There are several small actions that could improve your long-term financial performance.

Use your ISA allowance

Several clients come to us believing that there is little value in using their annual ISA allowance, which currently stands at £20,000. The main benefit of stocks and shares ISAs is their tax-efficiency, which overall will lead to far less tax leakages within your portfolio. ISAs are exempt from:

- Income tax

- Dividend tax

- Capital gains tax

Additionally, it’s important to bear in mind that making regular contributions to the value of your ISA annual allowance adds up. In fact, we've seen that it’s possible to become an ISA millionaire by using the maximum ISA allowance every tax year. Having over £1 million in a portfolio that you don’t pay tax on is valuable to anyone. But remember, investments in an ISA can go up and down and you may get back less than invested. The tax treatment of ISAs may change in the future.

Maximise your pension

The current pension rules are designed to incentivise people to provide for their retirement. Since April 2023, the tax advantages of paying into a pension have improved following the abolition of the pension lifetime allowance regime and increase in the pension annual allowance. The pension annual allowance is the amount that you can pay into a pension and enjoy tax relief. This is currently set at £60,000 or 100% of your relevant UK earnings (whichever figure is lower). The tax rates and reliefs depend on individual circumstances.

It is this generosity of tax incentives that has led successive Chancellors to limit benefits for higher earners, which in turn results in layered and complex pension rules.

At present, the new Labour government's view on the tax advantages of pensions is unclear. Moving forward, we suspect that a comprehensive review will be announced and changes to the tax treatment of pensions could potentially be brought in. Whatever the outcome, we still expect pensions to remain the most attractive and tax-efficient method of long-term saving for retirement. With your financial planner’s help, making use of your pension allowances could help you to achieve your financial goals. But remember, the value of pension investments may go down as well as up.

Carefully think about how much cash you are holding

Keeping enough money aside as an emergency fund is essential but checking that you do not hold too much in cash is equally as important. It’s a common misconception that cash is risk-free. The biggest risk to cash is inflation, which often outstrips its spending power. Essentially, if you are holding too much money in cash, it can erode in real terms.

For example, you have £100,000 in a current account this is paying no interest. Inflation stays at a relatively benign rate of 3% for five years. Over that period, you would lose £14,000 in real terms.

Your financial planner will work with you to calculate how much money you need to set aside as a reserve and how much you can afford to invest for the future to fund your plans. However, you should bear in mind that, unlike cash, investing puts you at risk of losing money as the value can go down.

Look at your total income

Tax is the single biggest charge on growing your wealth. On income between £100,000 and £125,140, an effective rate of 60% income tax becomes chargeable. This can eat away at your portfolio and impact your overall financial plan.

Interest received on cash and dividends on investments have resulted in many people unwittingly slipping into this invidious band. It is possible to reduce your income, and therefore your marginal rate of income tax, by making further pension contributions or a charitable donation using gift aid.

Consider your retirement income

The main financial objective in retirement for many people is to withdraw funds from their savings at the lowest possible rate of tax.

This not only involves considering your tax position but also the impact on future generations, as pensions on death are outside of your estate for inheritance tax purposes. The reduction in capital gains tax allowances to £3,000 and dividend allowance to £500 in recent years makes this a bigger challenge. Building up portfolios in a myriad of investment structures outlined by your financial planner can help you when executing your goals.

