Revenue among law firms has reached record highs according to recent figures. However, key barometers of efficiency appear to be questioning how healthy the sector really is.

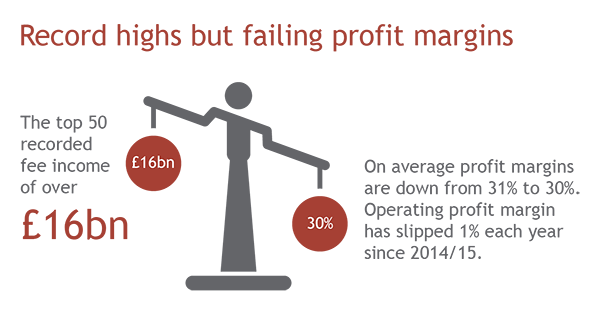

The top 50 law firms had fee income of over £16bn in the most up-to-date audited accounts representing the 2016/17 year and nearly every major law firm has heralded their investment in technology in their recent press releases.

When the figures are examined in detail, a worrying trend emerges regarding the efficiency of law firms. Over half (26) of the top 50 law firms have profit margins down year-on-year.

While on average the profit margins of the top 50 firms are down only slightly from 31% to 30%, this follows a continuing trend over the past three years where operating profit margin has slipped by 1% each year. This is during a period where firms have been investing increasing amounts into IT and different ways of working to improve efficiency.

Operating profit margin is one of the key indicators of efficiency within an organisation. The fact that margins are falling suggests that firms have to work harder and harder just to stand still.

While the percentage changes may sound small they have been consistently declining. In essence this means that law firms are earning 1p less for every £1 they are charging to clients. Over the last three years law firms have effectively lost 3p in each £1.

This gradual change may mean it escapes notice but law firms need to stay on top of it or they risk being caught out if the economy suffers a shock and they are unable to maintain their income growth.

Increasing efficiency by just 1% could help generate on average an extra £3.2m of profit for each of the top 50 firms.

Technology Investment

With almost all businesses looking to drive efficiencies, following the global financial crisis, technology has been heralded as one of the key ways to do this: developing better practice management systems and processes should allow partners to devote more time to fee generating work while the increasing use of AI, such as in the case of documentation review, should allow the re-deployment and upskilling of individuals at the more junior end of firms.

As a result, headcount would rise at a slower rate to income, albeit the average cost of a fee earner should rise as the more junior roles are replaced by automation and robotics.

However, while income across the top 50 firms increased year-on-year by an average of 9% - figures that were swelled by the demise of sterling post the referendum - the cost of lawyer/support staff was up 12% year-on-year.

With these increasing numbers, it is a challenge to pinpoint just where this technology investment has been successful. It may be that the investment is simply upgrading legacy systems and bringing law firms up to speed with their competitors, rather than companies across the business landscape.

Alternatively it could be that this investment is taking longer than expected to deliver material benefits.

DISCLAIMER

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.

Disclaimer

This article was previously published on Smith & Williamson prior to the launch of Evelyn Partners.