The Directive on Administrative Cooperation 6 (“DAC6”) is a response to the OECD’s Mandatory Disclosure Rules aiming to strengthen tax transparency across the EU and counter aggressive tax planning.

On 31 December 2020, HMRC confirmed that the application of DAC6 will be severely limited in the UK to align with the OECD’s Mandatory Disclosure Regime (“MDR”). This means that only those arrangements that meet Hallmark D of DAC6 will need to be reported in the UK. DAC6 continues to apply in full across the EU.

The DAC6 regulations require ‘intermediaries’ and, in some circumstances, taxpayers to report details of cross-border arrangements to the tax authorities where they meet at least one of five prescribed hallmarks.

In the UK, reportable arrangements are now only those that fall under ‘Hallmark D’. Broadly, Hallmark D catches arrangements that undermine the Common Reporting Standard (“CRS”).

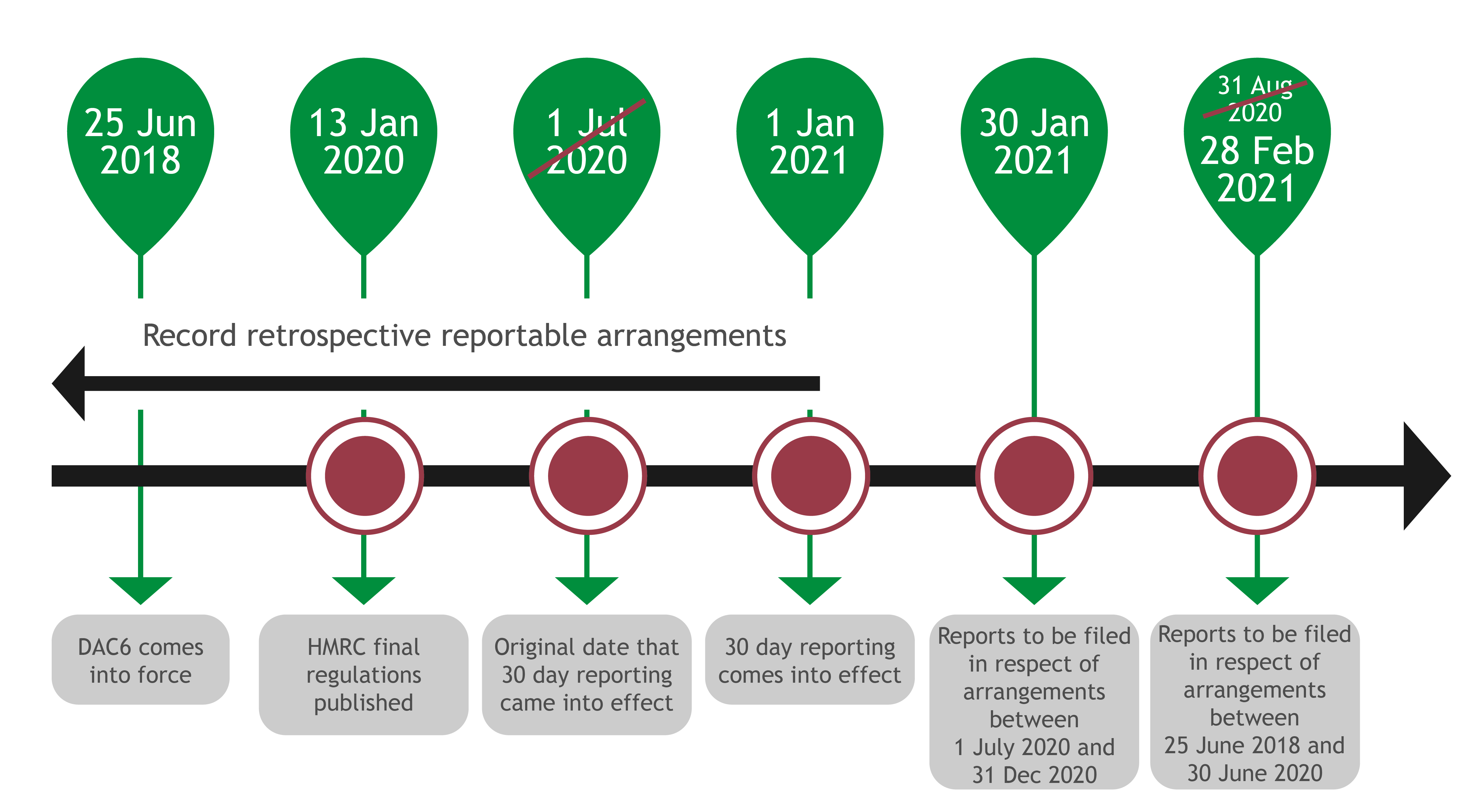

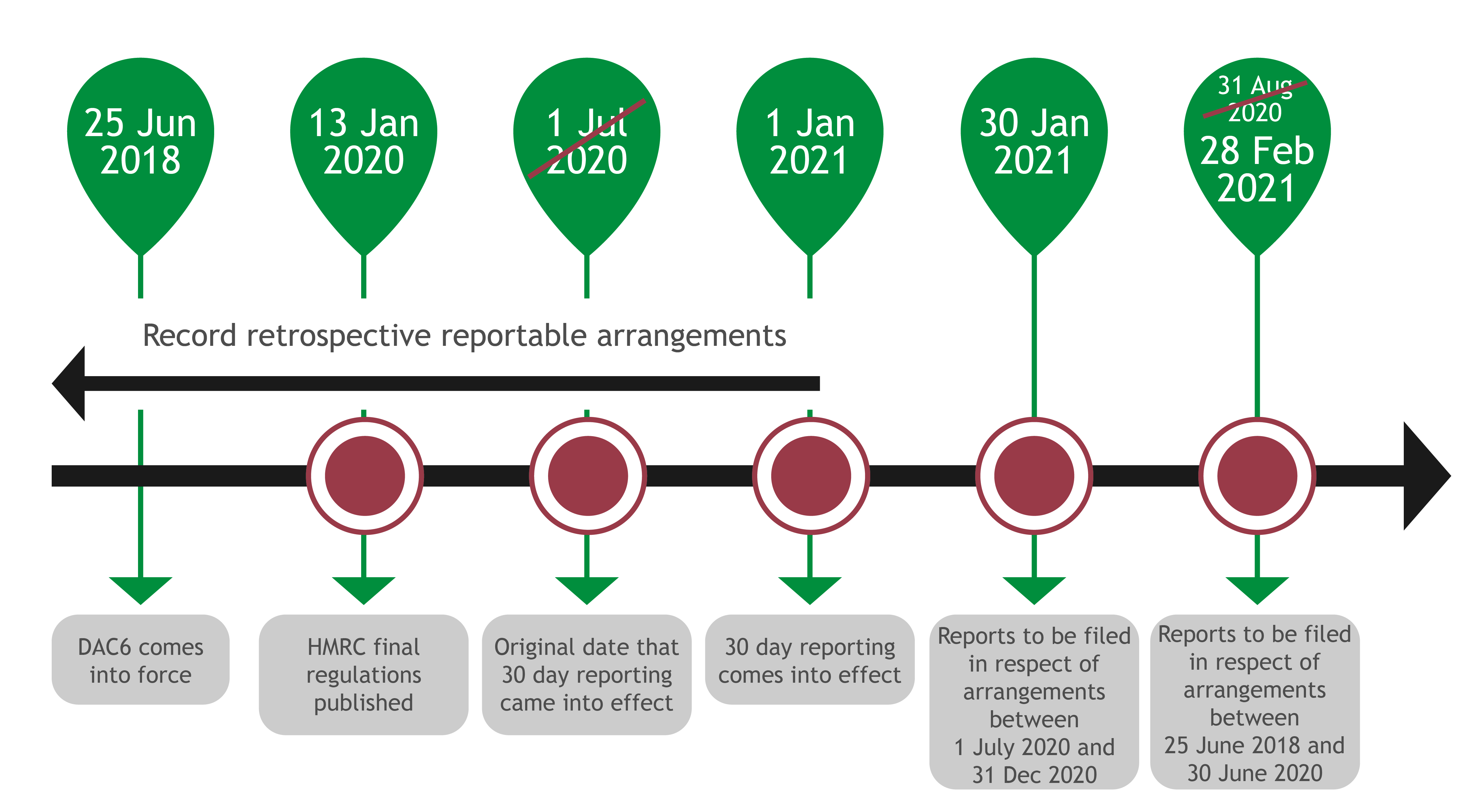

The rules apply to arrangements implemented or made available since 25 June 2018. Penalties will be imposed for errors and failures to report, so it is important for organisations to comply with these regulations. The rules require retrospective reporting in relation to arrangements implemented from 25 June 2018 to 31 December 2020, and an ongoing 30-day reporting requirement from 1 January 2021. These are the revised dates under the six-month deferral that was introduced as a result of the COVID-19 pandemic.

Hallmark D

Reportable cross-border arrangements are now only those that fall under Hallmark D in the UK, which is equivalent to the OECD’s MDR. These are essentially arrangements designed to undermine tax reporting under CRS and are split into two types:

