Your money should work hard for you

You have probably worked hard for your money, so it’s natural to want it to work hard for you in return. This means it is important to review your pension and make sure your money is held in high-quality investments that have the potential to grow for you over time. If it isn’t, you might want to make some changes. After all, the better your investments perform the more money you should have to enjoy in retirement.

The difference good investments can make

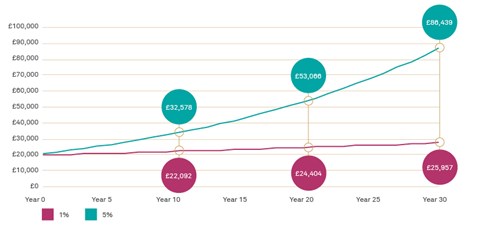

Just how big of a difference can the quality of your investments make over time? We’ve crunched the numbers and created the chart below to give you an idea. It shows two £20,000 pensions left untouched for 30 years. The first has good investments that grow by 5% a year and the second has bad investments that grow by 1% a year.

Two pensions growing by 1% and 5% a year

Over 30 years we can see the first pension growing to £86,439 – that’s £60,000 more than the second! Of course, not everybody has three decades to let their pension grow before they retire, but even over 10 years, the first pension outpaces the other by more than £10,000.

Keeping an eye on your pension

If you think your investments could be doing better, don’t panic – scroll down to find out more about how Tilney could help. But even if they are performing well, it’s important to bear in mind that you still need to check up on your pension every once in a while. An investment might have been performing well in the past, but there’s no guarantee that it will continue to in the future.

Investment options with Tilney

At Tilney our investment professionals can help you with your pension investments and make sure your money is working hard for your future.

We can manage your pension investments for you

If you have more than £50,000 in your pension you could have your investments managed by our experts. They can make all of the decisions for you – choosing which investments to buy or sell, how much to invest and when to do so.

You can work with an investment adviser

If you want to manage your own investments but would like support from a professional, you could work with one of our investment advisers. They will recommend a portfolio and give you advice on all your investment decisions, but you will have the final say over where your pension is invested.

Speak to a pension expert

If you have questions about your pension or would like more information about how we can help you with your investments, please get in touch. The easiest way is to book a free telephone pension consultation with our resident pension experts. Just fill out our short online form, or call us on 020 7189 2400.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.