Weekly macroeconomic and market review – 3 April 2017

Weekly macroeconomic and market review – 3 April 2017

Weekly macroeconomic and market review – 3 April 2017

A look back over macroeconomic and market events for the week ending 31/03/17. A relatively quiet week saw the UK savings ratio fall to the lowest reading on record, and an anomalous drop in Eurozone inflation. Plenty of economic activity data this week, with the US Non-Farm Payrolls at the end of the week likely to be the biggest impact item, at least in terms of scheduled data releases.

The UK savings ratio fell sharply in the final quarter of 2016, according to data from the Office for National Statistics, while GDP growth was unchanged at 0.7% quarter on quarter. The savings ratio – effectively the proportion of disposable income that UK households are saving – fell from 5.3% in Q3 to 3.3% in Q4, reportedly the lowest saving rate on record and a clear trend seen through 2016, though there are some technical elements potentially depressing the figure. At the same time, we’ve seen consumer credit growth steadily increase to pre-global financial crisis levels. With real wages remaining under pressure as headline inflation continues to surge, question marks persist over the durability of the strong consumption we saw in the second half of 2016. Eating into savings or loading up the credit card is not economically healthy in the long term.

There was a sharp fall in Eurozone inflation. CPI fell from 2.0% to 1.5% year on year (1.8% was forecast), while core CPI slipped from 0.9% to 0.7%. Although this caused a bit of a stir, a number of one-off factors arguably disrupted this figure, including volatile energy prices, a spike in food prices in the first two months of the year and shifting holiday patterns – with an early Easter in 2016 (in March) and a late Easter in 2017 (in April). It does serve as a timely reminder of how erratic short-term figures can be – this is why we look to the underlying economic backdrop and economic drivers rather than relying purely on the raw statistics.

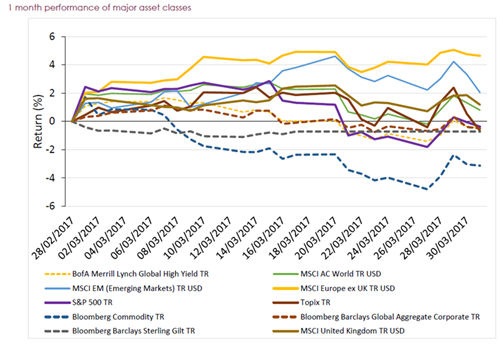

With little data to go on, markets were subdued once again last week.

Equities – Europe was the best performing region, with the MSCI Europe ex-UK index up 1.6% on the week, followed by the US’s S&P 500, which gained 0.8%. The UK was flat overall, while in Japan, the TOPIX index fell -1.2% and the Hang Seng in Hong Kong was off -1.0%.

Bonds – UK 10-year gilt yields fell four basis points (bps) to 1.14% and the equivalent German bund yields were 7 bps lower at 0.33%. Over in the US, 10-year Treasury yields were unchanged at 2.39%.

Commodities – Oil rebounded during the week, but remains some way below recent highs – Brent Crude oil was last seen at US$53.54/barrel. Gold weakened to US$1,244.40 and Copper was slightly stronger at US$2.65/lb.

Currencies – Sterling strengthened against major currencies last week, with the euro being notably weak. Sterling finished at US$1.25, €1.17 and ¥140.

It is back to Non-Farm Payrolls (NFP) this week as well as economic activity data from a number of regions. On Friday, markets are forecasting US NFPs to show 180,000 jobs added in March, while earnings and unemployment data will also be interesting to watch. Before that on Friday, UK Industrial Production figures are out, expected to have accelerated to 3.7% year-on-year growth (from 3.2%). A range of PMI data are also out during the week – details below. Elsewhere:

Monday: Early in the morning, Japan’s quarterly Tankan surveys will highlight manufacturing activity from large-cap industry. After that, UK Manufacturing PMI starts the week’s PMI data run, expected at 55.1 (from 54.5). The Eurozone unemployment rate is published in the morning. In the afternoon, US Manufacturing PMI figures from the Institute for Supply Management (ISM) are released (a fall from 57.7 to 57.0 is expected).

Tuesday: UK Construction PMI numbers are out in the morning, followed by Eurozone Sales figures (an increase from 1.2% to 1.4% year on year is expected). It’s a quiet day in the afternoon, with just Economic Optimism survey results and Factory Orders from the US of any note.

Wednesday: UK Services PMI are the highlight of the morning (53.5 from 53.3 expected), then the US Non-Manufacturing PMI from the ISM are out in the afternoon (57.0 expected from 57.6). In the evening, the latest Federal Open Market Committee (FOMC) minutes are released.

Thursday: Early in the morning, the private Caixin Services PMI data from China are released, followed by Japanese Consumer Confidence. Just after midday UK time, the minutes from the latest European Central Bank monetary policy meeting are out.

Friday: Starting in Japan, the Coincident Index and Leading Economic Index numbers are out, providing an update on forward-looking economic activity surveys. UK manufacturing and industrial production figures for February are out later in the morning, as well as Construction Output. The big US NFP release, covered above, will keep markets busy through to the close.

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.