- arrangements that have the effect of undermining reporting requirements under agreements for the automatic exchange of information; and

- arrangements that obscure beneficial ownership and involve the use of offshore entities and structures with no real substance.

The Government has announced that it intends to repeal the legislation implementing DAC6 in the UK and implement the OECD’s MDR as soon as practicable, in order to transition to international, rather than EU standards on tax transparency. The Government will consult on draft legislation to introduce MDR in due course.

Intermediaries

The definition of an intermediary is widely drafted to include “any person that designs, markets, organises or makes available for implementation or manages the implementation of a reportable cross-border arrangement”. HMRC refers to such intermediaries as ‘promoters’.

The definition also extends to any person that provides “aid, assistance or advice” with respect to a cross-border arrangement. This includes service providers, such as banks, consultants, accountants and law firms that advise on a reportable arrangement that is implemented by another person. It is possible for a service provider to argue that it is not an intermediary on the basis that it did not and could not reasonably be expected to know that it was involved in a reportable arrangement. It may, however, be required to provide evidence to support this position.

HMRC has confirmed that where multiple intermediaries are involved in an arrangement, only one intermediary is required to submit a report. HMRC will issue an Arrangement Reference Number, which must be communicated to the other intermediaries involved in the arrangement. There are complex rules regarding deadlines, obtaining evidence of reporting, and ensuring that all information is properly reported. It may be that the same arrangement must be reported several times where the intermediaries involved have access to different information.

There is a narrow exemption from reporting where an intermediary has legal professional privilege. This does not, however, exempt the intermediary from reporting any aspects of the arrangement that are not protected by legal professional privilege.

Key dates and reporting

Penalties

The regulations impose strict penalties for failure to comply. For intermediaries, these can be as high as £600 per day for each day of non-compliance. For taxpayers, the maximum penalty is £10,000 for each offence. In addition, the First-tier Tribunal has the power to increase these penalties to £1 million.

How Smith & Williamson can help

We are assisting businesses with analysing past and present arrangements and assisting with reporting by:

- identifying whether the business has a reporting obligation under DAC6;

- conducting an impact assessment to determine the size of the impact;

- assisting in identifying the reportable arrangements under Hallmark D;

- reviewing current processes;

- assisting with the implementation of a reporting framework to identify reportable arrangements and ensure businesses have an efficient process in place to identify and collate reportable information; and

- providing training for relevant staff.

Once the Government repeals the DAC6 legislation and implements the OECD’s MDR, we can advise on compliance with these rules.

Find out more about Directive on Administrative Cooperation 6 (“DAC6”) and how Smith & Williamson can assist your organisation by visiting our services page here

Ref: NTAJ14022126

DISCLAIMER

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.