Weekly Macroeconomic and Market Review – 27 February 2017

Weekly Macroeconomic and Market Review – 27 February 2017

Weekly Macroeconomic and Market Review – 27 February 2017

A look back over macroeconomic and market events for the period ending 24/02/17. UK GDP ‘twisted’ with growth revised up for the final quarter of 2016 but down for the first quarter. UK business investment growth remained negative, raising questions over economic stability. This week, President Trump’s address to a joint-session of Congress will be closely watched for any details of highly anticipated fiscal policy changes.

There was a ‘twist’ to UK GDP in the latest revisions, with final quarter GDP being revised up 0.1% to 0.7% quarter on quarter. But a downward revision to the first quarter of 2016 means full year GDP growth was 1.8% from 2.0% previously. The main contributing factor to the Q4 upward revision was better manufacturing output than initially estimated. Consumption and trade were also positive during the period, but it is the weakness from business investment which gives rise to some concerns. Business investment fell -0.9% in the fourth quarter from a year earlier, and is the fourth consecutive negative reading, defying expectations for a rebound to a 0.2% increase. The importance of business investment should not be underestimated – last week we talked about how fickle consumers can be; sustainable economic growth needs business investment and wage growth. If businesses start holding back, that can have a significant knock-on to the wider economy and markets, albeit with a lag. It is still too soon to call a weakening economic outlook, but these data come at the same time as slowing retail sales growth and core inflation, and softening inflation expectations. This suggests a cautious investment stance continues to make sense in the UK.

The latest purchasing managers index (PMI) readings from the US and Eurozone contained some surprises, as the US figures unexpectedly slipped whilst the reverse was true of the Eurozone figures, which unexpectedly improved. In the US, Manufacturing PMI from Markit slipped from 55.0 to 54.3, defying forecasts of an increase to 55.3, whilst the services measure fell further, from 55.6 to 53.9 (55.8 was forecast). This is largely driven by somewhat reduced business optimism and caution around job creation. Although a slight moderation, it is worth remembering that January PMIs were at 14 month highs, so it is important not to get too carried away with these short-term disappointments. Conversely, the data from Europe appears to be an ongoing pattern of an improving economy. Manufacturing PMI increased from 55.2 to 55.5 (55.0 expected) whilst services PMI rose from 53.7 to 55.6 (no change was expected), with the composite measure at a 70 month high. New orders were strong, as was employment with February having the biggest gain in employment since August 2007.

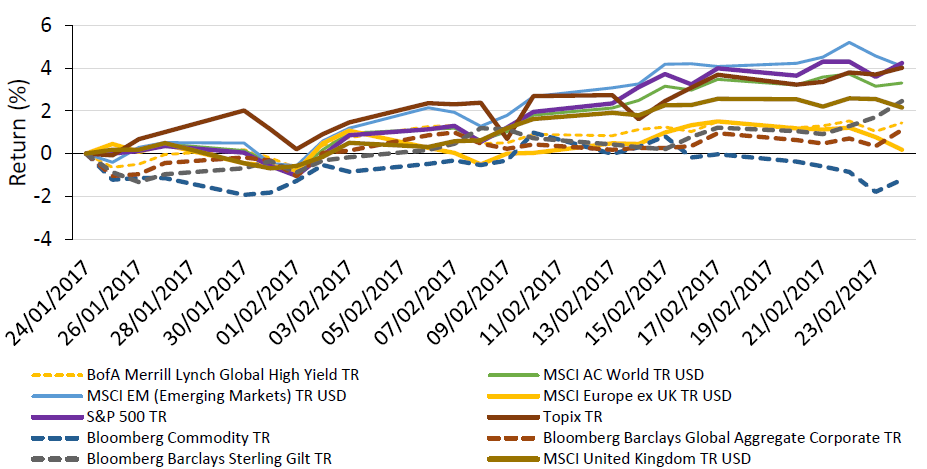

Equity markets continue to be largely unmoved, though sovereign bonds rallied through the week.

Equities – No movements more than 1% across major equity markets. The best performing market was the US where the S&P 500 gained 0.7%, with Japan just behind on a 0.4% gain for the Topix. European equities (MSCI Europe ex-UK) slipped -0.2% on the week and the MSCI United Kingdom index was down -0.5%.

Bonds – 10-year UK gilts rallied as yields fell 14 basis points (bps) to 1.08%. It was a similar story and magnitude for 10-year US Treasuries and German bunds, with yields on both 12bps lower at 2.32% and 0.18% respectively.

Commodities – Oil remained relatively steady, with Brent Crude finishing at US$55.99 per barrel, and copper closed largely unchanged at US$2.67 per lb. Gold had a stronger week, appreciating to US$1,255.90 per ounce.

Currencies – The euro weakened across the board, whilst the yen was generally stronger. Sterling finished at US$1.25, €1.18 and ¥140.

President Trump’s address to a joint session of the US Congress on Tuesday will be closely watched for any details of the new president’s highly anticipated fiscal plans. Ahead of that, on Monday US durable goods numbers are released, with forecasts suggesting a rebound to 1.6%. We also have more PMI data – Chinese manufacturing and services/non- manufacturing PMIs from official and private sources are reported, with manufacturing recently hovering close to the 50 mark that marks the boundary between expansion and contraction. We also have US PMI data, this time from the Institute for Supply Management, and markets will be comparing these to indications from Markit numbers that we discussed above. Also of note are the PCE Price Index data and information on personal incomes and expenditures which are due out on Wednesday. Elsewhere:

This article was previously published on Tilney prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.