A look back over macroeconomic and market events for the week ending 19 May 2017. Markets finally started reacting to political developments, though the magnitudes remain limited. Easter caused a spike in UK inflation and retail sales figures, and China announced details of an ambitious trade investment initiative. This week sees some global activity data as well as the Federal Open Market Committee (FOMC) minutes and UK business investment.

Easter's effect on inflation and retail sales figures

Easter effects continued to complicate data releases, with an early Easter in March last year and a later one in April this year contributing to a rebound in the April figures for UK retail sales and inflation after a March dip.

Starting with inflation, headline CPI surged from 2.3% year on year (yoy) in March to 2.7% in April, slightly ahead of forecasts for 2.6%. The core measure, which strips out volatile food and energy prices, rose 0.6% to 2.4% (2.2% was forecast). Air fares were the biggest contributor to the surge, and many parents will be only too familiar with the price hiking travel companies engage in around the Easter holidays! There were also contributions from energy suppliers and clothing manufacturers, suggesting that higher input costs are starting to be passed on to consumers.

Retail sales figures were also up, increasing 4.0% yoy from 2.0% previously and well ahead of forecasts for 2.1%. However, the moving three-month average, which smooths out some of the noise from the Easter effect, is still below the high levels seen in the second half of 2016 as higher prices start to impact consumers. Whilst we remain wary of the ability of the UK consumer to continue driving economic growth, as was the case in the second half of 2016, we still believe the elevated levels of inflation are transitory. On that basis, and with the upcoming general election, we think the Bank of England will sit on its hands for a while yet, even as real wages (that is, after the effects of inflation) turn negative.

China announces a new trade investment initiative

China announced a fresh ‘Belt and Road’ initiative to boost trade routes to Central Asia, Europe and Africa. This will inject hundreds of billions of further renminbi into an ongoing programme aimed at improving trade links, as well as Chinese influence.

This came as China reported disappointing economic data: Fixed Asset Investment fell from 9.2% to 8.9% yoy growth (9.1% expected) and Industrial Production growth slowed from 7.6% to 6.5% yoy (7.1% expected). Retail sales growth was also 0.2% lower at 10.7% yoy, but this was just ahead of forecasts for 10.6%. China is seeking ways to manage its economic slowdown as it addresses high debt levels and over-capacity.

Last week's other events

- In Europe, the ZEW survey of economic sentiment showed a strong reading of 35.1 in May, up from 26.3 and better than the 29.1 expected. Consumer confidence was also improved from -3.6 to -3.3, though this disappointed expectations for -3.0

- US industrial production picked up, growing 2.2% yoy in April from 1.5% in March. There were mixed signals from regional activity measures - the NY Empire State Manufacturing Index for May showed a surprise fall to -1 from 5.2 in April (markets expected an improvement to 7) whilst the Philadelphia Fed Manufacturing Index for the same period showed a strong improvement from 22 to 38.8 compared to forecasts for a fall to 19.5

- Japanese Q1 GDP was reported at 2.2% annualised in the preliminary estimate. Machinery orders failed to pick up, growing 1.4% month on month (mom) in March from 1.5% in February (2.1% was expected)

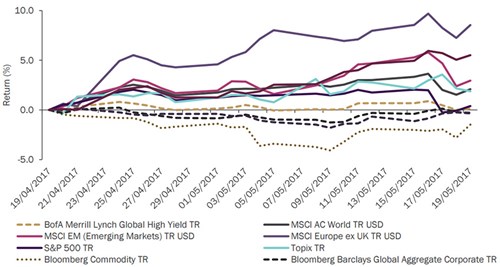

The markets

There were some signs that markets were starting to react in response to US political developments as we head into a period typified by lower volumes (which often means higher volatility) – though the size of these movements remained limited.

Equities – the US and Europe gave up early gains to finish the week down – in the US the S&P 500 was down -0.3% and the MSCI Europe (ex-UK) fell -0.9%. Japan was also weaker with the Topix index falling -1.3%. The UK bucked the trend, making a positive 0.7% return for the week (MSCI United Kingdom), whilst in Hong Kong the Hang Seng also recorded a gain, up 0.5%.

Bonds – 10-year US Treasury yields fell 11 basis points (bps) during the week, closing at 2.23%, whilst 10-year German bunds were 3 bps lower to finish at 0.36%. UK gilt yields were unchanged overall, at 1.10%.

Commodities – it was a strong week for the commodity complex. Oil continued to strengthen, with Brent Crude finishing at US$53.61 per barrel. The gold price rebounded to US$1,252.70 an ounce and copper was also stronger, closing at US$2.57 per lb.

Currencies – the US dollar weakened against major currencies, down around 1% versus sterling, whilst the euro was stronger across the board, rising 1.5% against sterling. Sterling finished at US$1.30, a level not seen since last September, €1.16 and ¥145.

The week ahead

There are some useful business activity measures to look forward to this week. Tuesday morning has Japanese Manufacturing PMI just after midnight (previously 52.7), followed by Eurozone PMI (Manufacturing forecast unchanged at 56.7 and estimates for Services pointing to a 0.1 improvement to 56.5) later in the morning. In the afternoon there is US Markit PMI, with Manufacturing forecast up 0.2 to 53.0 and Services down 0.1 to 53.0. Friday has US Durable Goods reported (a fall to -1.3% mom from 0.7% growth previously is expected). The latest FOMC minutes are released Wednesday evening, and Thursday morning has UK Business Investment for Q1 released. Elsewhere:

Monday: Japanese Balance of Trade and Exports growth are reported early in the morning. In the afternoon the Chicago Fed National Activity Index is released.

Tuesday: Aside from the PMI readings, we also have the German IFO Business Climate survey results for May reported.

Wednesday: German Consumer Confidence is out in the morning, then in the afternoon US existing home sales data are out along with US oil inventories.

Thursday: As well as UK business investment, the second estimate for GDP growth is updated in the morning. The afternoon has US Wholesale Inventories as well as the Kansas Fed Manufacturing Index and natural gas stocks.

Friday: Seeing out the week, we have Japanese inflation updated early in the morning whilst in the afternoon the US Durable Goods reading will be accompanied by quarterly readings on US corporate profits and PCE inflation.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.