October compared to 182,000 forecast. There were also revisions up to the August and September figures, and the jobless rate has fallen to 5%. Meanwhile, average hourly earnings have risen 2.5% over a year, although the rate of growth has been slower as we move through 2015. The market is now pricing in a 70% probability of a US rate rise in December, which gives us a sense of just how quickly views are changing.

UK interest rates remain unchanged

In the UK the Bank of England left base rates unchanged at 0.5% and there was no change to the £375 billion stock of assets in the asset purchase facility. The minutes continue to reference risks from abroad and there was an eight to one vote to leave rates unchanged. The Bank of England inflation report put more emphasis on a return to inflation target (and beyond) in 2 to 3 years’ time.

Last week’s other events

The markets

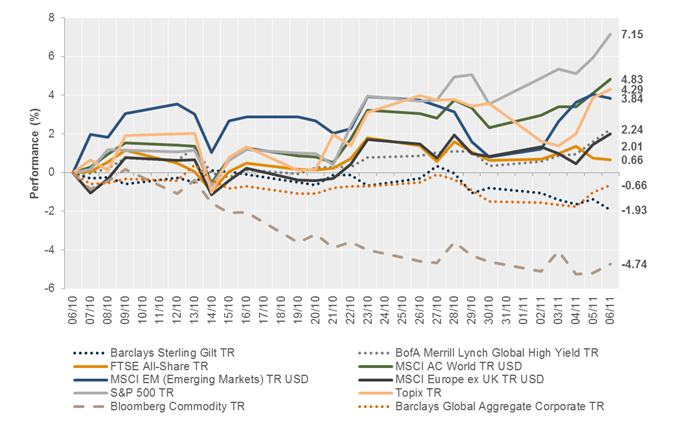

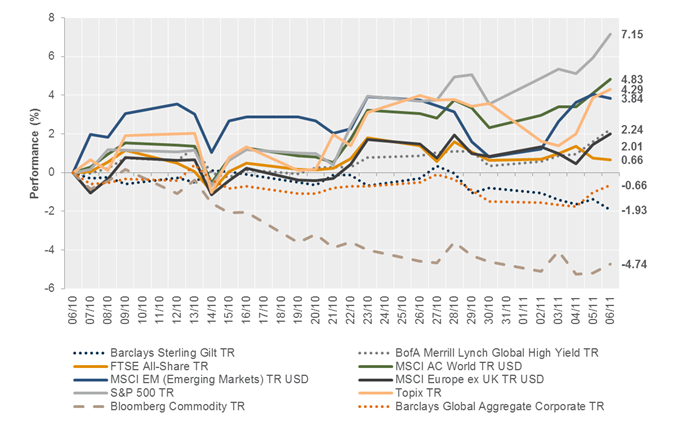

The reaction to the strong employment figures in the US saw bond yields rise and the dollar strengthen.

Equities – The markets were broadly positive over the week with the S&P 500 up 0.55% and European and Japanese markets up almost 1%. The FTSE 100 lagged, falling very marginally by 0.11%.

Bonds – The reaction to strong employment figures in the US saw 2 year treasury yields rise 16 bps on the week to 0.9%.

Commodities – Oil (as measured by Brent Crude) fell 5% during the week to US$47.51. Meanwhile a strong dollar weighed on gold prices, which fell 5% last week to US$1,089.5 per ounce.

Currencies – The DXY (dollar index) was up 1.3% on Friday to 99.78. The sterling weakened following US data releases, the Bank of England releases and Bank Governor Mark Carney’s conference. The euro fell 1.3% against the dollar.

The week ahead

During the week ahead we will look to data releases for a barometer of the performance of the global economy.

This week from the US we have the latest Census Bureau October retail sales report – consensus is for a strong reading of +0.6% over the previous month, which could add to the case for US economic strength. We also have consumer confidence and further speeches from Federal Reserve officials, including some voting members of the Federal Open Market Committee.

In the UK, labour market statistics are expected to show no change in the unemployment rate (which is currently running 5.4%).

In Europe, the Eurogroup meeting of finance ministers is expected to agree a further €2 billion payment to Greece. European GDP growth is expected at 0.3% quarter on quarter, and on Monday we have German trade figures to look forward to alongside European inflation figures and French business confidence. French industrial production and manufacturing production figures are also due out on Tuesday. ECB President Draghi is also expected to speak in London.

Over in Asia, Japanese trade date figures are out this week along with producer price index, machine orders and industrial production figures. In China, look out for October retail sales, industrial production and fixed asset investment data as well as import and export figures.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.