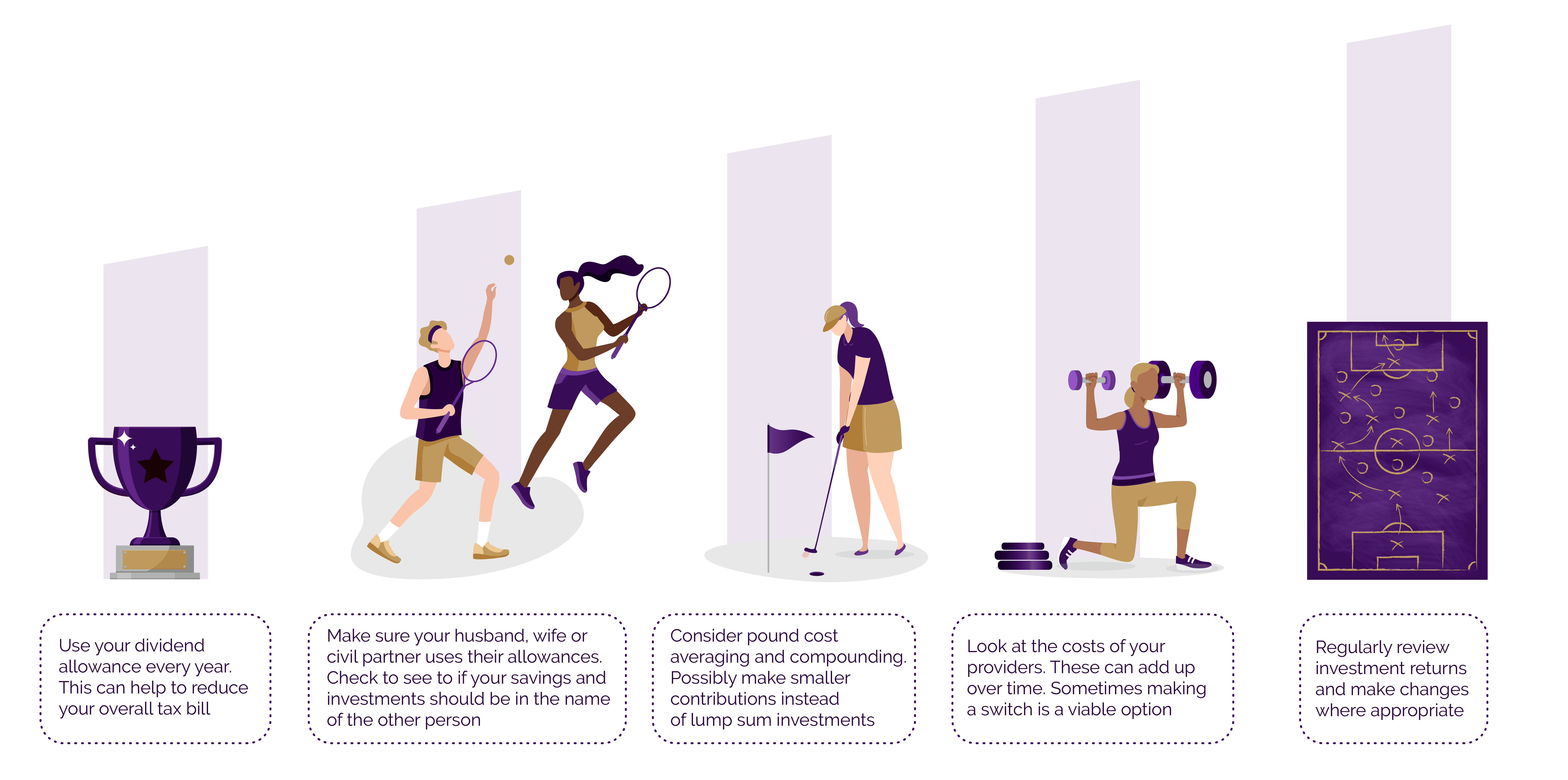

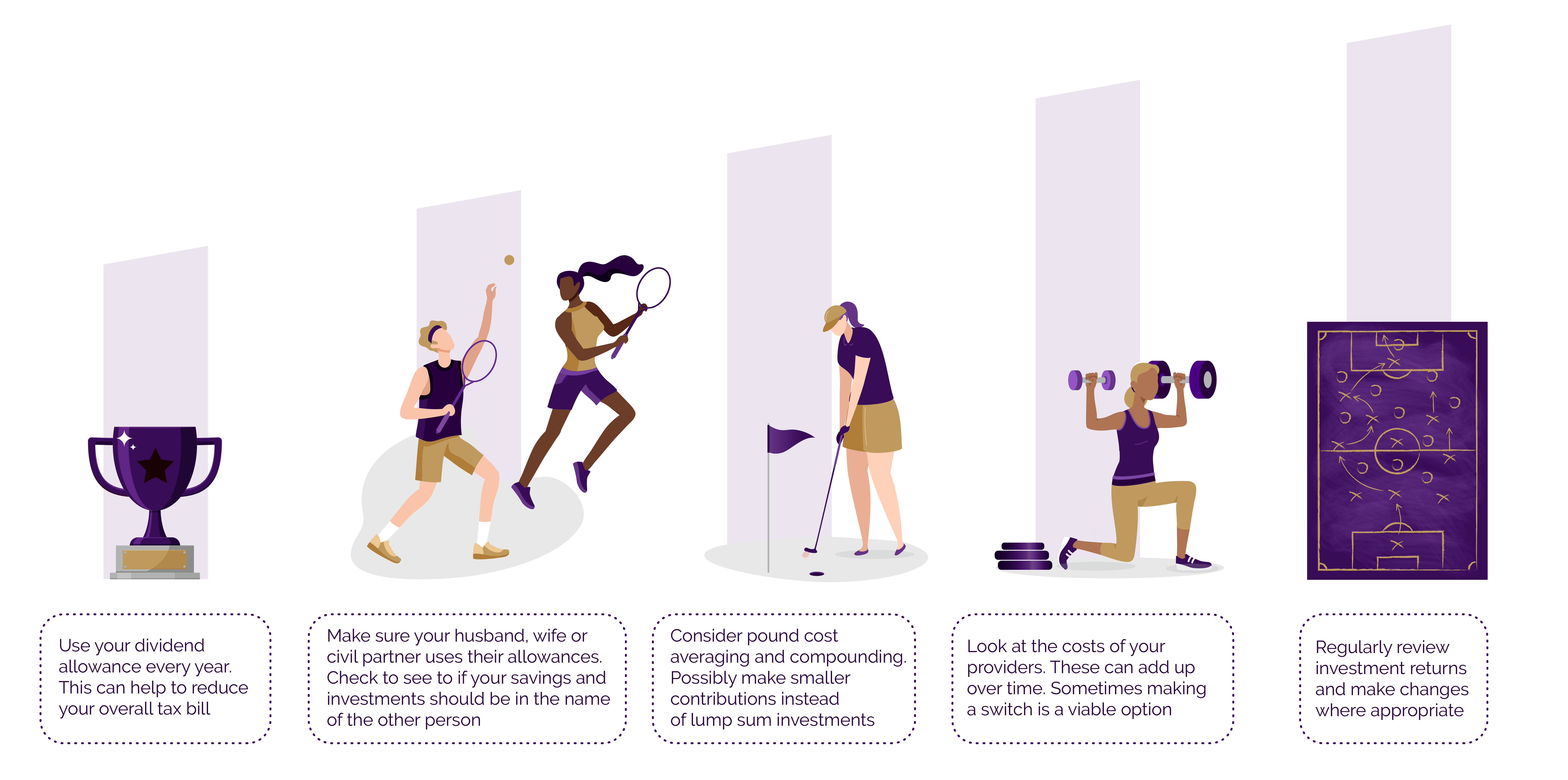

Further marginal gains - how we can contribute to your long-term wealth growth