More questions over US monetary policy

Mixed US economic data raised further questions about the US monetary policy outlook. US non-farm payrolls fell short of expectations, coming in at 151,000 compared to expectations for 190,000, whilst the previous figure was revised down to 262,000 (from 292,000). Data also showed the participation rate remained subdued at 62.7% (though this was expected), whilst initial estimates of fourth quarter productivity disappointed, showing -3.0% less productivity on a seasonally-adjusted basis than in Q3.

It wasn’t all doom and gloom though, as the unemployment rate fell below 5% to 4.9% and average earnings ticked up 0.5% month on month – accelerating from flat in the previous month and better than forecasts for 0.3%. However, even as personal income measures picked up (0.3% month on month by the Bureau of Economic Analysis measures), none of this flowed through to spending – personal spending was flat month on month in December, from 0.5% in November. This clearly raises questions over the ability of the rejuvenated consumer to spur continued economic growth in the US.

Bank of England leaves interest rates as they are

The Bank of England’s Super Thursday reinforced the doves’ argument, as the single rebellious voter pushing for an interest rate hike – Ian McCafferty – capitulated. He voted with the rest of the committee to leave rates on hold, as he acknowledged wage growth was more subdued than he expected. At the same time, the latest inflation report once again downgraded to inflation and growth.

The latest forecasts show inflation below 1% through all of this year, without hitting its target until the first quarter of 2018. On GDP growth, the forecast for 2016 was cut from 2.5% to 2.2% with a similar cut for next year from 2.7% to 2.4%.

Last week’s other events

- Eurozone unemployment fell 0.1% to 10.4% in December, but retail sales slowed to 1.4% year on year in December from 1.6% in November

- In China, the Caixin Services PMI (an independent measure) surprisingly picked up to 52.4 in January from 50.2. The Manufacturing PMI from the same source also picked up slightly, but remained below the tipping point at 48.4.

- UK manufacturing PMI, as reported by Markit/CIPS ticked up from 52.1 to 52.9 in January, although construction PMI fell from 57.8 to a still-respectable 55.0

- Just ahead of Chinese New Year, the Peoples’ Bank of China reported another fall in the FX Reserves of just under US$100 billion.

The markets

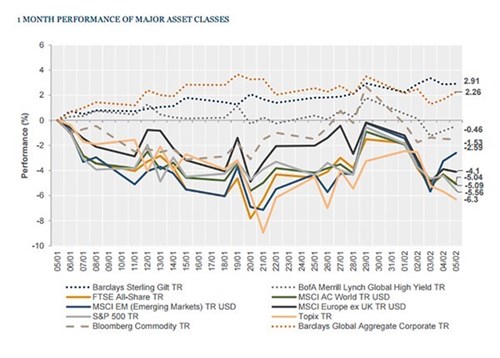

Another tough week for equities given the growing concerns over global economic growth. Sterling and the greenback weakened on softer economic data, whilst gold continued to rebound.

<

Equities – A tough week for all of the major bourses. In the UK, the FTSE All-Share fell -3.6% and the story was similar in the US and Europe (S&P 500 -3.1%, Europe ex-UK -2.0%). Equity markets in the Far East were similarly down – the Topix index of Japanese equities fell -4.4%, and in Hong Kong the Hang Seng was down -2.1%.

Bonds – US Treasury yields fell with the 10-year 9 bps lower to 1.84%, whilst UK gilts were barely changed – the 10-year gilt yield was just 1 bp lower at 1.56% by the end of the week. 10-year German bunds were 4 bps lower at 0.29%, but 10-year Japanese Government Bonds are rapidly approaching zero with yields last seen 7bps lower on the week at 0.03%.

Commodities – Oil was again weaker on the week, although it did recover from a mid-week dip. Brent crude finished the week at US$34.01. Copper’s weakness appears to be levelling off and finished at US$2.10 per pound. Gold’s New Year strength continued, and it was last seen at US$1,169.50 an ounce.

Currencies – Following the weak data releases, the US dollar was weaker across the board. The currency was down 1.81% against sterling (which had its own issues after the BoE releases), down 2.85% against the euro and 3.62% against a resurgent yen. Looking back to sterling, despite strengthening against the US dollar it was down 1.04% against the euro and 1.85% against the yen.

The week ahead

After an eventful couple of weeks data-wise, this week is notably quieter. The Eurozone and Japan both report fourth quarter GDP, finishing off the pack of major economies to do so. On Wednesday, Eurozone fourth quarter GDP is expected to have moved 0.1% to 1.5% year on year, whilst on Sunday Japanese fourth quarter data is forecast to have been contractionary, falling - 1.2% on an annualised basis from 1.0% growth in Q3. It is also worth highlighting that the first US primaries (as opposed to caucuses) take place on Tuesday in New Hampshire, whilst we expect a quiet week in China as the country marks its New Year. Elsewhere:

First thing on Monday morning, we get Japan’s measures of ‘economy watchers’ reports, with a reading that has been consistently below 50 since last August. In the afternoon the US Fed reports on labour market conditions.

On Tuesday the UK Balance of Trade for December is reported, after showing a £3 billion deficit in November. In the afternoon US JOLT Openings are expected to show 5.4 million vacancies. On Wednesday morning the UK reports industrial and manufacturing production growth – expected at +1.0% and -1.4% respectively – then in the afternoon Fed Chairwoman Janet Yellen gives testimony to the House Financials Services Committee.

On Thursday, Federal Reserve Chairwoman Janet Yellen continues to provide testimony while US initial jobless claims are released. Eurozone GDP will be the highlight on Friday, but in the afternoon there will also be US trade data, retail sales and a look at the attitudes of consumers with the latest Michigan Consumer Sentiment surveys.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.